3 Reasons Ollie’s is as Relevant as Ever

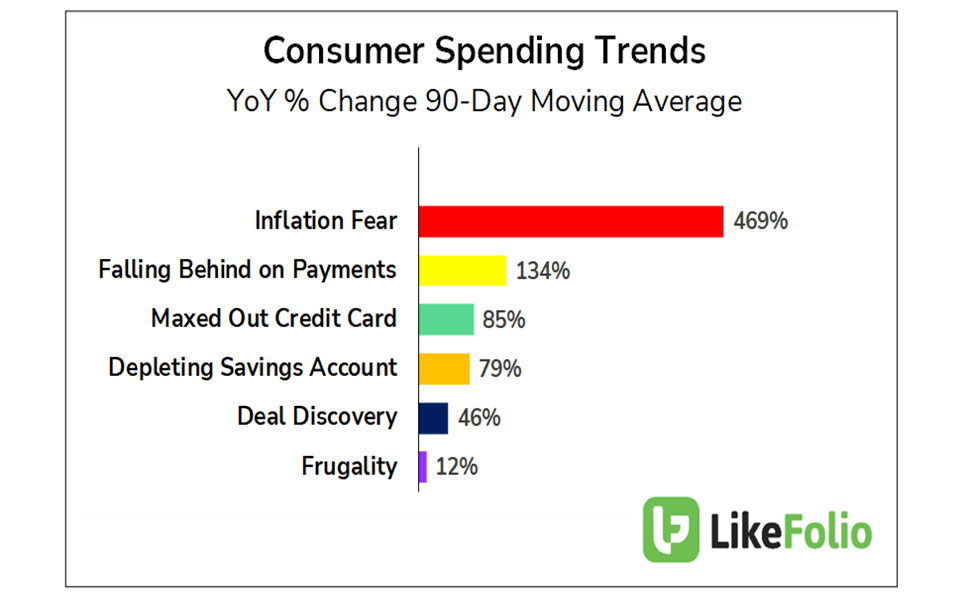

| 1. The Consumer is Strapped Management’s giddy tone during the Jefferies Consumer Conference told us that Ollie’s is on the brink of outperforming in the discount retail space. Coming off a downbeat Q1 that was largely expected absent stimulus check spending, CEO John Swygert said “we are excited. this is our time”. Comparing the current economic landscape to The Great Recession of 2008-2009, he was referring to the increasingly strapped U.S. consumer and the looming recession. Retailers don’t typically get excited about economic weakness. Ollie’s does. Before we get more into why, let’s review the current state of the consumer. Americans are no doubt feeling the heat and we don’t mean July temps. Inflationary pressures are everywhere from $5 gas to insane food prices to expensive big-ticket items. And with wage increases failing to keep up, people are falling behind on payments, maxing out credit cards, and dipping into emergency savings to stay afloat. LikeFolio has been closely tracking the social media chatter around these trends to learn about what’s forthcoming. Break out the icepacks because the heat is clearly on! |

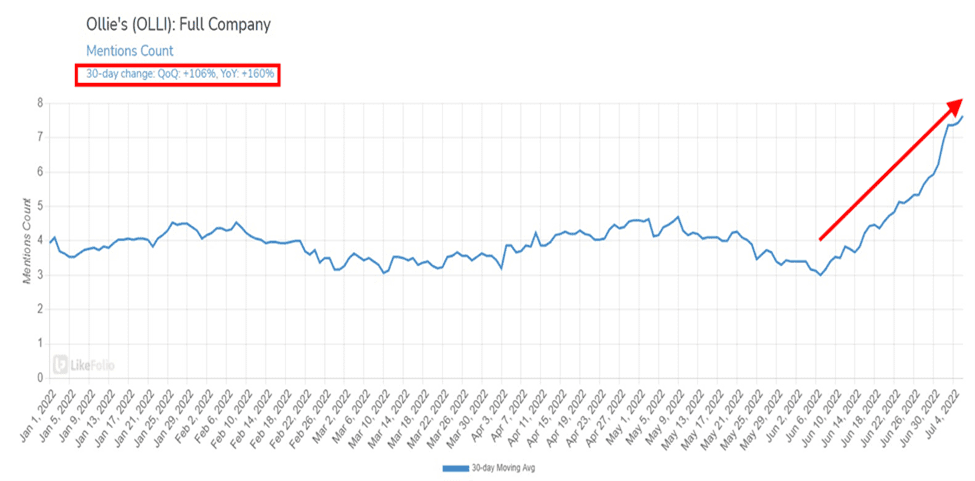

| At this point, inflation is far from breaking news, but it seems as debilitating as ever to the nation’s collective psyche. With elevated prices weighing heavily on the minds of Americans, people are more frequently discussing their stretched financial status. Talk about finding good deals and being frugal to make hard-earned dollars go further are also on the rise. Yeah, it’s a pretty gloomy picture. But it’s one that suits Ollie’s just fine. Why? A major shift in consumer behavior is underway. 2. The Trade-Down Effect is Coming No one knows when but it seems inevitable. We aren’t talking about yet another dance competition on TV. The mounting impact of high prices and low credit availability will soon cause millions of consumers to forego their usual purchase habits. Known as the ‘trade-down’ effect, people are expected to seek out bargains like banshees to turn down the dial on the inflationary pressure cooker. Around this time in 2008, the environment was similar. Fuel and food prices were soaring, and the economy was slowing to a crawl. Granted, the current labor and housing markets are much healthier, but the stress faced by the consumer is just as high. The record low consumer confidence reading says it all. We think consumers will keep spending as they did then but where they spend will change. Price will matter big time drawing more consumers to ‘trade-down’ retailers like warehouse clubs, dollar stores - and to a large extent, Ollie’s. In the words of Mr. Swygert, the trade-down effect is “not too far away”. Our proprietary data on Ollie’s confirms that the consumer is already bracing for the shift. As seen in the chart below, the social media buzz around the extreme discount retailer is climbing fast. |

Up 160% YoY on a 30-day moving average, surging social media mentions of Ollie’s as a shopping destination for hard times tells us that the retailer is already becoming more relevant.

The early signs of a trade-down could be coming from fixed or low-income consumers that have no choice but to buy food and household essentials for less. A wave of middle-class consumers making the same move will likely mark the next phase and confirm that the trade-down is on.

Ok, so the trade-down effect makes sense, but what’s so special about Ollie’s?

Well, to use the company’s tagline, it sells “Good Stuff Cheap”.

As in, a wide, ever-changing assortment of closeout merchandise at drastically reduced prices. Ollie’s says it sells at prices up to 70% below department and ‘fancy’ stores and up to 50% below mass-market retail.

Deeply discounted housewares, bed & bath items, food, health & beauty aids, clothing, and pet products fulfill essential needs. Electronics, toys, furniture, and other non-essentials at hard-to-resist prices keep shoppers filling up carts.

Aside from the prices, its no-frills stores also appeal to shoppers because they:

- Offer brand name merch. So, no need to switch to no-name generics. National brands and closeouts account for about two-thirds of sales. Private label brands and brands exclusive to Ollie’s make up the difference.

- Are one-stop destinations. With gas prices crazy, being able to get an entire shopping list knocked out in a single trip matters a lot more than it did a year ago. Ollie’s warehouse-style stores are packed with unusual deals on just about everything.

- Are set up for a fun, treasure hunt-shopping experience that is similar to what attracts people to Costco.

- Store signage is simple and witty, a refreshing change from boring, supermarket-style billboards.

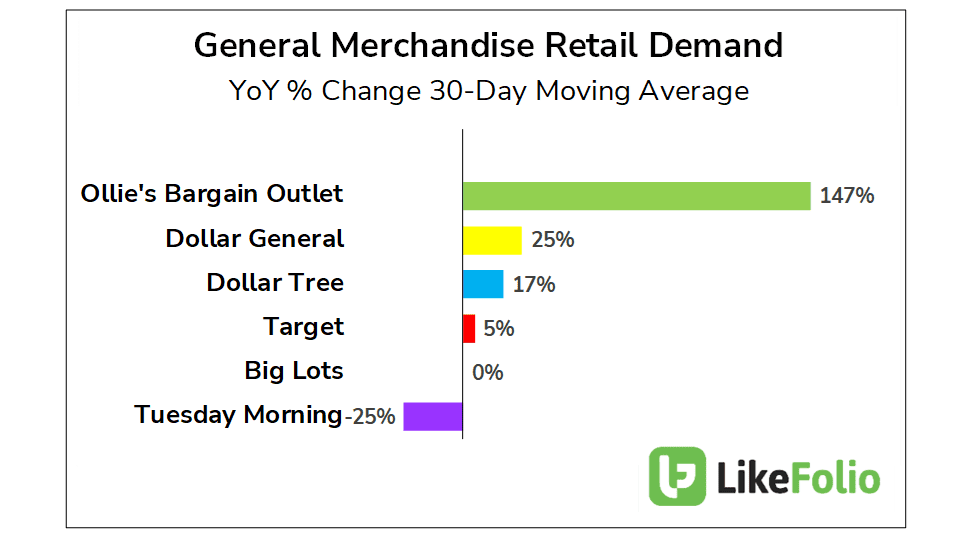

| 3. Ollie’s is Positioned to Outperform Surely other discount retailers must be seeing similar trends. Not so. Purchase Intent (PI) mentions at the dollar stores is up YoY but nowhere near as much as at Ollie’s. That’s up 147%! Target and Big Lots demand is virtually flat. |

Ollie’s is the value retailer of choice for a growing cadre of American shoppers known as Ollie’s Army. Membership in the rewards program, which gives consumers access to even bigger deals and early promo notices, increased 8% in Q1 to 12.9 million. The cult-like following accounts for approximately 80% of sales and is a key part of the growth strategy.

And with the ranks of Ollie’s Army likely to swell in the months ahead, Ollie’s has another very important trend in its favor.

Deal flow is on the upswing.

Manufacturers and retailers are having a harder time selling and are looking to offload excess inventory. Their pain is Ollie’s gain.

Combine this with the hundreds of relationships that Ollie’s has with major wholesalers, distributors, and brokers, and inventory levels are getting healthier at the right time.

Having growing product availability heading into an ideal operating environment bodes well for outsized financial results. We can see why the leadership team is so pumped.

And when you generate solid cash flow, growth comes easier.

Ollie’s plans to use internally generated cash to expand westward in the years ahead. It sees its current 29-state footprint stretching from 439 stores to a nationwide network of more than 1,000 locations. A fourth distribution center in the Midwest planned for 2024 will be a huge next step.

Ollie’s is in a strong financial position heading into this opportunity. It sits on more than $200 million in cash and has no debt, a luxury most peers wish they had.

The Street is projecting a strong rebound in profits next years as near-term cost pressures ease. Current EPS estimates for the year ending 1/31/24 imply 48% YoY growth. Based on the consumer trends we are seeing the stage is being set for even better results.

Ollie’s is the value retailer of choice for a growing cadre of American shoppers known as Ollie’s Army. Membership in the rewards program, which gives consumers access to even bigger deals and early promo notices, increased 8% in Q1 to 12.9 million. The cult-like following accounts for approximately 80% of sales and is a key part of the growth strategy.

And with the ranks of Ollie’s Army likely to swell in the months ahead, Ollie’s has another very important trend in its favor.

Deal flow is on the upswing.

Manufacturers and retailers are having a harder time selling and are looking to offload excess inventory. Their pain is Ollie’s gain.

Combine this with the hundreds of relationships that Ollie’s has with major wholesalers, distributors, and brokers, and inventory levels are getting healthier at the right time.

Having growing product availability heading into an ideal operating environment bodes well for outsized financial results. We can see why the leadership team is so pumped.

And when you generate solid cash flow, growth comes easier.

Ollie’s plans to use internally generated cash to expand westward in the years ahead. It sees its current 29-state footprint stretching from 439 stores to a nationwide network of more than 1,000 locations. A fourth distribution center in the Midwest planned for 2024 will be a huge next step.

Ollie’s is in a strong financial position heading into this opportunity. It sits on more than $200 million in cash and has no debt, a luxury most peers wish they had.

The Street is projecting a strong rebound in profits next years as near-term cost pressures ease. Current EPS estimates for the year ending 1/31/24 imply 48% YoY growth. Based on the consumer trends we are seeing the stage is being set for even better results.