When social-data and stock price are moving sharply in opposite […]

3 Reasons why we like Etsy Long-term

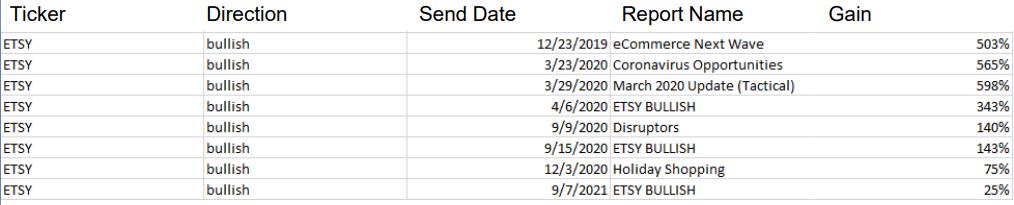

Etsy has been one of our favorite companies to track in the last few years.

Just take a look at our win rate featured on our November MegaTrends report…

Now the Street is cautious of Etsy’s continued growth. Shares are trading ~40% below November highs.

Is this move justified?

LikeFolio data does show YoY tempering in overall consumer demand.

Etsy Purchase Intent Mentions have decreased -34% YoY.

However, some tempering is expected alongside reopening behavior changed, and considering the major pull-forward of events (Covid) that has played out over the past year.

Most importantly, LikeFolio data shows 3 positive signs for the digital retailer moving forward:

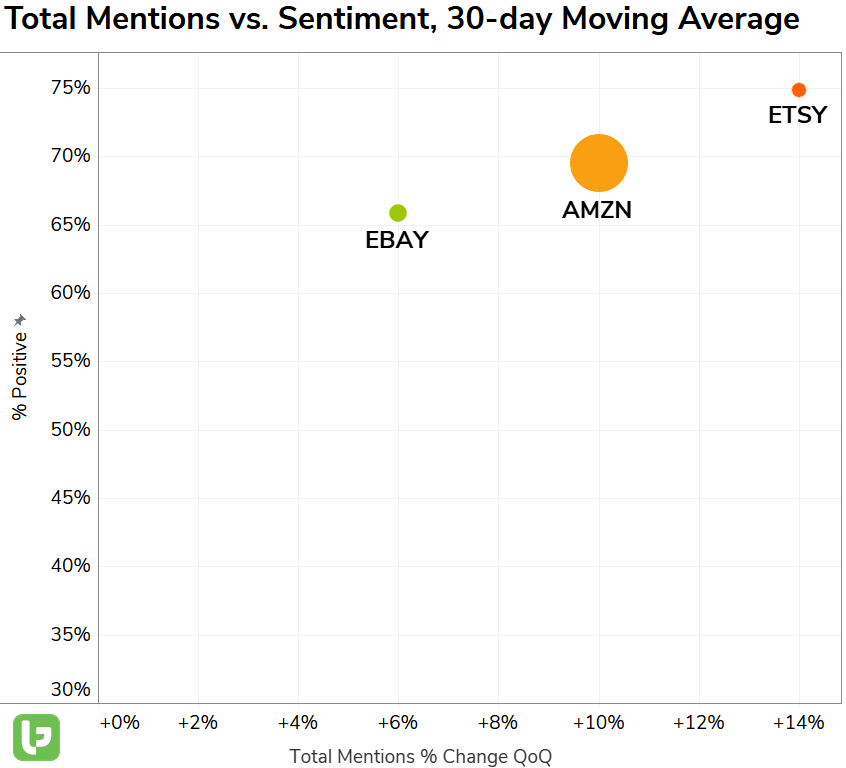

1. ETSY is outperforming peers in near-term demand momentum and consumer Happiness.

QoQ demand growth displays comparative resilience, and Happiness levels remain on top.

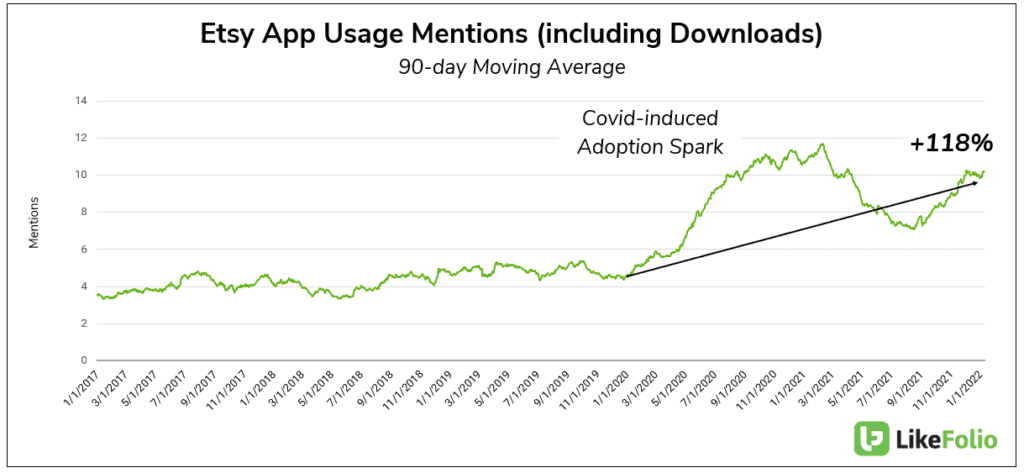

2. Etsy-specific app usage mentions (including app downloads) recorded a significant spike over the holiday season, much higher than pre-Covid levels. An indicator of stickiness.

Etsy proved this on its last report when it posted results that beat analyst expectations on the top and bottom line, in spite of post-pandemic-era mask comps.3. The personalized products and unique nature of shops make Etsy the ideal place for gift giving.

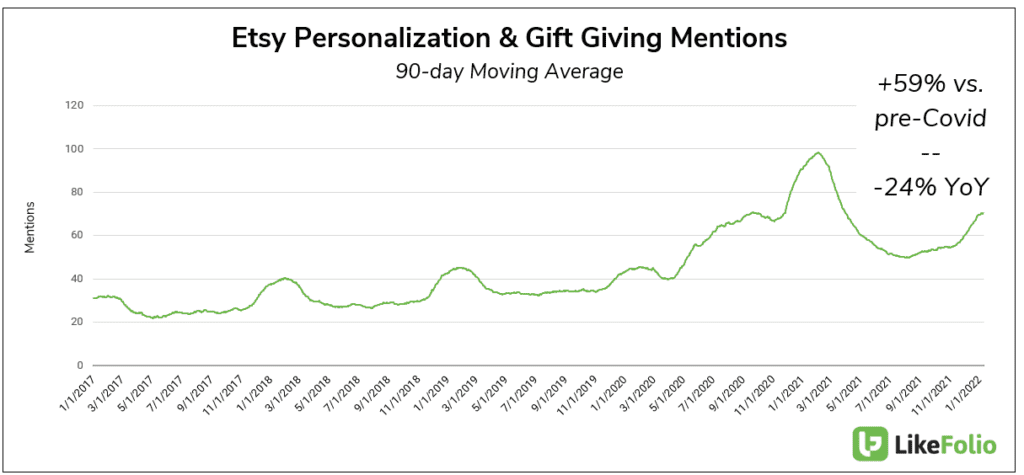

The chart above shows Etsy’s “Personalization & Gift Giving” Mentions +59% higher than pre-Covid numbers.