Hotels are Making a Comeback: $HLT $H $MAR $ABNB ABNB […]

5 reasons Marriott (MAR) could breakout BIG soon

July 10, 2023

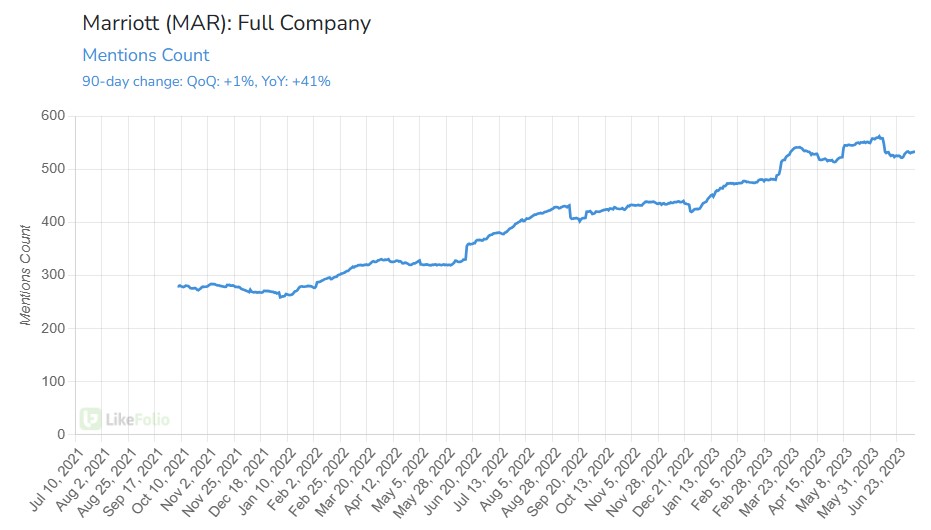

- LikeFolio Data Shows High Consumer Demand Growth: LikeFolio's data is a treasure trove of insights.

One standout fact?

Marriott's Consumer Buzz levels have shot up by a whopping 41% year over year.

This surge indicates a significant increase in consumer interest, which could translate into higher bookings and revenue for Marriott.

- Overall Surge in Travelers: The travel industry is witnessing a massive upswing. With travel volumes expected to hit record-breaking levels, the demand for hotel stays is set to skyrocket. As one of the leading players in the hospitality industry, Marriott is well-positioned to benefit from this trend.

- An Industry-Leading Portfolio of Brands: Marriott's portfolio is a force to be reckoned with. With 30 diverse brands, from the luxurious Ritz-Carlton to the budget-friendly Fairfield Inn & Suites, Marriott caters to a wide range of consumer preferences. This diversity gives Marriott a competitive edge and could drive its stock higher.

- Sector Performance on Wall Street: The broader market trends are painting a rosy picture for Marriott. Travel stocks are charging higher ahead of the peak season.

Given Marriott's prominent position in the industry, it's likely to ride this wave and see its stock price increase. - Stock Near All-Time Highs: Marriott's stock (MAR) is currently trading at a robust $189, up 24% from a year ago and near all-time highs. This strong performance, combined with the positive trends in consumer demand and the travel industry, could push Marriott's stock to new heights.

As you’ve probably heard me say many times --- stocks at all-time highs tend to go higher.

With Marriott, we expect new all-time highs within the next 30 days and a breakout to as high as $220/share by the end of the year.