Target finds itself in an interesting position. Inflation is driving […]

5 Stocks to Watch This Week (HD, TGT, KSS, FL, EBAY)

November 14, 2022

Here are some names LikeFolio is keeping a close eye on this week.

Happy trading!

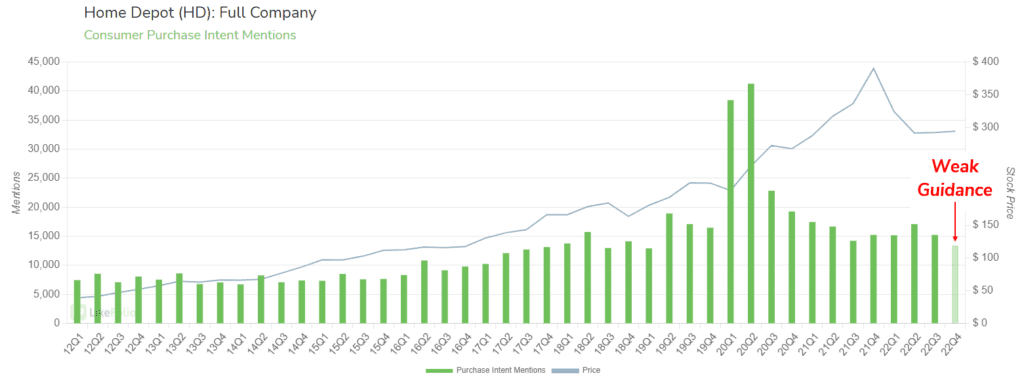

The Home Depot (HD)

- Home Depot demand grew by +7% in the third quarter vs. the same quarter a year ago, but demand now appears to be weakening. In the first two weeks of November, demand has dropped by -12%. Consumer buzz follows a similar trajectory.

- Home Depot has benefited from a more balanced mix of DIYers and professional customers peer Lowe's, especially as contractor activity outperforms the DIY segment. This continues to hold true, with hiring a contractor mentions +14% higher YoY while home reno mentions (favoring DIYers) trails.

- This contrast was evident on both company's last earnings report. Lowe's generates ~75% of sales from DIY customers and just 25% from professional customers. In contrast, Home Depot's professional customers comprise nearly half of its revenue and the company noted, "our large Pros were the best performers this quarter."

- Home Depot maintains higher happiness levels and demand growth vs. traditional and eCommerce peers in the home renovation space, but this growth is tempering. Heading into earnings, LikeFolio's score reveals a cautiously bearish outlook.

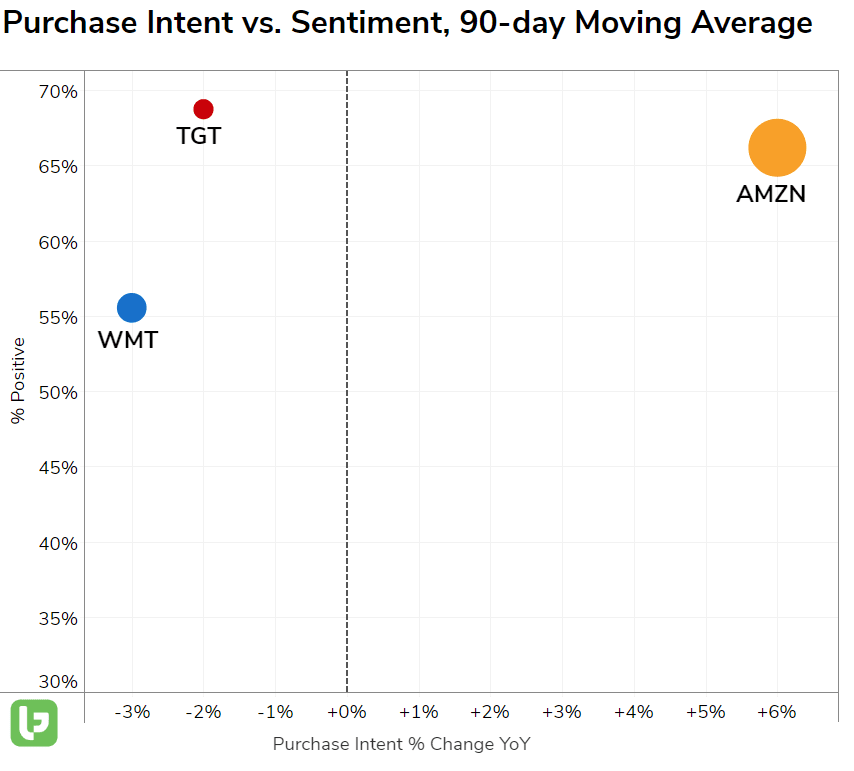

Target (TGT)

- A couple of weeks ago, Amazon (AMZN) missed Q3 revenue expectations, signaling a warning to retail investors. The CFO, Brian Olsavsky, mentioned that the company was bracing for slower economic growth in a with call reporters.

- Target has missed profit estimates for the last 2 consecutive quarters, due in part to a decrease in discretionary spending on the consumer front and a major sell-off of unwanted inventory that the company hopes will pay off in the long run: “If we hadn’t dealt with our excess inventory head on, we could have avoided some short-term pain on the profit line, but that would have hampered our longer-term potential.”

- Target is leaning into its omnichannel approach through its store format. Last week the company introduced a new large-format store (20,000 square feet larger than its current average) that will allow more space for backroom fulfillment to fulfill same-day omnichannel services including Order Pickup and Drive Up.

- LikeFolio data is neutral in all major data points going into TGT’s report on Wednesday morning. Demand has slipped by 2 points YoY but Happiness remains highest vs. retail peers AMZN and WMT.

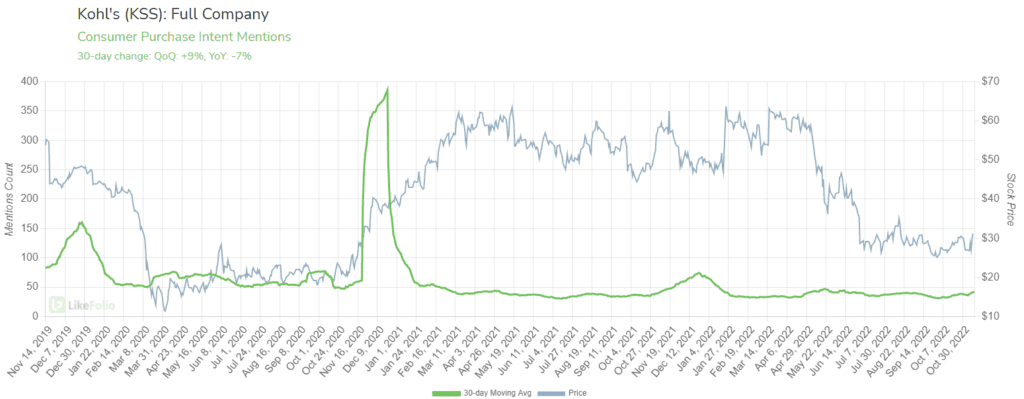

Kohl’s (KSS)

- KSS shares jumped last week upon news of a transition in management and positive preliminary third quarter earnings. Chief executive Michelle Gass is stepping down from her position as CEO at Kohl’s on Dec. 2 to become president of Levi Strauss (effective Jan. 2). The company expects earnings of $0.82, higher than the expected forecast of $0.63.

- Kohl’s expects comp sales to decline by ~7% in the quarter, which falls exactly in line with LikeFolio Purchase Intent mentions. Mentions in the current quarter are buzzing higher, mostly in response to news of the company’s change in leadership.

- Despite this near-term bump in investor optimism, shares remain 32% lower year-to-date.

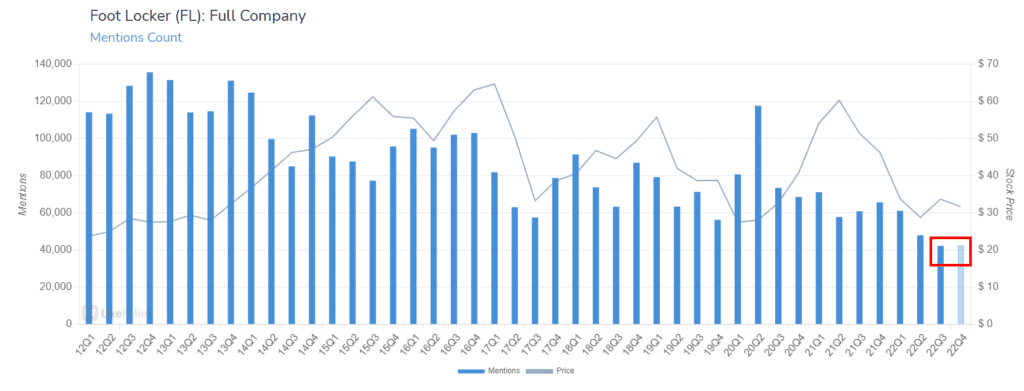

Foot Locker (FL)

- Footlocker is facing an uphill battle as a sneaker middleman. Nike plans to distance its relationship with FL to accelerate its DTC strategy and now, all Yeezy products will be pulled from FL’s shelves amid negative PR news from Yeezy founder, Kanye West.

- LikeFolio data shows Foot Locker's quarterly mention volume is at decade lows ahead of its 22Q4 earnings report. This loss of buzz momentum coincides with macro trends revealing lower foot traffic in key retail locations. Consumer mentions of shopping in a mall, where most Foot Lockers reside, is down --20% QoQ.

- Foot Locker reports on Friday, Nov. 11 before the market open.

eBay (EBAY)

- EBAY shares have gained steam in November, following a better-than-expected third quarter report. Revenue fell in the time period but remained well above prior guidance. Earnings followed suit, with EPS of $1 in the quarter vs. the expected $0.93.

- The company cited strength in refurbished goods and luxury offerings on its earnings call, touting itself as a price-friendly alternative for cash-strapped consumers with a taste for high quality: “As consumers in our major markets face persistent inflation, higher interest rates and rising home energy costs, they are increasingly turning to eBay for better value.”

- Consumer interest in high fashion and luxury goods continue to record strength, displaying a tale of two consumers: the haves and the have-nots. Consumer demand for high-end apparel has increased by +61% YoY and demand for high-end furnishings and décor has increased by +15% in the same time frame.

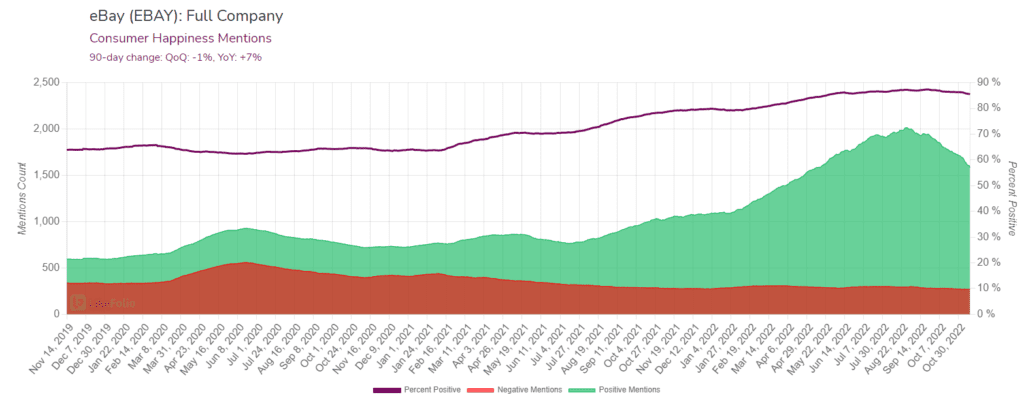

- Looking ahead, the most positive long-term indicator for EBAY is its improving sentiment rating. Consumer happiness has risen by +7 points YoY, driven by the company’s on-trend product offerings (like collectibles) and its improved user experience.