Coke (KO) Poised to Benefit from Reopening KO was hit […]

5 Stocks to Watch This Week (KO, DECK, META, TDOC, MCD)

October 24, 2022

| A BIG earnings-focused week is upon us! Here are some stocks we're watching: Coca-Cola (KO) |

- Earlier this month, PEP posted Q3 results that handily beat Street expectations, sending shares +4% higher. The beverage company noted a strong summer and significant brand power: as the company hiked prices, consumers followed.

- Coca-Cola may be positioned for a similar surprise if the company effectively hiked prices and recorded similar brand power. Pepsi did post volume declines in its Frito-Lay and Quaker snacking divisions (though pricing increases offset these declines). KO is insulated from any declines in consumer snacking behavior due to its beverage-only composition.

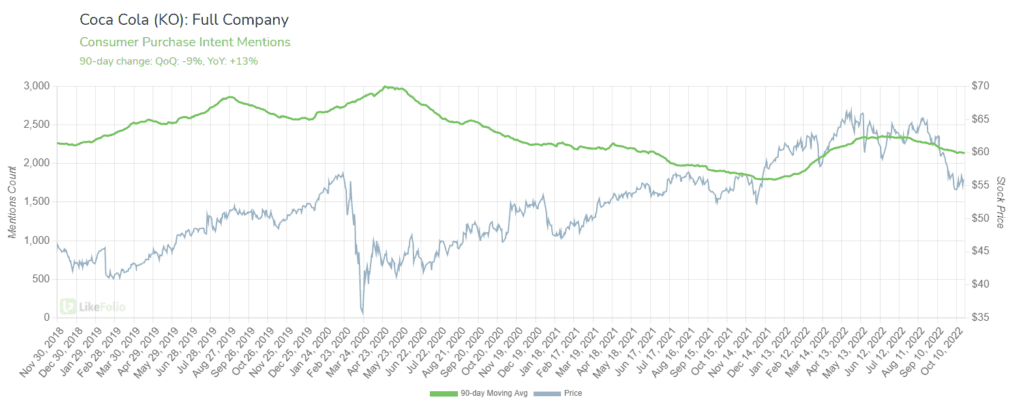

- Coca-Cola is recording higher YoY demand growth vs. Pepsi, reflective of strong beverage demand: +13% YoY vs. +1% YoY. From an energy drink perspective, Celsius (Pepsi minority stake) is continuing to steal market share from Monster (KO minority stake).

- LikeFolio is recording outperformance in the brand's non-cola offerings as well, including Fairlife (milk), Simply Juices, Honest Juices for Kids, and BODY ARMOUR.

- Last quarter, KO posted higher-than-expected earnings and revenue growth and raised guidance, noting it wasn't seeing a significant pullback in consumer spending.

| Deckers (DECK) |

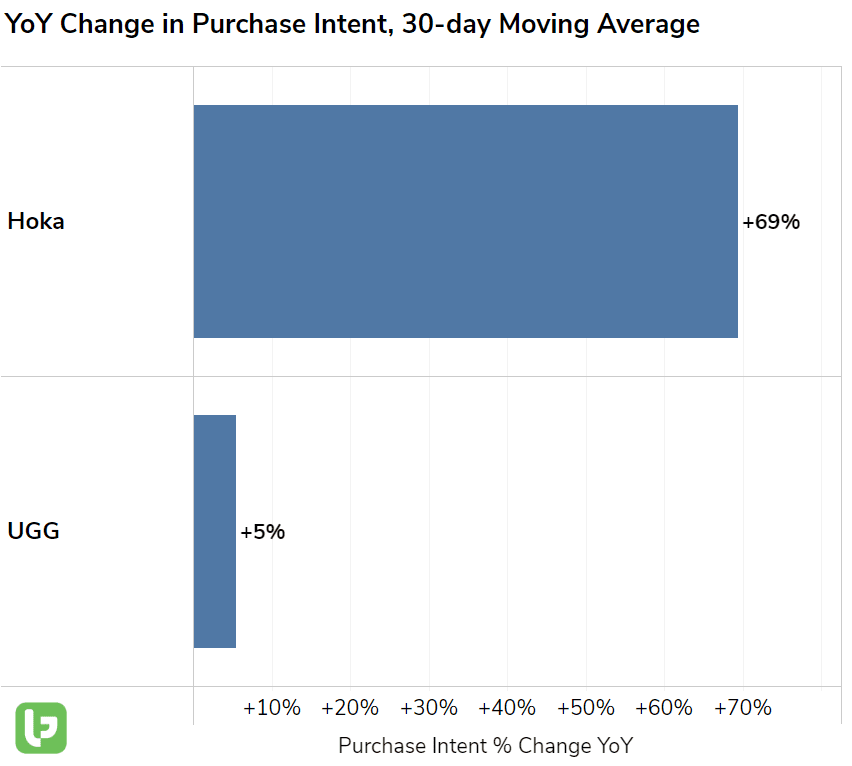

- Deckers demand is building in the current quarter: +4% YoY. Momentum is being driven by explosive demand for the company’s HOKA products (+69% higher YoY) from consumers seeking comfortable and supportive running shoes.

- In 23Q1, the HOKA brand achieved its first-ever $300 million quarter propelled by a robust DTC adoption and international market growth.

- UGG – the company’s largest brand from a mention volume perspective – is also recording demand growth ahead of its seasonal peak: +5% YoY. Brand buzz is growing at a steeper clip (+13%) as fashionistas question if they wrote the brand off too soon. Positive reviews from Kylie Jenner and Gigi Hadid on TikTok are helping to breathe new life into the brand.

- DECK reports Thursday after the bell and we’re expecting a solid report.

| Meta (META) |

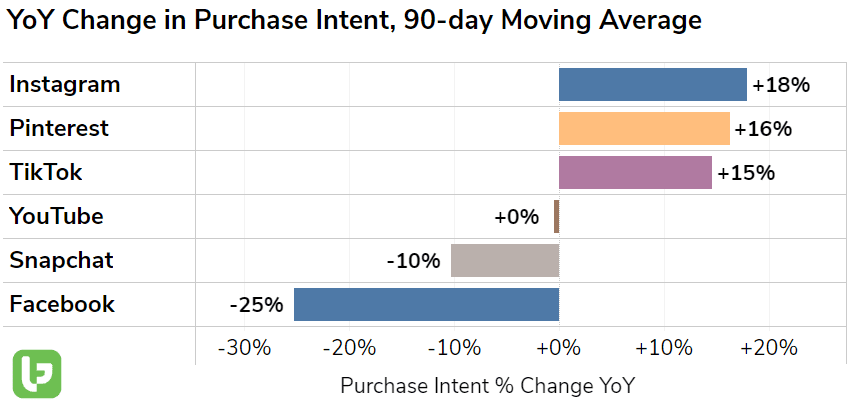

- SNAP shares plunged last week following the company’s third-quarter report featuring weaker-than-expected revenue and a struggling advertising market. META shares traded lower in sympathy over concerns of weak advertising spend across all social platforms but have since recovered.

- LikeFolio data reveals Meta’s Instagram brand is leading ALL social platforms in regard to YoY demand (downloads). External sources support this, citing Instagram as the most downloaded app worldwide in the third quarter of this year. On the other hand, Meta’s Facebook platform continues to lose steam with demand dropping -25% YoY.

- Meta’s diverse offerings including multiple social platforms (not just Facebook) and its Oculus brand suggest the company may not belong in the same boat as Snapchat. In fact, we featured a discrepancy in ad effectiveness in August, highlighting how much better Instagram was doing at connecting brands with consumers.

| Teladoc (TDOC) |

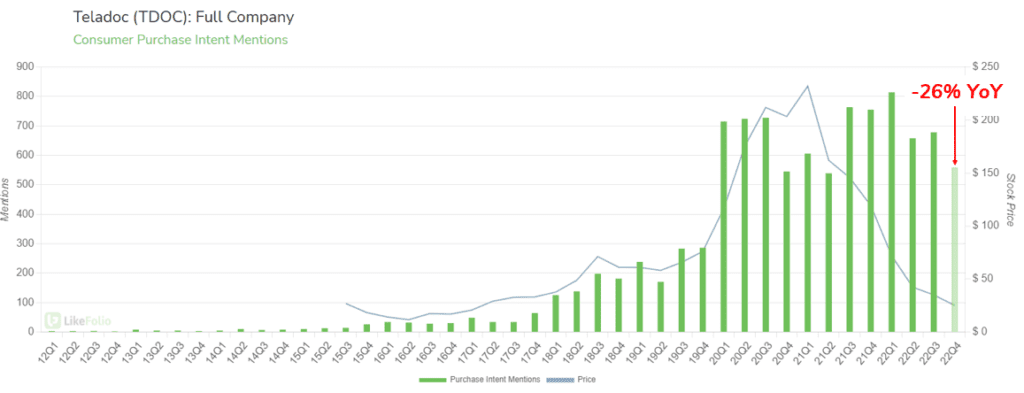

- The telehealth sector has underperformed the S&P 500 in 2022, with top names shedding -33% in value vs. the S&P’s -24% in the same time frame.

- Teladoc demand is slipping in the current quarter, currently pacing -26% lower YoY. However, it’s also relevant to note long-term adoption trends. Teladoc demand remains more than double the levels recorded prior to the pandemic despite post-pandemic tempering.

- Telehealth trends suggests opportunity is building long-term in virtual-friendly sectors like improving mental health (+8% YoY) and improving skin conditions (+7%YoY), which continue to be top of mind for consumers.

- Teladoc’s BetterHelp mental health platform is gaining steam in the current quarter, with demand +25% higher vs. last quarter. However, the brand needs to work on customer satisfaction to ensure continued adoption. Happiness levels have dropped -22 points YoY as consumers site shockingly high costs alongside low-quality “therapy” sessions.

- Teladoc reports 22Q3 results Wednesday after the bell.

| McDonald’s (MCD) |

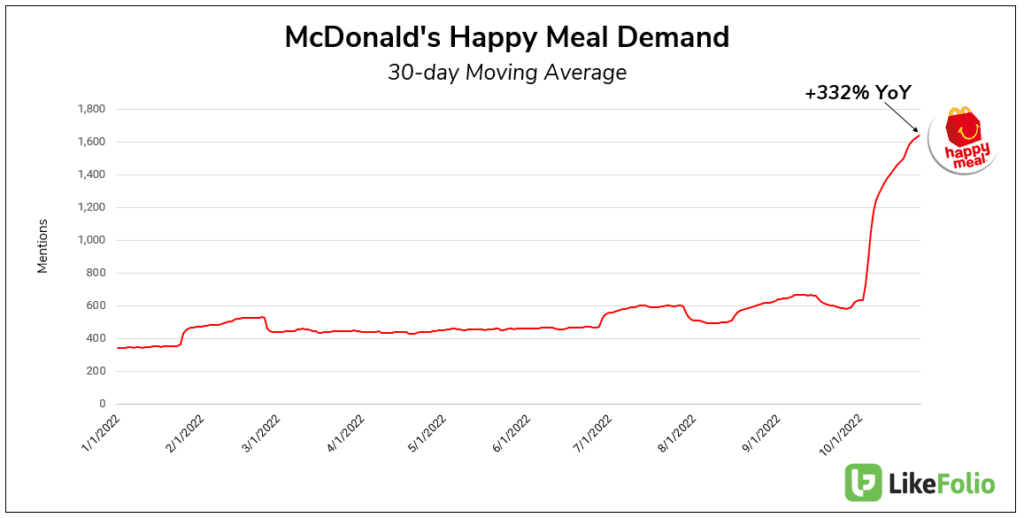

- McDonald’s is tapping into the feeling of nostalgia with its Adult Happy Meal menu addition launched in October. The meal features a Big Mac or 10-piece nuggets, fries, a drink, and a toy (which have been selling for thousands of dollars on third-party markets). LikeFolio data shows that “happy meal” demand has surged by more than +300% YoY.

- This promotional product drop is helping to move the needle for McDonald’s as a whole. Consumer mentions of ordering food from McDonald’s is pacing for +36% growth in the 4th quarter, which started Oct. 1. Demand is also surging higher in response to the company’s seasonal McRib offering “for the last time.”

- Metrics are improving in the current quarter and could translate to an unexpected surprise for the Street.

Want deeper insights? Get Free Access to The Vault.

Tags: