Roku makes streaming devices that allow its customers to stream […]

5 Stocks to Watch this Week -- $REAL $WIX $GOOGL $AMZN $SHOP

September 26, 2022

Here’s what’s popping in the LikeFolio data universe…

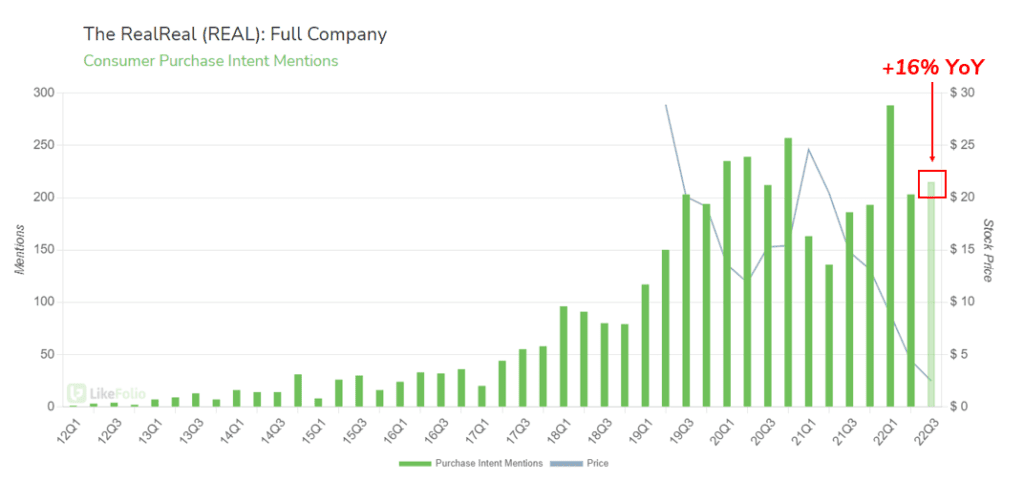

The RealReal (REAL)

- The secondhand luxury market is recording higher growth vs. new luxury purchases, according to the Wall Street Journal.

- LikeFolio macro trend data confirms consumers are buzzing for high-end retail: Luxury fashion demand mentions have risen by +62% YoY, and thrifting mentions are up +4% YoY.

- One beneficiary of BOTH luxury trends is The RealReal, an eCommerce retailer of luxury consignment.

- Consumer mentions of shopping with The RealReal are rising in the current quarter: +16% YoY. REAL shares have shed more than -87% in value in the same time frame. Divergence forming?

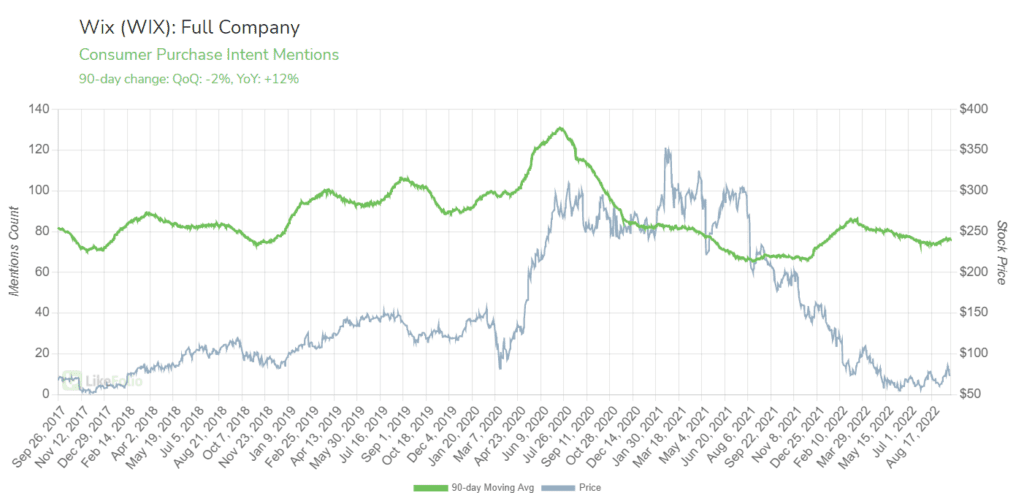

Wix (WIX)

- WIX shares popped last week after an activist investor announced a large stakein the company, stating is was undervalued at its current level. Starboard purchased 5.2 million shares of Wix – 9% of the company.

- Since then, the stock has given back most of the announcement-driven gains. Shares are currently trading more than -60% lower YoY.

- LikeFolio data suggests the activist investor may be on to something: Consumer mentions of signing up for or using the WIX platform have risen by +12% YoY.

- Data also suggests more users are returning to the platform. The number of returning users in August is 6% higher vs. levels recorded at a low point in November 2021.

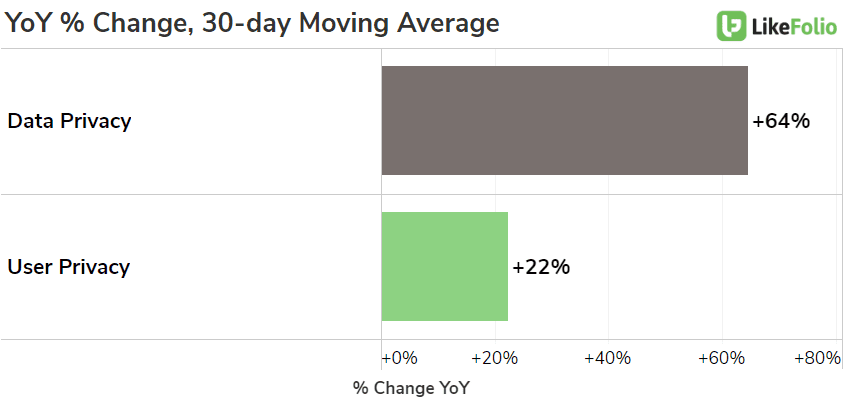

Alphabet (GOOGL)

- Alphabet completed its acquisition of Mandiant, a leader in “dynamic cyber defense, threat intelligence and incident response services.”

- Mandiant will continue to operate under its current name but will live under the Google Cloud umbrella.

- LikeFolio data demonstrates that user privacy and data concerns are at the top of consumer minds. Each privacy-related trend in our universe is recording YoY growth in mention volume.

- We featured GOOGL as a tech winner in the September MegaTrends report, and this acquisition supports our thesis. Google continues to adapt to growing security priorities among consumers and businesses.

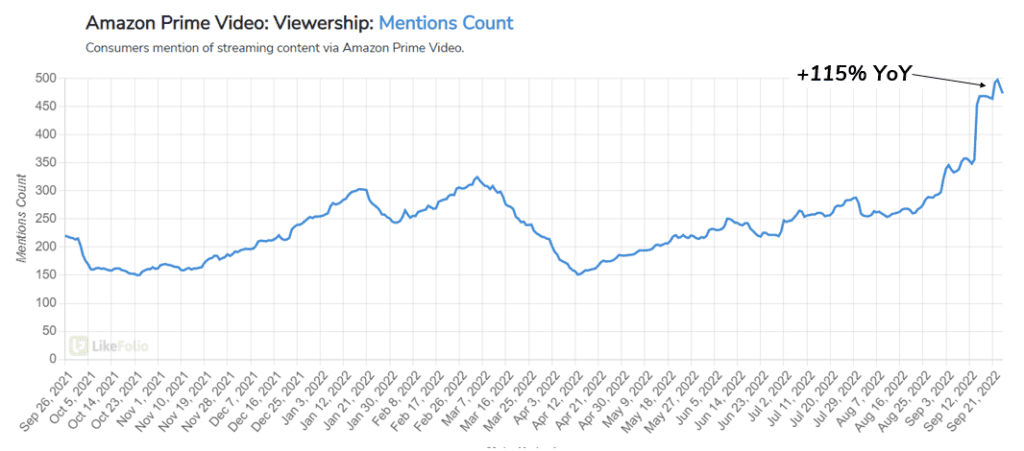

Amazon (AMZN)

- Amazon Prime Video viewership is receiving a massive bump thanks to its streaming rights for NFL ‘Thursday Night Football.’ Mentions of streaming content on Amazon Prime have risen by +115% YoY.

- Not only is this partnership driving viewership, but it’s driving new Prime subscriptions too. Prime video subscription mentions (which are included with an Amazon Prime membership) have risen by +56% YoY.

- This is a positive driver of buzz for Amazon, which is exhibiting positive consumer momentum in the current quarter. Company-wide, Amazon mention volume is pacing +11% higher YoY, a significant improvement for a company that garners more than 40,000 mentions/day.

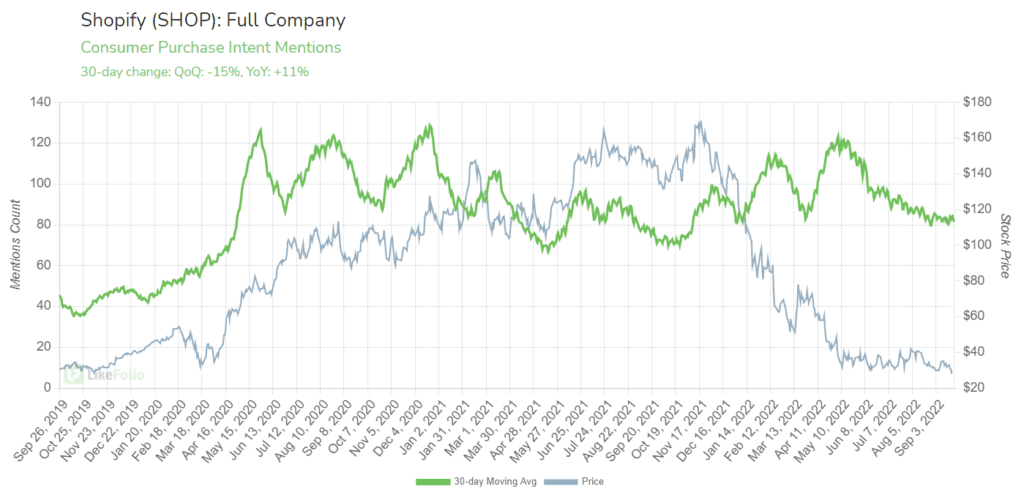

Shopify (SHOP)

- Shopify is showing early signs of divergence – meaning, consumer demand is heading in one direction, and the stock price is heading in the opposite direction.

- SHOP shares are trading -77% lower YoY – below levels recorded in 2019. But consumer mentions of signing up for or using the eCommerce platform are +11% higher YoY and + vs. 2019.

- In addition, macro trends including eCommerce (+9%) and shopping from a mobile device (+29% YoY) are showing near-term strength.

- Keep an eye on this name. Members should watch for official alerts.