Activision Blizzard (ATVI), Take-Two Interactive (TTWO) Gaming is gaining steam […]

5 Stocks to Watch This Week ($ULTA, $NWL, $U, $TTWO, $SEMR)

August 8, 2022

| Another week of earnings season! Here are 5 names that LikeFolio is watching for this week. Ulta Beauty (ULTA) |

- Last quarter Ulta Beauty smashed expectations, recording double-digit comparable sales growth across all major categories. Shares surged +11% following the report.

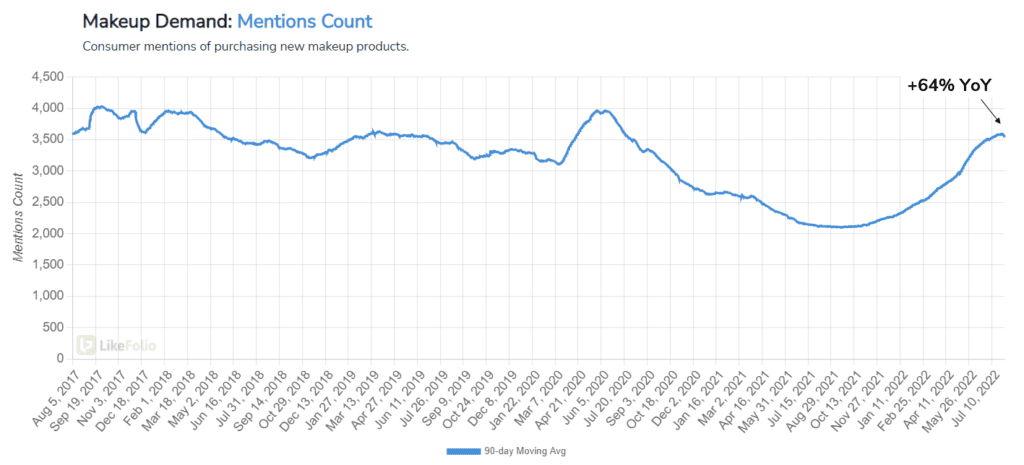

- One major driver of Ulta’s recent strength: Makeup Demand. LikeFolio data confirms demand for makeup products has exceeded pre-pandemic levels, currently trending +64% higher YoY.

- ULTA confirmed demand was bolstered from consumers increasing traveling and social activities. On its earnings call, leadership noted: “Importantly, sales of makeup exceeded pre-pandemic levels in both mass and prestige cosmetics. The makeup recovery is progressing faster than we expected coming into this year. Compared to the first quarter of 2021, prestige cosmetics outperformed mass cosmetics, driven by new and expanding brands and a strong 21 Days of Beauty event. From a trend standpoint, foundation, concealers, eyeliners, and lipstick continue to deliver strong comp growth.

- LikeFolio data shows ULTA store visits remain strong in the current quarter: +48% YoY. In-store visits are critical for the cosmetic provider as the tangible product experience is difficult to replicate online. Sentiment remains +4% higher vs. pandemic levels, driven by positive shopping experiences and new product lineups.

- ULTA purchase intent capped off 22Q2 +20% higher, YoY. This represents an acceleration vs. demand growth recorded in the prior quarter (+6% YoY). Ulta will report 22Q2 results at the end of August.

| Newell Brands (NWL) |

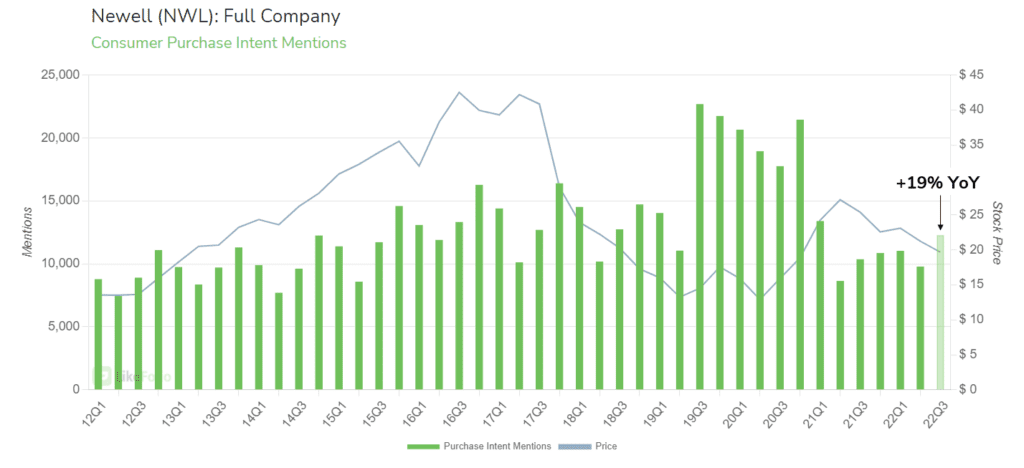

- Newell is recording a back-to-school demand boost in 22Q3. Mentions are currently pacing +19% YoY, driven by demand for brands like Sharpie, Elmer’s Glue, and Crockpot.

- Back-to-school shopping mentions suggest a strong shopping season as students return to the physical classroom. Across the board, back-to-school shopping mentions are +35% higher YoY. Back-to-school spending is expected to rise to $34.4 billion (highest on record) this year due to inflation.

- NWL share slipped -3% immediately following the company’s last earnings report at the end of July, mostly due to investor concerns about weaker-than-expected guidance. The company’s Learning & Development segment outperformed, recording net sales +2.5% ($865 million) while other segments recorded YoY declines.

- LikeFolio data confirms continued strength in Learning & Development, and perhaps a surprise in Home Appliances due to rising Crockpot demand. We’ve got a close eye on this moving forward, as the company may be positioned to beat expectations if it keeps up its current demand pace.

| Unity (U) |

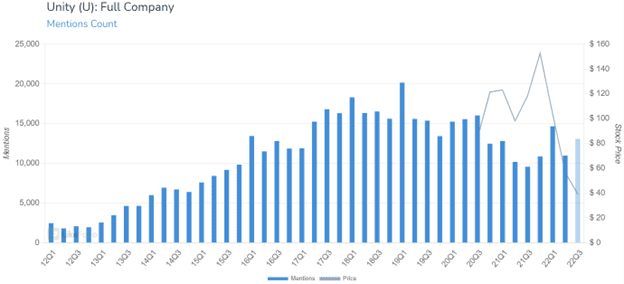

- Unity’s Earnings disappointed the market last quarter. With the company’s 2022 Q1 net loss widening to 53% of revenue (up from 47% in the prior year). However, the gaming software company has continued to demonstrate strong revenue growth, posting a +36% YoY increase.

- Unity has an edge on traditional companies in the gaming industry. While most publicly traded game publishers develop and release fully completed games, Unity’s software and asset marketplace empower third parties to develop games. As a result, Unity benefits from increased decentralization in the industry.

- Unity software aids in the development of mobile games, one of the fastest growing segments within the broader gaming industry. Consumer Mentions of downloading or playing mobile games are trending +14% YoY on a 90-day moving average.

- Unity Mentions are showing a resurgence in 2022. Consumer Buzz declined on a year-over-year basis for five consecutive quarters between 2020 and 2021. However, total Mention volume has resumed growth in recent quarters.

- Unity is set to report earnings results for the second quarter of 2022 on Tuesday after market.

| Take-Two (TTWO) |

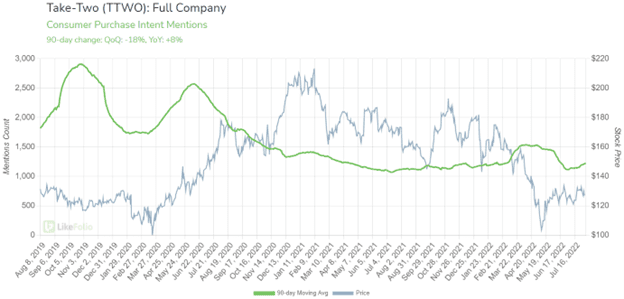

- Take-Two has become one of the leading companies in legacy gaming. The traditional gaming industry has been trending towards consolidation over the past decade. Once Microsoft (MSFT) completes its acquisition of the market leader Activision Blizzard (ATVI), Take-Two stands to become the second-largest publicly traded game developer in the U.S.

- TTWO’s profits are declining, due in part to rising operating expenses. On its most recent earnings report, TTWO reported a -30% pullback in net income with a +11% increase in revenue. However, the company expects to see contributions from recent acquisitions and future releases help boost the bottom line going forward.

- Take-Two relies on recurrent consumer spending. Recurrent consumer spending, often called “microtransactions” in the gaming industry, refers to in-game currency and other add-ons that can be purchased as part of both free-to-play and standard titles. Recurrent consumer spending, which accounts for 60% of TTWO’s total net bookings, declined -6% YoY in the last quarterly report.

- The company reports earnings for the quarter ended 6/30 after the bell today.

| SEMrush (SEMR) |

- Consumer Demand for SEMrush’s software is booming, at a new all-time high on a 90-day moving average and up +39% QoQ and +133% YoY.

- SEMR helps businesses of all sizes compete in an increasingly web-focused economy. Semrush’s suite of online visibility management tools helps businesses to differentiate themselves from competitors, reach the right consumers, and drive increased traffic to websites and social media pages.

- LikeFolio data shows that Businesses are prioritizing efficiency — Mentions of improving business efficiency are trending +77% YoY (90d MA). This trend serves as a major tailwind for SEMR’s B2B platform.

- Semrush has demonstrated impressive sales growth. Since going public in 2021, reported revenue and total paying customers have increased sequentially and year-over-year in every quarter. However, the company operates at a slight loss, which has caused shares to pull back nearly -60% from their post-IPO highs.

- We’re looking for a positive reaction to this week’s quarterly report, scheduled to take place Wednesday after the close.

Want deeper insights? Get Free Access to The Vault.

Tags:

$TTWO, Newell Brands, NWL, semr, Semrush, Take-Two, U, Ulta, Ulta Beauty, Unity