Carnival Cruise Lines is starting to show some weakness in […]

5 Things Investors Should Know: CCL Earnings

5 Things Investors Should Know: CCL Earnings

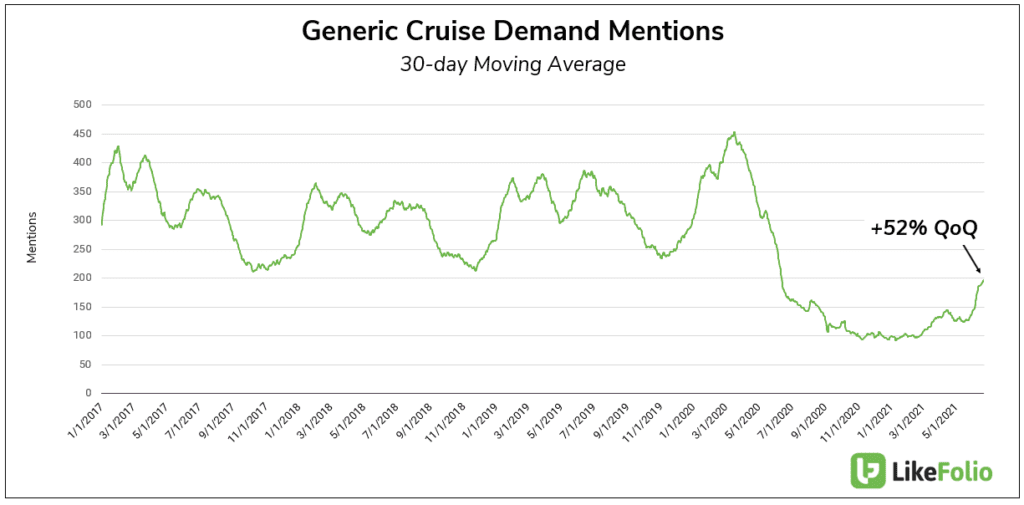

1. Consumer Demand to take a cruise is returning: mentions have increased +52% QoQ, +15% YoY.

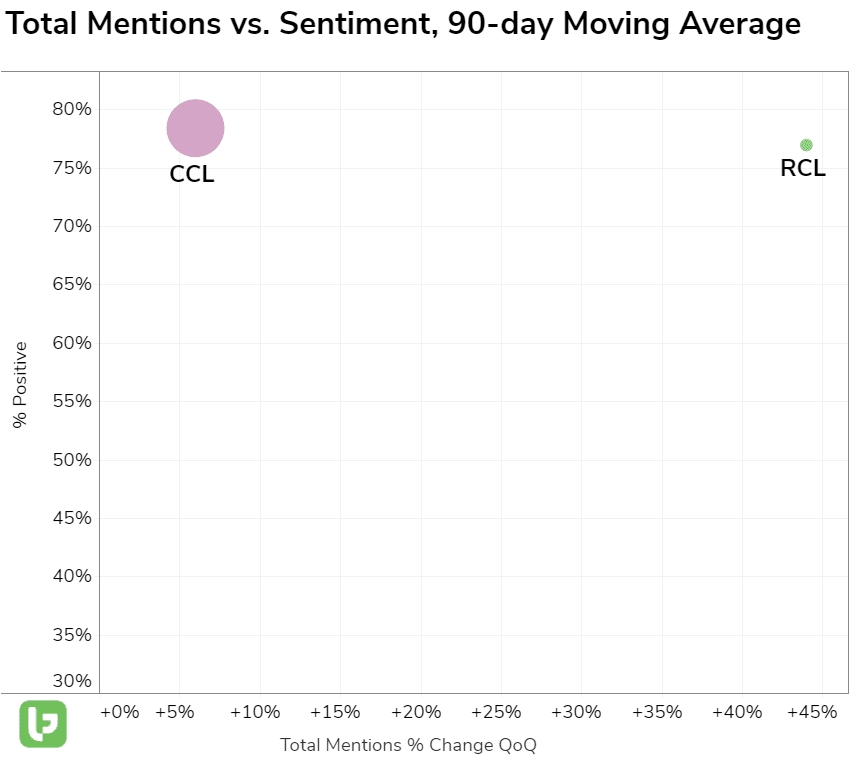

2. Cruise Demand has not returned to pre-Covid levels. These mentions remain -49% lower vs. 2019. Cruise liners still have a lot of catching up to do. 3. RCL is Gaining Buzz quicker vs. CCL, but CCL has made incremental improvements in Sentiment. If RCL were to report Earnings today, its score would be +34 (vs. CCL at +6). On the positive side for Carnival, Consumer Sentiment has jumped by +25% YoY to 78% positive, in line with RCL Happiness. This normalization of sentiment for both cruise lines is a positive note for potential future bookings.

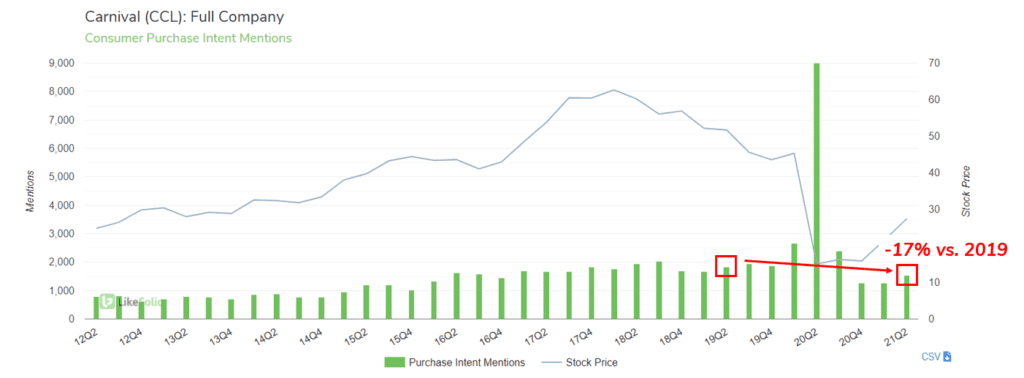

4. CCL booking mentions in 21Q2 remain below 19Q2 levels: -17% vs. 2019. This is a +21% QoQ improvement vs. Q1, but not complete normalization.

5. Prepare for an extended recovery. CCL revenue in 21Q1 fell -99% vs. 20Q1, and now the company is offering highly discounted packages to entice consumers to jump aboard. Couple this with the $31 billion in total debt held at the end of the quarter, and you can see the hill the company has to climb.

We'll be paying close attention to demand and sentiment as consumers actually return to the sea.