9 Companies That are Gratefully Winning Thanksgiving

A recent survey suggested that inflation, including high turkey prices, will cause 1 in 4 Americans to skip Thanksgiving this year. That seems hyperbolic, but we get it.

Households are financially stressed. Smaller gatherings and smaller portions may make it tougher to get that second helping of mashed potatoes this year.

And at $2 a pound, we haven’t seen turkeys this high since our epic company bowling night.

But come on, it’s a tradition!

So, we decided to take up our own survey. We asked LikeFolio team members what they are most grateful for this Thanksgiving.

The top responses: Family, Health, and Freedom.

(Yeah, football and weeklong leftovers ranked pretty high too.)

And since we’re obsessed with providing actionable insight from our proprietary consumer sentiment data, we took things a step further.

We wondered: What are some of the companies that embody the American spirit of family, health, and freedom?

Better yet, which ones are experiencing the strongest social media buzz?

Social media discussions show that these are the names putting the ‘attitude in gratitude’:

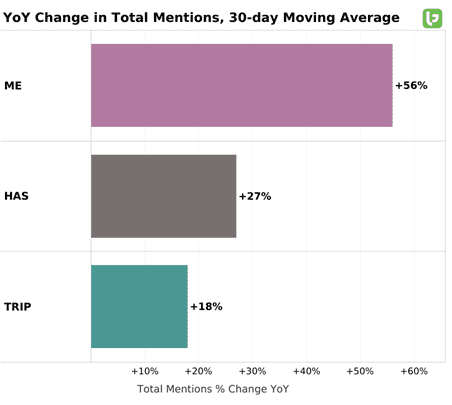

1. Family – 23andMe (ME), Hasbro (HAS), TripAdvisor (TRIP)

| A lot of priceless traits get passed down from generation to generation. Grandpa’s sense of humor. Mom’s nurturing compassion. Unfortunately, so do genetic diseases and disorders. That’s where 23andMe comes in. The company is a leading provider of genetic health reports based on an individual’s DNA. Its research platform is used to develop drugs for cancer, cardiovascular, and respiratory diseases. Just as people are becoming more curious about their ancestry, interest in genetics is growing rapidly. Often the two are linked. 23andMe’s database increased to 13.4 million customers last quarter. New reports were launched for anxiety, fibromyalgia, and seasonal allergies. Learning about pre-disposition to certain diseases can lead to prevention and early diagnosis. Personalized data obtained from 23andMe is helping consumers take action—eating healthier, exercising more, and sleeping better. LikeFolio data supports that learning about the family tree is about more than discovering what countries we’re from. Total Mentions of 23andMe are up 56% YoY on a 30-day average. |

And if you’re anything like our families, you spoil the kids. That’s why we have our eye on Hasbro heading into the holiday shopping season.

Demand for Hasbro toys and games typically perks up in Q4, but it has been especially strong of late. Hasbro Purchase Intent (PI) mentions are up 27% compared to this time last year. Maybe Santa isn’t scaling back on discretionary spending after all.

Hasbro is also a major player when it comes to family game nights. Its lineup of board games includes classics like Clue, Monopoly, and Scattegories.

Then there’s the wildly popular Magic: The Gathering card game. PI Mentions of the brand are up 81% YoY.

Last month, Hasbro’s Wizards of the Coast unit teamed up with Grammy-nominated artist Post Malone to launch a set of Magic: The Gathering Secret Lair cards. A good example of how Hasbro is winning over younger consumers by tagging in pop culture icons.

And what would Thanksgiving be without a good old family trip?

With the travel industry rebounding and experiences commanding a greater part of household spending, many are turning to TripAdvisor to plan their next getaway.

Consumer buzz around the world’s largest travel guidance site has trended higher since the year began. The stock, however, is on pace for a 4th straight annual decline, a disconnect we think could correct over time.

Trip Advisor’s Q3 revenue jumped 51%. The core business, Viator travel marketplace, and TheFork restaurant booking business all grew nicely.

We were also encouraged to see monthly unique users across all Tripadvisor sites climb 8% in the period and inch closer to pre-Covid levels. This along with LikeFolio trend data point to a healthy rebound underway in the consumer travel space.

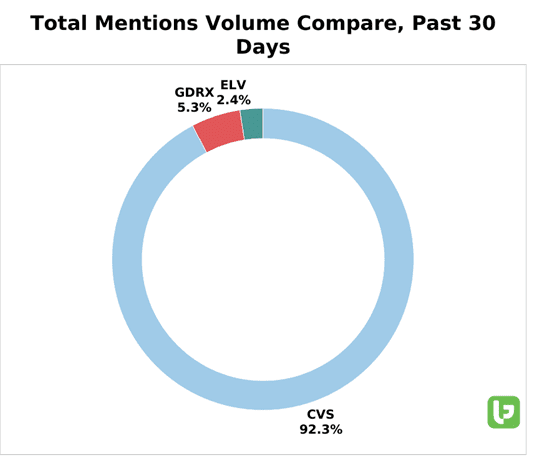

2. Health – Elevance (ELV), CVS Health (CVS), GoodRx (GDRX)

| Health and wellness continues to be one of the hottest trends coming out of the pandemic. We’ve seen a wide range of companies benefit from consumers’ increased focus on personal and family health. One of them is Elevance Health, a whole health business offering health plans and healthcare services encompassing physical and mental health. Demand for the company’s Anthem, Blue Cross, Blue Shield, and Wellpoint health plans is on the rise. Consumers are gravitating towards whole health care plans that strike a balance between coverage and affordability. Meanwhile, the lesser-known Carelon tech solutions side of the business is serving 1 in 3 Americans through various partnerships. Elevance Health has 29% higher Mentions YoY on a 30-day average. As whole health becomes a bigger deal to consumers, we expect the recent buzz around the company to continue. |

CVS Health is all about comprehensive care these days too.

Total mentions of CVS Health increased 8% QoQ in Q3 and are on pace to increase again in Q4.

What’s driving this? Nowadays, there’s more to CVS than retail and traditional pharmacy services.

A significant amount of the buzz is around CVS Specialty. This is the company’s new prescription management and personalized care brand.

Consumers are discussing the convenience and reliability of the offering. Online refills, home delivery, and 1-on-1 support from the CVS Specialty CareTeam.

In a world where healthcare privacy and personalization matter much, people like being able to connect with a nurse or pharmacist who is specially trained for certain medical conditions.

And if you’re like me, you want to pick up a new script on the way home from the doctor’s office. But knowing if it’s ready yet requires a crystal ball. On the CVS Specialty app, you can monitor orders and get real-time alerts.

Year-to-date through September 30th, 2022, CVS Health grew revenues 10.7%. It once again beat estimates in Q3 and raised its full-year outlook. The company’s strategy to expand into more areas of health care is paying off and is consistent with the uptick in discussions about comprehensive health care.

Pending the approval of the Signify Health acquisition, CVS will soon have another growth catalyst in the mix. Signify’s tech-enabled complete care platform could help bring CVS customer engagement to another level.

GoodRx is also generating a good amount of buzz over the last few weeks. Why?

Consumers are looking for any edge they can get when it comes to saving money. GoodRx gives them price transparency when it comes to the sometimes foggy world of prescription medications.

The company’s Q3 report showed a YoY decline in subscription plans which is consistent with what we are seeing in other areas, most notably streaming TV.

However, we think demand for services that 1) are health-related and 2) help consumers save money point to a longer-term uptrend in GoodRx Gold and Kroger Savings Club subscriptions.

In other words, digital healthcare tools are less likely to get wiped from the budget than digital entertainment.

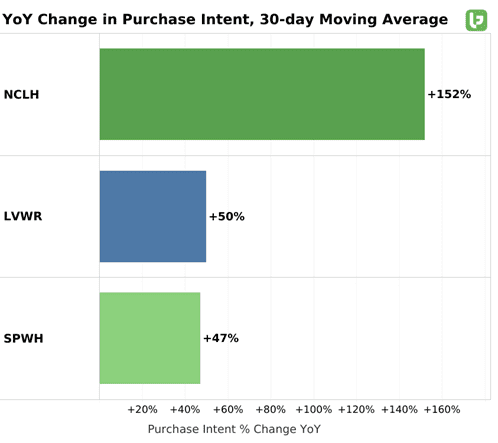

3. Freedom – Norwegian Cruise Line (NCLH), LiveWire (LVWR), Sportsman’s Warehouse (SPWH)

| Speaking of entertainment, Americans’ ability to pursue a wide range of leisure activities is certainly something to be thankful for. Whether it be sailing the high seas, hitting the country roads, or exploring the great outdoors, demand for adventure is climbing fast. Consumer mentions of Booking a Cruise are up 85% YoY. Cruises have been one of the most resilient discretionary categories in our universe. Norwegian Cruise Line is seeing some of the strongest demand. While Royal Caribbean and Carnival PI Mentions have slowed in Q4, NCLH PI Mentions are on pace to exceed Q3 demand—and are up 152% on a 30-day average. Norwegian’s Q3 report had a trio of bullish consumer metrics: 1. The occupancy rate improved to 82% 2. Revenue per passenger was up 14% compared to 3Q19, and 3. 2023 bookings match the record levels observed in 2019—despite prices being significantly higher! Based on the trends we are seeing, it’s no surprise that cruise line stocks are on cruise control. Quarter-to-date, NCLH, RCL, and CCL are each up approximately 60%! |

Another name we’re watching closely is LiveWire, Harley-Davidson’s electric motorcycle spin-off that started trading on the NYSE in September. The stock has skidded to a new low but based on the favorable social media chatter, LVWR looks likely to rev higher over time.

While its stock is relatively unknown, LiveWire’s motorcycles are quickly gaining traction among consumers. Much of the discussion is around the new low-cost S2 Del Mar model. LiveWire started taking reservations in September and production is slated to start in Spring 2023.

Its predecessor, the Del Mar Launch Edition, sold out in 18 minutes this past May.

One leisure stock that is starting to reflect strong LikeFolio data is Sportsman’s Warehouse.

SPWH has rallied roughly 30% from its September 2022 low. PI mentions have been on an uptrend since August 2022.

The retailer of all things outdoors appears to be gaining momentum after Q2 sales topped internal guidance.

Comprehensive Demand for SPWH hunting, camping, and fishing gear looks headed for a 4th consecutive quarterly increase. Yes, there is a seasonality effect here, but the level of buzz is trending back toward the post-pandemic peak of 2Q20.

This tells us that Americans’ interest in the great outdoors was not just a pandemic fad. People still want to get outside and enjoy nature. In turn, they are enjoying the one-stop shopping experience across Sportsman’s Warehouse’s expanding store footprint.

Now that’s a breath of fresh air!

Family. Health. Freedom.

From our team to yours, we wish you a very Happy Thanksgiving!