A Day In The Life: LikeFolio Intern

The following post was written by Jake Ballard upon completion of his LikeFolio internship in the summer of 2020.

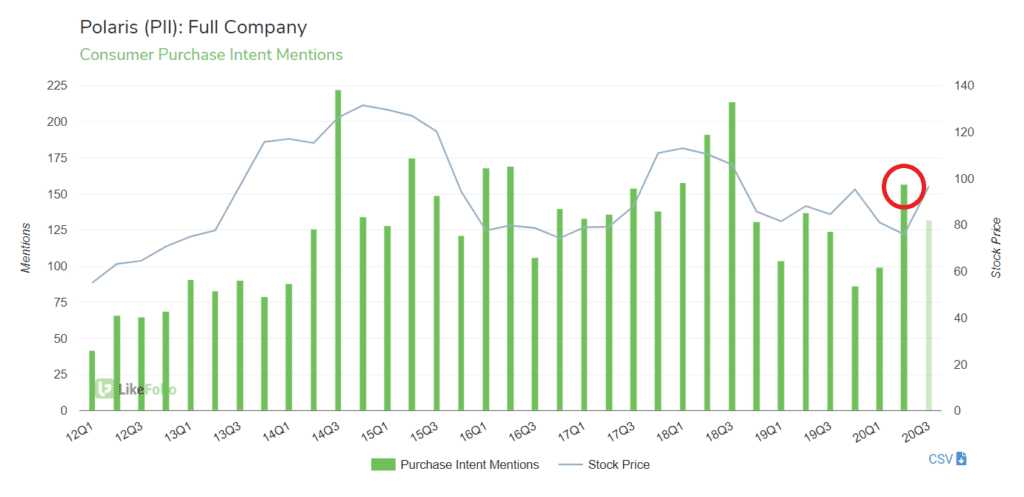

Read about the ins and outs of the internship, which culminated with Jake discovering and publishing an opportunity in Polaris stock that netted LikeFolio clients a 7.44% overnight gain when the company reported earnings that were better than expected... just as Jake had used LikeFolio data to predict.

LikeFolio does... what?

Going into my Internship at LikeFolio, I really had no idea what to expect. I knew the basis of what LikeFolio did (analyzing social media to understand shifts in consumer spending before Wall Street catches on), but I never realized how much detail truly went into everything.

The idea of studying tweets to predict the success of a brand is so unique that usually when I tell people about LikeFolio, they are completely blown away that such a concept exists...as was I.

The work environment, while incredibly quiet and relaxed, was super helpful and supportive. I liked the idea of not enforcing “work clothes” and allowing myself to work at my own pace. It was not stressful or over-taxing. This makes for a much more efficient, successful work environment in my opinion.

At the end of the day, I’m leaving with valuable skills. I came in the first day with practically zero Microsoft Excel experience. And while I’m still by no means an expert, I am much more comfortable navigating through it. This, along with the financial market knowledge I have gained the past couple months, are some of the numerous abilities I will be able to carry over into my career.

Here's the truth. daily activities required creativity, persistence, and varied greatly.

From creating keywords, running stat and tweet probes,analyzing spikes, or helping out with notes for a dailyappearance on the TD Ameritrade Network, my responsibilities varied wherever the office needed me.

A few of the projects I worked on this summer surprised me. I never thought I’d be paid to research and understand the hard seltzer market, for example. Projects like that entailed a great deal of focus and creativity when creating keywords. After a while, it can be difficult to continue doing the same thing over again, so this is where being able to focus on a task until it’s complete has helped me out. Trying to get creative with the tags is another factor that I think has been beneficial in these projects.

Instead of only listing the obvious keyword phrases, trying to dig a little deeper, putting myself in the shoes of someone tweeting, makes for a more successful probe.

In addition, researching companies for earnings every day really gave me a sense of how important it is to get a full picture of how a company has performed in the past, and not just the current quarter.

Client-quality Report Creation

This understanding of consumer sentiment and the “big picture” helped me spot an opportunity with Polaris.

I have always thought their RZR line was impressive...looking back through the decade at how hard they have thrived, especially in the mid-2010s,

Polaris seemed to remain in the driver’s seat regarding the off-road vehicle industry.

When scrolling through brands and top tag mentions, I realized how hard Polaris had rebounded since he beginning of the Pandemic...and I saw great potential.

See this chart...

That rebound in LikeFolio Purchase Intent told me some people were tired of the extended quarantine times during the first nation-wide shut down and were ready to be outside.

Not only did a tweet analysis reveal my hypothesis about consumers longing to be outside correct, but it also told me people were talking specifically about riding or driving a Polaris. After reviewing almost 200 tags, the Polaris RZR, Indian Motorcyle, and the new Polaris Slingshot were all at the top of the most mentioned products.

So…I constructed a bullish Polaris update that was delivered to clients prior to earnings.

Given the circumstance of the Covid-19 pandemic, Polaris was able to perform well for its most recent earnings.

It passed expected revenue by 11.83%.

The market reacted to positively to the news, and PII traded 7.44% higher in the day following Q2 earnings release.

I’m excited to continue using consumer insights to follow the market in the future.