Despite recent market volatility and some arguing for a bear […]

A Food Delivery Winner is Emerging (DASH)

May 24, 2021

A Food Delivery Winner is Emerging (DASH)

Access to food delivery was a godsend during lockdown. But now that the world is reopening, what are the lasting impacts of this massive shift in consumer behavior? Here are our key takeaways:

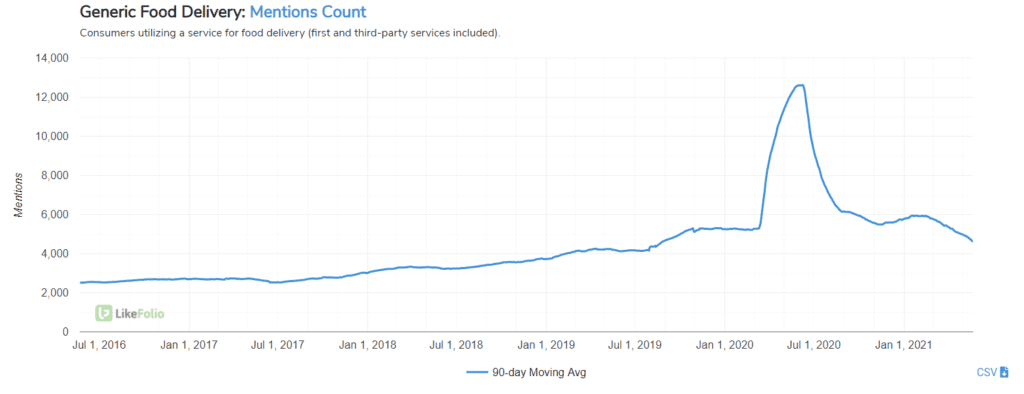

- Food delivery has some staying power, but rapid growth is over. Overall demand mentions remain elevated vs. pre-pandemic levels but have normalized substantially. Generic food delivery mentions have fallen -20% QoQ, but remain +11% higher vs. 2019.

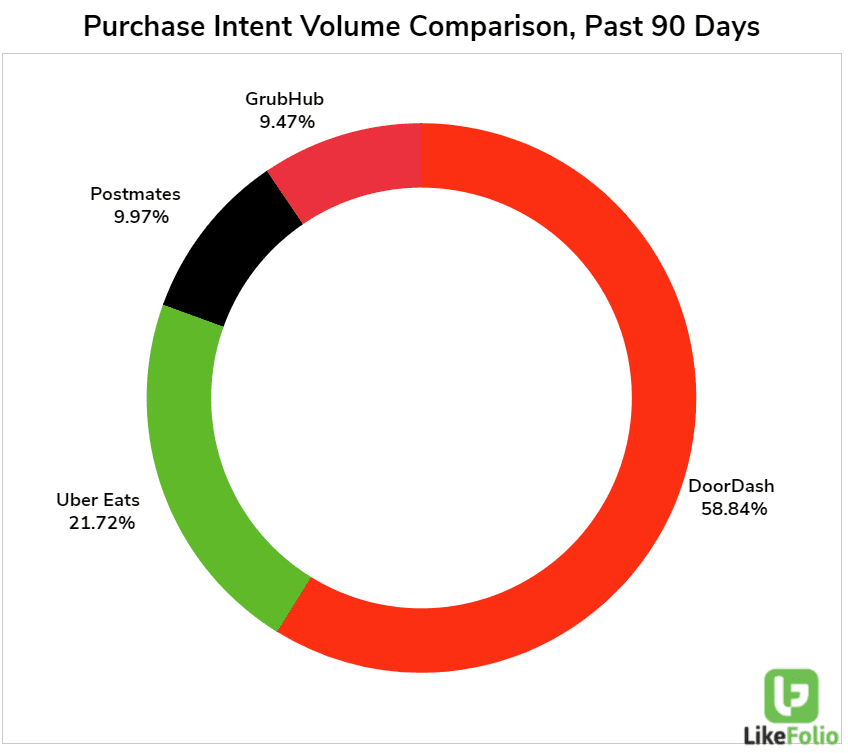

- DoorDash is the dominant player in the space. DoorDash continues to increase market share, comprising nearly 60% of all Purchase Intent mentions in the last 90 days. A year ago, DoorDash's share was 45%.

- Uber is trailing DoorDash in food delivery demand, but has a reopening edge. Uber's food delivery segment ranks second in market share at ~32% (the company owns both Uber Eats and Postmates). But UBER collectively is gaining the most traction on a QoQ basis thanks to its ridesharing segment.

- Grubhub is the clear loser in this space. It had an early edge, and led in mention volume through 2016. However, it continues to purge users. It held 16% of food delivery market share in 2020, and now holds less than 10%, the smallest piece of the pie. Don't be fooled by its high levels of consumer happiness....it holds the lowest volume of users, and these are likely the most loyal bunch.

Looking ahead, we've got an eye on DoorDash as it expands its delivery partnerships beyond food. The company has key partnerships with Walgreens, Rite Aid, Vault Health and Everlywell (digital health companies), PetSmart, Sam's Club, and even Macy's. This is the clear leader in the delivery space.