Stitch Fix (SFIX) Last quarter, SFIX shares fell 14% after […]

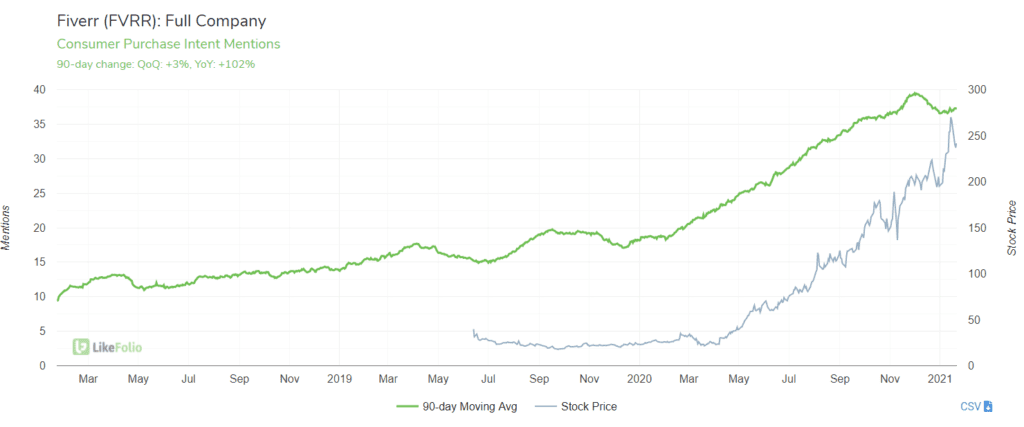

Analysts downgraded FVRR. LikeFolio data suggests they're wrong.

Fiverr (FVRR)

Since a downgrade from UBS analysts over valuation concerns, FVRR shares have shed ~10% in value.

LikeFolio data suggests consumer demand growth (pacing +102% YoY) is more than enough to justify Fiverr's current valuation.

In 20Q3, FVRR Purchase Intent increased nearly exactly in line with revenue growth reported: +86% YoY (vs. reported +88%).

This means at its current pace, the adoption of Fiverr's platform is accelerating.

Fiverr reports 20Q4 earnings Feb. 18 before market open, and we expect a strong report.

Trend Watch: Real Estate

In 2020, home sales activity reached the highest level seen since 2006. We’ve spent a lot of time heralding industry disruptors, like Redfin (RDFN), but there’s another, more traditional company that’s been quietly profiting from the real estate boom…