Inflation Fear is Impacting the Markets LikeFolio data shows that […]

Are Inflation Fears Driving Investors Away from Stocks?

U.S. Consumers’ level of concern regarding monetary inflation has not slowed since we featured it last month…Quite the opposite- It’s risen to a new all-time.

The 7-day moving average of consumer mentions expressing fear, uncertainty, and concern about inflation has gained +33% in the past month and +99% in the past quarter.

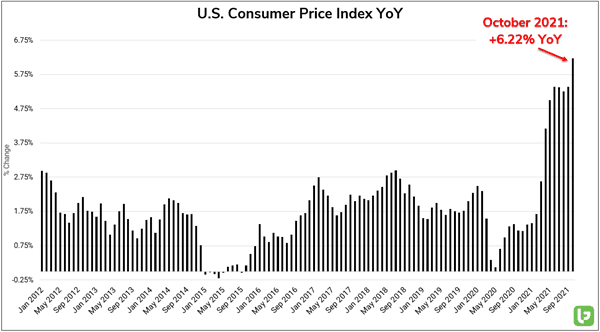

Those fears were vindicated again yesterday when the Bureau of Labor Statistics reported CPI growth for October which surpassed expectations.

The reported +6.22% YoY increase represents the highest rate of CPI growth since 1990.

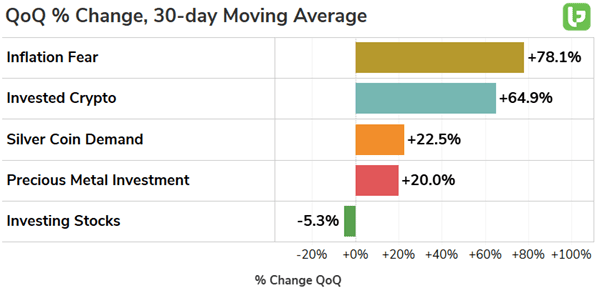

In response, individual investors are pouring into alternative assets as a hedge against inflation.

Cryptocurrency investment has continued its surge higher, with the total cryptocurrency market cap at an all-time high and nearing $3T.

Underlying chatter shows a healthy uptrend in retail investment demand -- Consumer mentions of crypto investment are currently trending +65% QoQ (30d).

Investment demand for precious metals has also continued to rise alongside inflation fear – Gold (GC=F) and Silver (SI=F) Futures both spiked higher in the wake of the hot CPI print.

Furthermore, demand for physical silver coins shows a +22% QoQ gain.

This trend mirrors the recent growth seen in the ‘Wallstreetsilver’ Reddit community, a spin-off of the ‘Wallstreetbets’ group who hold monetary inflation as a core tenant of their investment thesis.

Relative to the time-tested safety of shiny metals and the perceived potential of cryptocurrencies, stock investments have not enjoyed the same near-term boost in underlying demand.

However, consumer mentions of investing in the stock market remain at a higher level on a year-over-year basis: +19% on a 30-day moving average.