Nike reported an awesome quarter Tuesday evening. The stock is […]

Are Malls Making a Comeback?

Today, shares of Macys (M) and Kohl's (KSS) pushed higher after posting reports that exceeded analyst expectations.

(Both names were on the right side of the scatter chart we shared yesterday.)

Macy's digital sales increased +19% YoY and 49% vs. 2019, comprising one-third of net sales. This presence also helped to onboard new customers: 4.4 million of them.

Kohl's digital sales increased +6% YoY and +33% vs. 2019, comprising 29% of net sales. In addition, the company noted strength in athleisure and workout clothing...

Interesting.

So -- what does this mean for fellow mall-based retailer FootLocker (FL) ahead of its earnings? Let's look at the data.

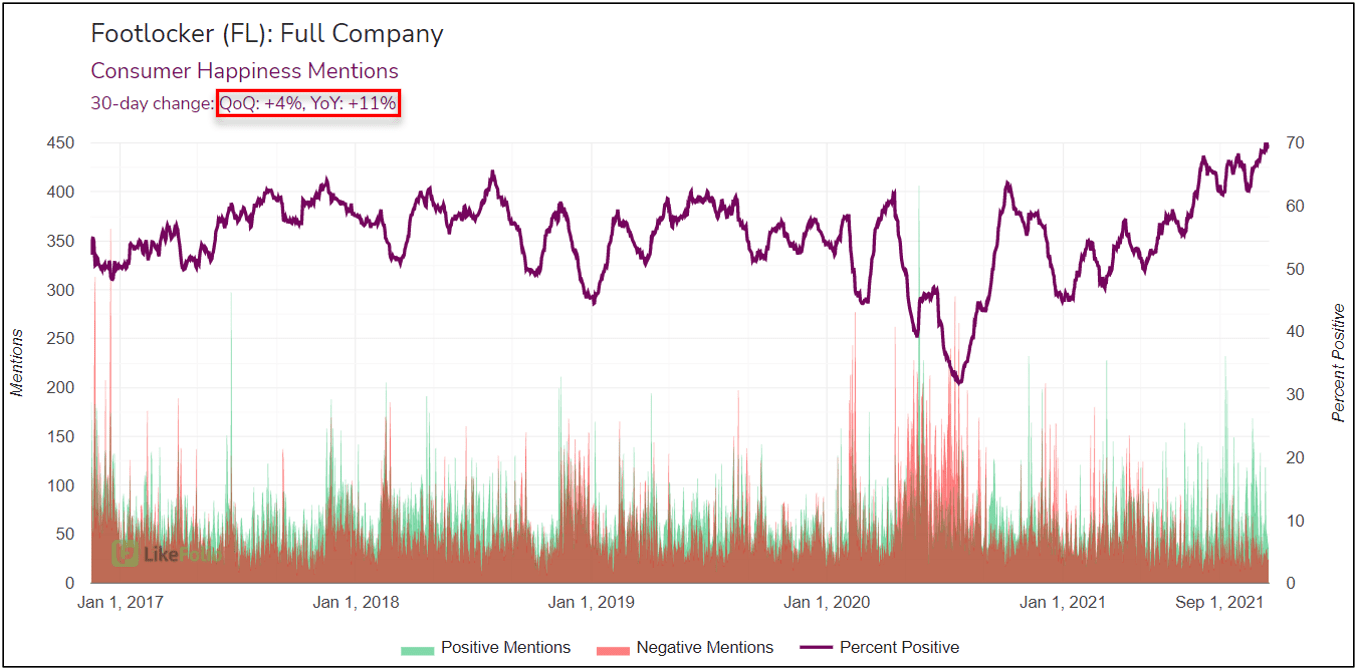

First: Happiness is Soaring.

Comprehensive levels of Consumer Happiness for FootLocker and its subsidiaries have risen by +11 points YoY and continue to build in the current quarter.

This is a positive sign that the company is getting a handle on its digital operations, one of the top drivers of negative sentiment for the company, historically.

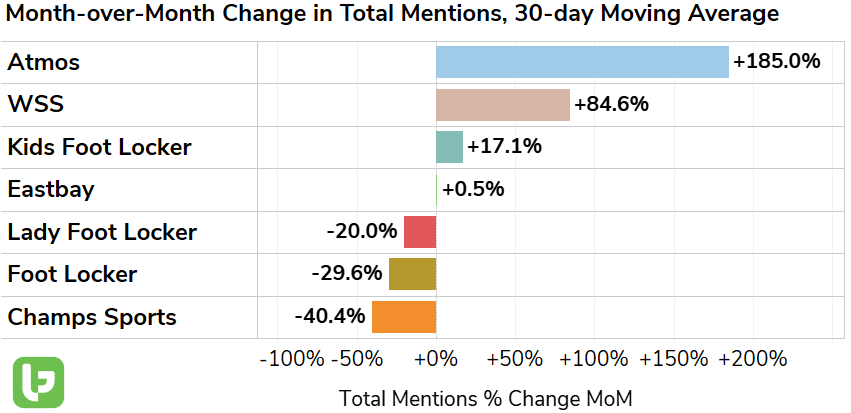

Recent acquisitions are also helping to bolster demand and sentiment.

FootLocker completed acquisition of WSS and Atmos in November. WSS is a U.S.-based athletic retailer with physical locations along the West Coast, intentionally avoiding malls. Atmos is a Japanese-based retailer with a hand in sneaker culture and a strong digital presence.

You can see the potential positive impact of both of these acquisitions for FootLocker on the chart below:

FootLocker will report 21Q3 Earnings Nov. 19 before the bell.