Peloton (PTON) Last quarter, Peloton crushed estimates: sales grew 172% and […]

Are Peloton (PTON) Users Sticking Around?

Are Peloton (PTON) Users Sticking Around?

Despite design flaws of late, Peloton has a knack for keeping consumers around.

Earlier this month Peloton announced it is beginning to repair recalled treadmill touchscreens (that were falling off), after previously implementing security features to enhance the safety of its tread prior to U.S. release.

LikeFolio data shows that recalls and safety concerns have not impacted overall brand happiness.

In fact, Peloton Happiness has actually increased +2 points YoY to 86% positive, 5 points higher vs. fitness equipment provider, NLS.

In addition, cancellation mention volume remains negligible (less than one mention per day). This lines up with Peloton's previous notes on high retention.

Last quarter, average net monthly connected fitness churn was 0.31%. This is extremely low. To give a goal post, Netflix, Disney and Apple streaming service churn rates fall between 2% and 15%.

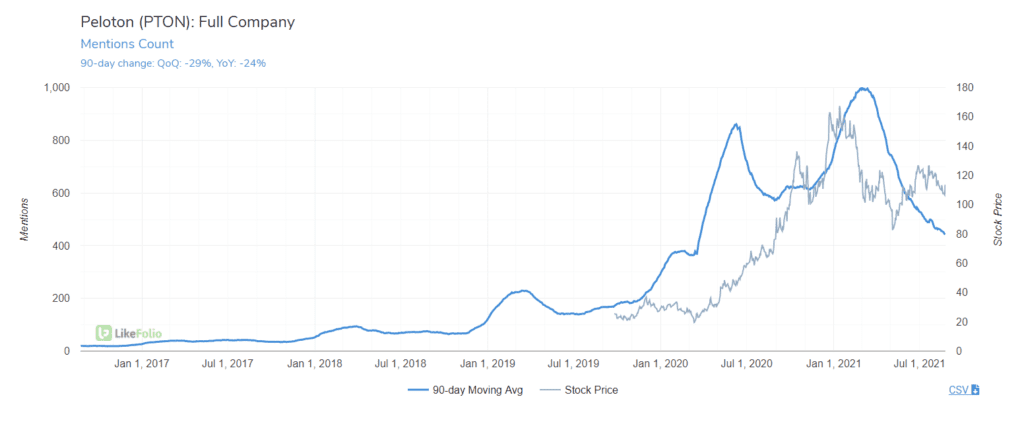

Another important LikeFolio metric to consider when gauging retention is mention volume.

Peloton Mentions remain +171% higher vs. 2019, though buzz has tempered vs. 2020's workout-from-home craze.

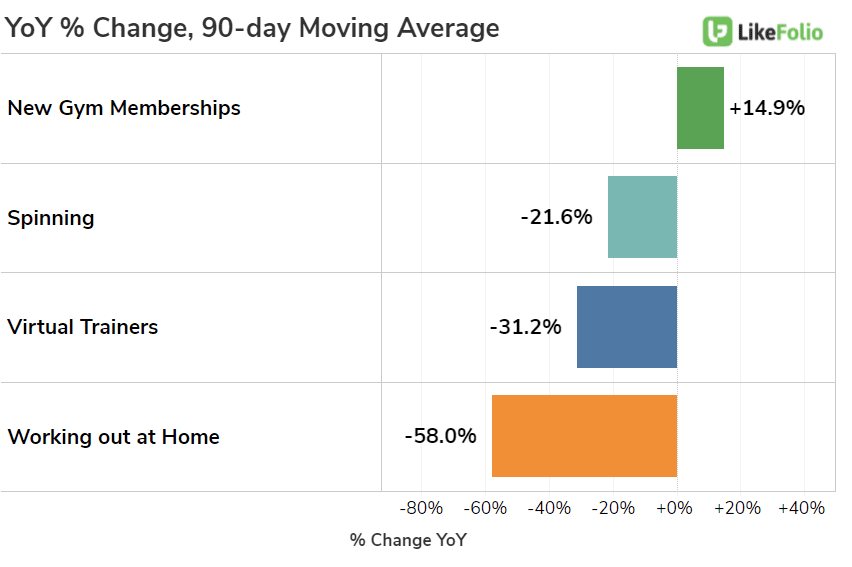

This theme is mirrored in overall fitness trends. Consumer mentions of utilizing virtual trainers remain ~100% higher vs. 2019, but are showing near-term signs of normalization.

In addition, data suggests some consumers are returning to the gym. New gym membership mentions are +15% higher vs. last year.

But stay tuned here...any changes in reopening/mask guidance could swing fitness trends back in Peloton's favor.

The company is facing tough comps and investors will be listening for updates on supply chain challenges and any impacts spurring from previously noted recalls and safety updates.

Peloton reports 21Q4 Earnings August 26 after the bell.