Bed Bath & Beyond (BBBY) Last quarter BBBY shocked the […]

Bed Bath & Beyond is getting a face-lift...

Bed Bath & Beyond investors have been on a rough ride. In the last 6 months, shares have shed more than half of their value and the company has struggled to juggle Covid-related traffic weakness, supply chain strain, "industry inflation," and internal execution snafus. Spoiler alert, people love the mailers (and they actually drive traffic). These headwinds contributed to sinking revenue, which came in -26% lower YoY on BBBY's last report. Well below Street expectations. Ouch. Suffice to say, the bar to clear has dropped. And Bed Bath & Beyond is attempting to refine its image and strategy. The company is closing 200 underperforming stores, remodeling ~150 stores, embracing omnichannel fulfillment, and even partnering with...Kroger? (Yes, Kroger.) So is it working?

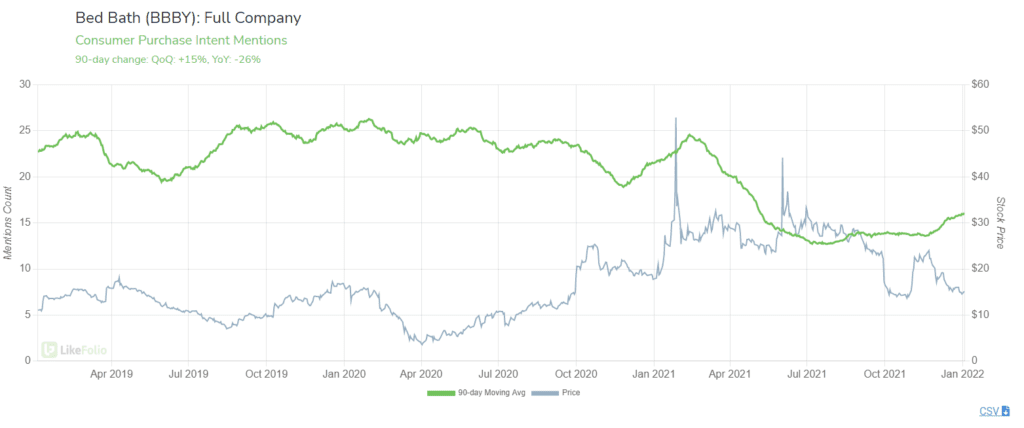

Purchase intent mentions continue to register lower on a YoY basis, but the trajectory has shifted. The green line on the chart is moving higher, breaking a multi-month downtrend in October. And happiness has improved by +2% YoY in the same time frame. What's driving this? According to LikeFolio data, omnichannel fulfillment.

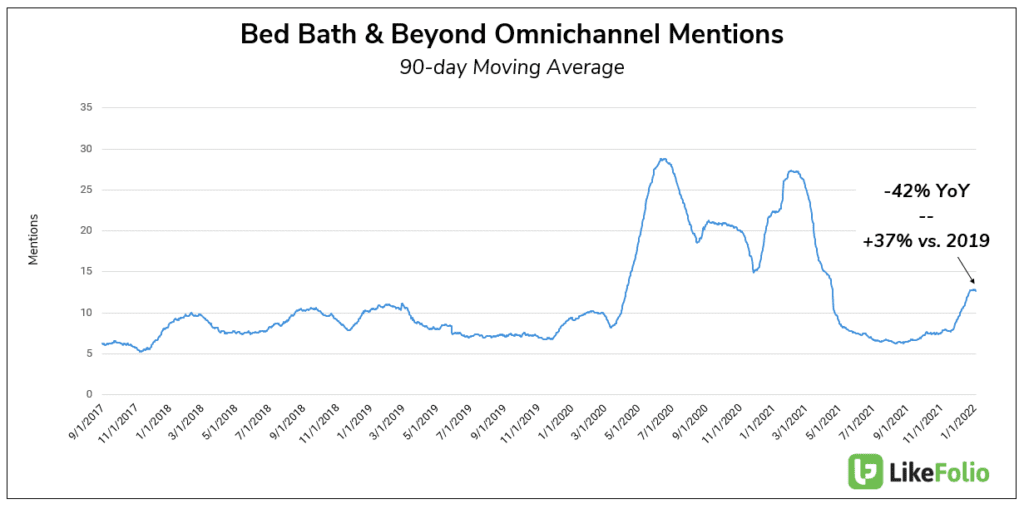

Consumer mentions of shopping online, utilizing same-day delivery services, or BOPIS (buy online pick up in-store) with Bed Bath & Beyond remain +37% higher vs. 2019 and recorded a nice uptick over the Holiday season. But this wasn't enough to propel overall demand back to pre-Covid levels. And data suggests the company is losing ground in what was once a key market: Registries. External surveys confirm LikeFolio's findings: more couples are using services like Amazon and Target vs. Bed Bath & Beyond for Wedding registries. In fact, Bed Bath & Beyond's current market share for Wedding Registries is the lowest it's ever been in the survey's 6-year history. Not a positive long-term indicator for a company in the middle of a "turnaround."