Black Friday and Cyber Monday -- this upcoming weekend is […]

Best Buy (BBY) Earnings Post-Mortem

February 25, 2021

Best Buy (BBY)

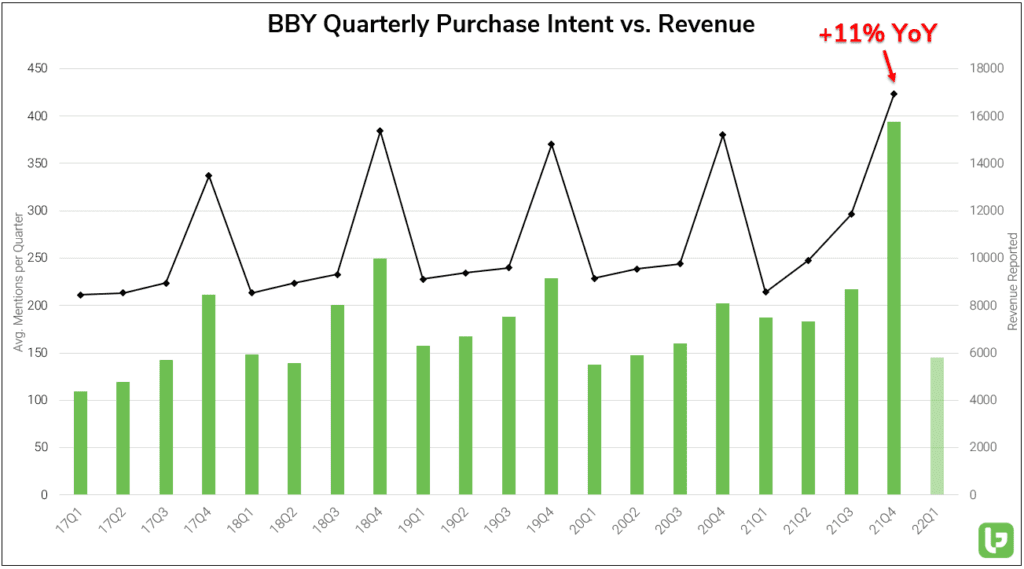

This morning Best Buy (BBY) reported record-high sales for 21Q4 (ended 1/31/21), up +11% YoY.

Why are shares trading -7% lower today? BBY wasn’t able to meet Wall St’s lofty expectations -- which means we now have to consider the fact that everyone who needed a webcam or an Xbox probably already has one.

This phenomenon is mirrored in Best Buy’s Underlying consumer data. Average Purchase Intent Mentions for the current quarter are on pace for a YoY decline, trending -22% YoY. And, we are entering a period of incredibly difficult comps for many companies.

We’re still maintaining a cautiously bullish outlook due to noted strength in digital execution, but we’ll be keeping a close eye on the impact of more stores re-opening going forward.