Black Friday and Cyber Monday -- this upcoming weekend is […]

Best Buy Consumer Sentiment Suggests Healthy Supply

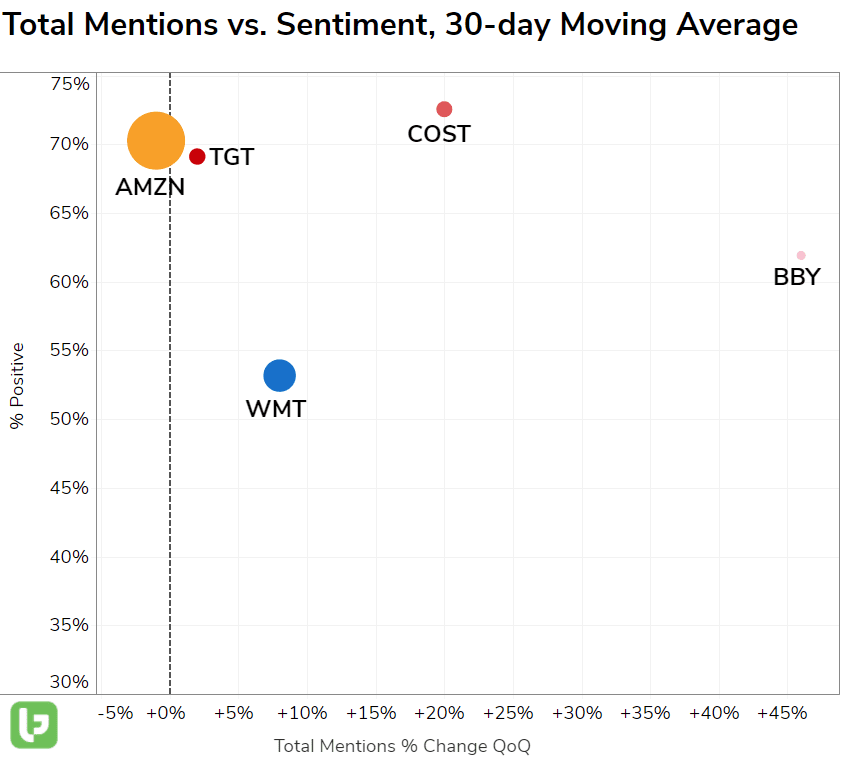

Last quarter Best Buy shares rose +8% following the company's 22Q2 report. High demand in its home theater, appliances, computing, mobile phones, and services segments helped to bolster same-store sales by +20% YoY. The company noted product availability improved in the quarter and excluding some pockets in appliances and home theater, did not limit overall sales growth. Is Best Buy's inventory position holding into the current Holiday season? According to LikeFolio sentiment data, consumers aren't showing any elevated signs of disappointment. Mentions reference "out of stock" products at a lower rate vs. 2020. In addition, Best Buy Consumer Happiness levels have improved +5 points YoY (and +3 points QoQ) to 61% positive. This sentiment increase is a positive indicator alongside increased mention activity. Consider the scatterplot below, showcasing near-term momentum in the current quarter:

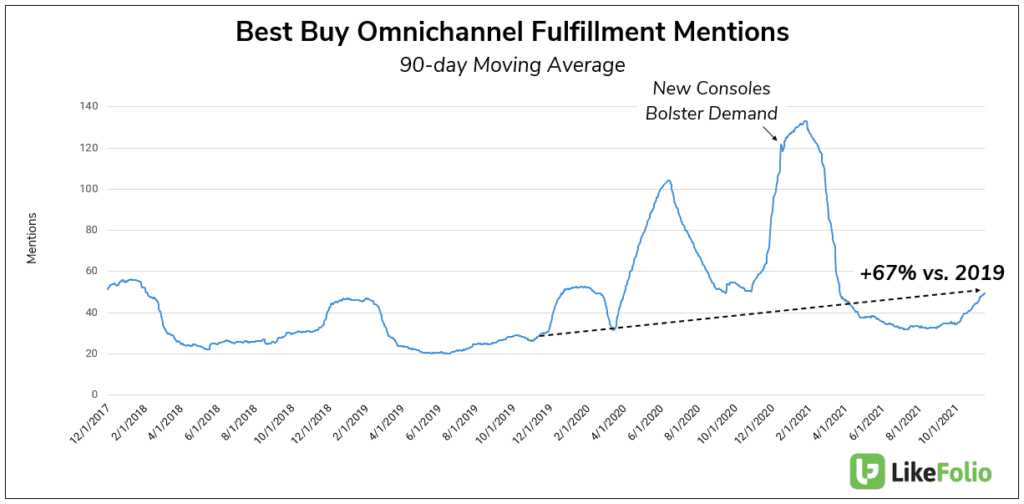

Part of this momentum in sentiment and buzz is driven by the company's omnichannel offerings. A year ago, Best Buy's online sales grew by +174% and the company was focused on extending its curbside pickup availability and consumer adoption. LikeFolio data shows that consumers continue to utilize omnichannel offerings (like curbside and in-store pickup) at increasing levels vs. pre-pandemic: +67%.