Restaurant dining room restrictions are lifted, and Americans (thank goodness) […]

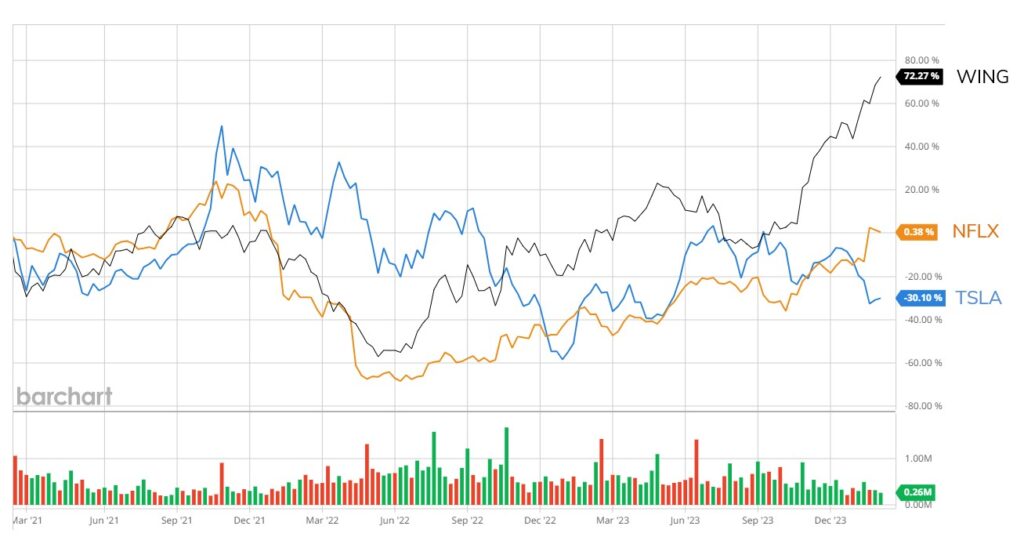

Bet you didn’t see this coming…

Time for a thought experiment.

It’s early 2021, and your pockets are rich from government stimmies and practically non-existent interest rates.

Which company are you going to invest in?

- A premiere electric vehicle manufacturer with a genius CEO (okay, it’s Tesla)

- The largest streaming channel around (Netflix)

- A company who sells chicken wings (WingStop)

If you chose the company who sold chicken wings – specifically, WingStop (WING), you’d be up more than +70% right now.

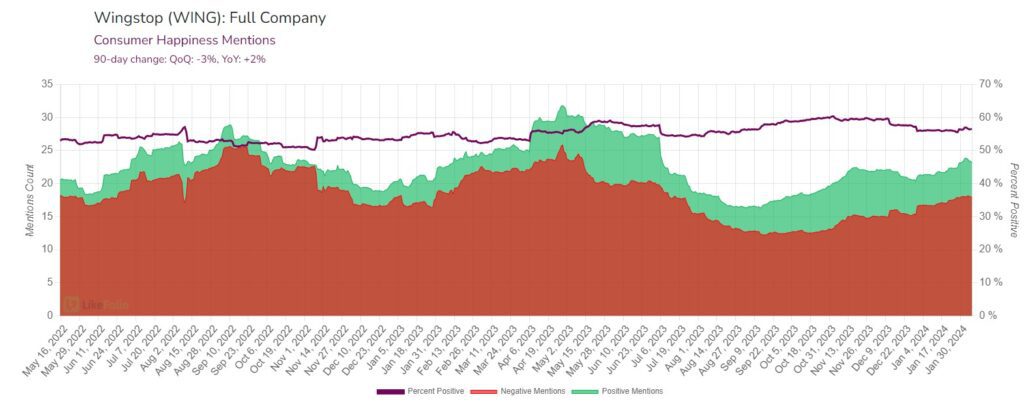

Does LikeFolio data support this move higher in WING, especially the surge in 2023?

Yes. Here’s why:

- Sentiment data confirms a happy, loyal customers. Happiness levels have increased by +2% YoY on a 90-day MA and +3% YoY on a 30-day MA (translation: getting even better).

- The adoption of digital sales channels, which consistently make up a significant portion of revenue, alongside innovative store concepts like ghost kitchens and cashless, off-premises-only formats, demonstrate WingStop's adaptability to consumer trends and market demands.

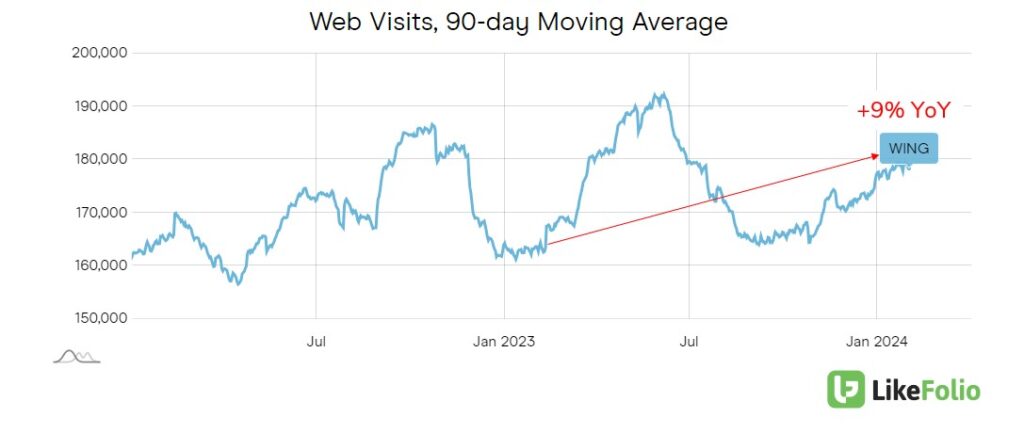

- Web traffic supports continued digital expansion: traffic is picking up steam, pacing +9% higher YoY vs. -1% a year ago and -8% last quarter

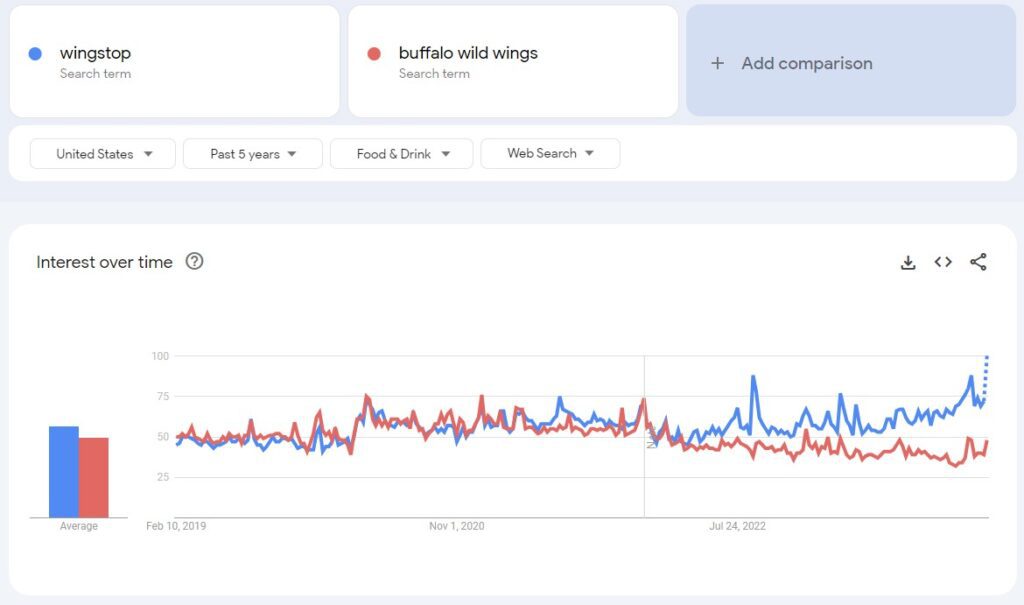

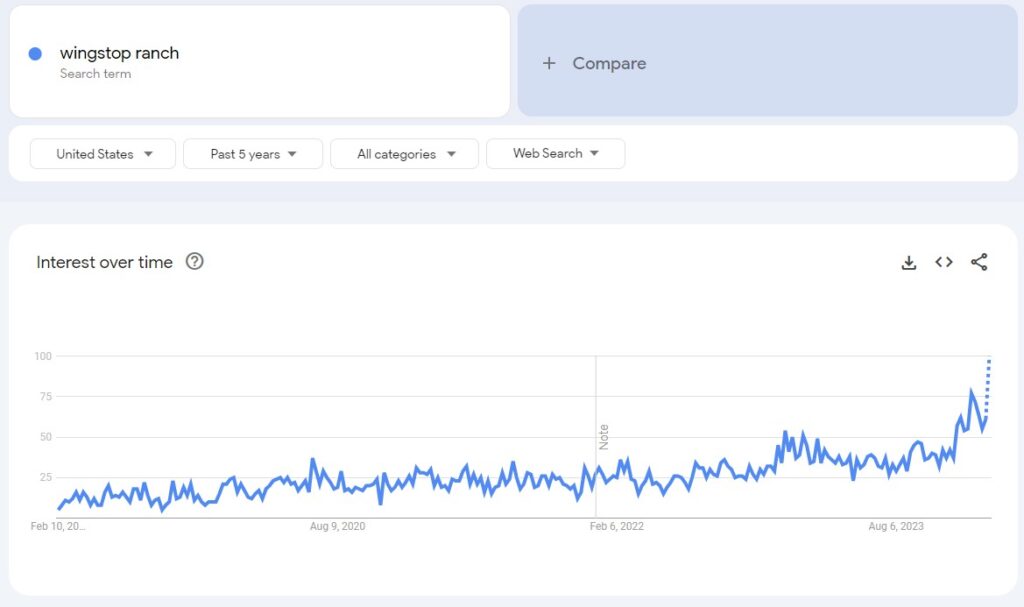

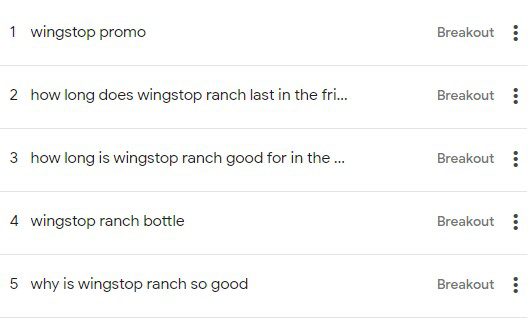

- WingStop is greatly overperforming peers when it comes to consumer active interest – aka search volume. Just look at the budding divergence below:

- Superior wing flavoring and high quality sauces (consumer applaud for WingStop’s ranch is off the charts), coupled with perceived affordability is driving demand and sentiment higher.

Bottom line:

WingStop's growth is propelled by a strategic blend of expansion, digital innovation, and operational efficiency. The brand's ambitious goal to increase its global presence to 7,000 stores is underpinned by robust domestic same-store sales growth and a significant increase in system sales and adjusted EBITDA.

LikeFolio’s score is positive, acknowledging recent gains and an extremely high bar. For now, the move higher appears justified.