“You know it's time to sell when shoeshine boys give […]

Bitcoin: How I’ll know it’s time to buy

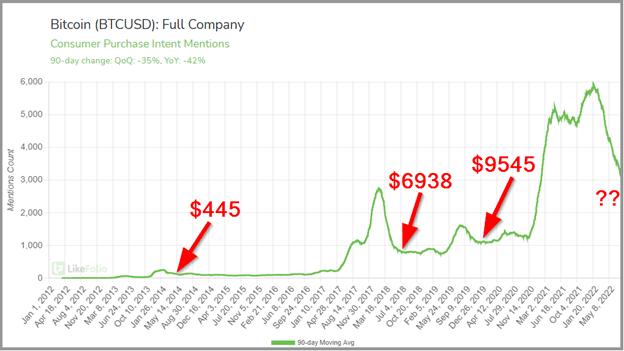

| We have seen three notable spikes of consumer interest in buying Bitcoin over the past decade. Each of these “hype cycles” was followed by a subsequent drop in interest, primarily driven by a pullback in Bitcoin price. In all three cases, consumer demand levels for Bitcoin stabilized at new, higher “baseline” levels than in the previous cycle. Every time these hype cycles stabilized, investors had an opportunity to buy Bitcoin at what would later become “buy of a lifetime” prices. You can see this on the chart below: |

We’re currently nearing the end of a fourth hype cycle in Bitcoin. Consumer demand levels hit all-time highs near the beginning of 2022, and have dropped off of a cliff ever since Bitcoin price started its fall from over $65,000 to under $20,000 last month.

So… what now?

We wait.

I’m watching for the consumer demand levels to stop their freefall and spend a little time establishing a new baseline of (higher) interest than we saw at the previous 2020 baseline.

If and when we get that opportunity, I’ll be ready to pounce on Bitcoin once again.

Note: If you’d be interested in a product or data feed regarding consumer interest levels in cryptocurrencies… reply to this email. I’d love your feedback as we build out a powerful new crypto-insights platform.