“You know it's time to sell when shoeshine boys give […]

Bitcoin's $100k Date With Destiny

Bitcoin’s $100K Date with Destiny: Why November 28, 2024, Will Be Historic

Bitcoin ($BTC) is teetering on the edge of its most significant milestone yet: $100,000.

At just over $96,000 today, all eyes are on November 28, 2024, a date with profound historical weight in Bitcoin's rise to dominance.

This isn’t just about price.

November 28 is Bitcoin’s defining date, one that has repeatedly marked transformative moments.

With ETFs now live, institutional interest surging, and supply tightening post-halving, this year’s November 28 is shaping up to be Bitcoin’s most important yet.

November 28: A Proven Catalyst

- November 28, 2012: Bitcoin’s first halving halved block rewards to 25 BTC, introducing real scarcity and setting the stage for its meteoric rise. The event, barely noticed outside of niche crypto circles at the time, was the first domino to fall in Bitcoin’s march toward mainstream adoption.

- November 28, 2013: Exactly one year later, Bitcoin broke $1,000 for the first time. That milestone silenced skeptics and shifted the conversation from “fad” to “revolution.”

Now, as we approach November 28, 2024, Bitcoin has matured into a global monetary asset, and the narrative is clearer than ever: scarcity drives value. This year, the stars have aligned for Bitcoin to take its next leap.

Why Bitcoin Breaks $100K on November 28

Bitcoin’s rise to $90K is the result of compounding forces that have been building for years.

Here’s why $100K on November 28 isn’t just possible; it’s likely:

Scarcity is King

The April 2024 halving tightened Bitcoin’s supply like clockwork, reducing block rewards to 3.125 BTC. Halvings have consistently led to explosive growth as supply contracts, and this year is no different. With Bitcoin’s issuance now lower than the annual gold supply increase, demand is quickly outpacing new supply.

ETFs Have Opened the Floodgates

The approval of spot Bitcoin ETFs in mid-2024 by giants like BlackRock (BLK) and Fidelity was a game-changer. These products have made Bitcoin accessible to trillions of dollars in institutional capital, from pension funds to family offices. Inflows since the launch have accelerated Bitcoin’s rise, creating a perfect storm of demand.

Strong Hands Dominate

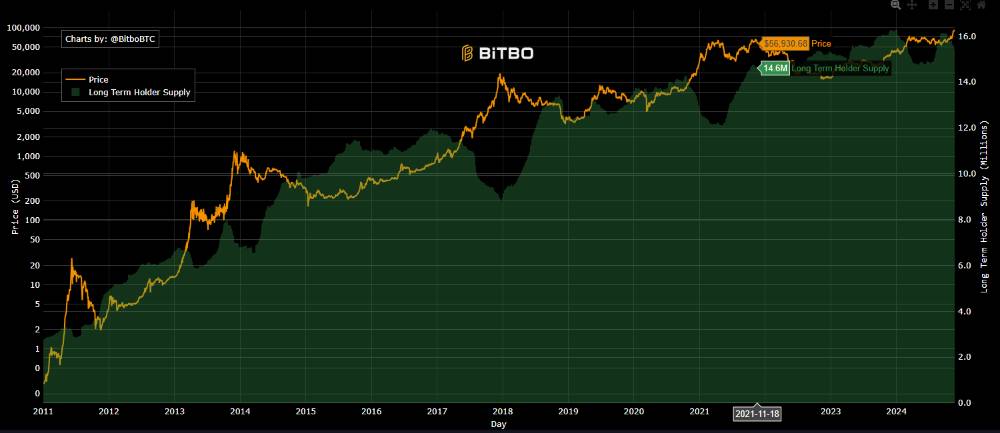

On-chain data shows that over 75% of Bitcoin is held by long-term holders, many of whom have no intention of selling below six figures. Meanwhile, exchange reserves are near historic lows, signaling that supply is drying up.

Cultural and Historical Momentum

The symmetry of Bitcoin’s history makes November 28 more than symbolic—it’s a psychological marker. And the fact that this year’s date falls on Thanksgiving in the U.S. only amplifies the impact.

Families gathered around their dinner tables will be talking about one thing: Bitcoin hitting $100K.

What $100K Means for Bitcoin—and the World

Breaking $100K is a turning point in Bitcoin’s evolution. At six figures, Bitcoin’s market cap will surpass $2 trillion, putting it on par with some of the largest assets on Earth. The implications are enormous:

- For Institutions: Bitcoin’s $100K milestone cements its place as a credible store of value alongside gold, making it an essential allocation in any diversified portfolio.

- For Retail Investors: Hitting six figures proves Bitcoin’s resilience and vindicates those who believed in its potential from the start.

- For the Global Economy: Bitcoin at $100K challenges the very foundations of fiat currency systems, reinforcing its role as a hedge against inflation and systemic risk.

Conclusion: November 28, 2024—Bitcoin’s Date with History

Bitcoin doesn’t just happen to succeed on November 28.

History shows it’s the day when this revolutionary asset delivers on its promise.

From the first halving in 2012 to its first $1,000 price point in 2013, November 28 has always been the day Bitcoin levels up.

At over $96,000 today, Bitcoin is knocking on the door of $100K.

And on November 28, 2024, that door will swing wide open, marking yet another defining moment for the most important asset of our time.

Are you ready for history to repeat itself?