Airbnb (ABNB) AirbnB is set to report earnings for the […]

Booking Is Flying High

The travel industry, which has taken the full brunt of Covid restrictions, has started to make a comeback...albeit tentatively.

There are a few factors that should see international travel demand further increase this year:

- The significant reduction in travel restrictions — specifically between the U.S. and Europe.

- The rise of the milder omicron variant

- Pent up travel demand

While the emergence of omicron was a worry at first, initial travel restrictions, which were quickly implemented on South Africa and other African countries, were removed not long after.

This has given hope that international travel in 2022 can get back to some kind of normality...

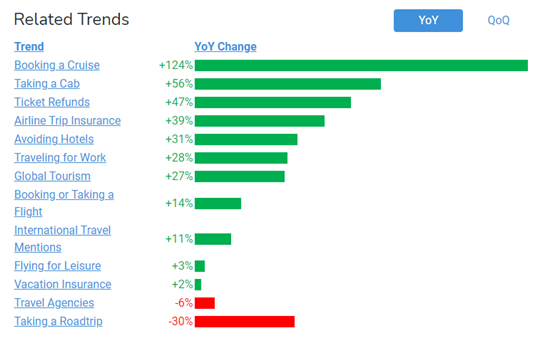

In the chart below, you can see the "taking a road trip" trend, something we could assume is usually undertaken in a person's home country (especially in the U.S.), is at -30% YoY.

Meanwhile, international travel mentions, booking or taking a flight, global tourism, and booking a cruise have all risen from the previous year — some more than others.

So which travel stocks should we be focusing on?

As you may well know, at LikeFolio, we focus on consumers to understand what drives significant changes in behavior.

Back in October, we highlighted Airbnb was losing ground with booking mentions falling — at the time, consumer purchase intent mentions were down 21% YoY.

And while intent mentions have improved since then, they have been unable to gain any significant momentum, despite Airbnb undoubtedly being the site to book a home away from home. Moreover, as previously highlighted, Airbnb is becoming more and more expensive, and at a time when international travel mentions are rising (+11% YoY), Airbnb mentions are down (-5% YoY and -9% QoQ).

Now that doesn't scream momentum, does it?

Regardless, there is one travel stock that is flying high...if you'll pardon the pun...

Booking Holdings. While people seem to be moving away from Airbnb, its rising prices, and strict rules set by property owners, consumer trends suggest they are utilizing Booking.com and its other travel-related websites. Consumer intent purchase mentions for Booking are up 141% YoY and 18% QoQ.

What does that mean? Well, BKNG has the momentum in a potentially pivotal year for travel. That's not to say that Airbnb stockholders should be looking to sell and pile into Booking shares.