Chipotle has been one of LikeFolio's biggest winners over the […]

Booze, Food, and Travel!

As we all wrap up a bustling holiday season, we’re taking a dive to understand WHERE consumers are spending their time…and money!

And by the looks of it, consumers are having a ball.

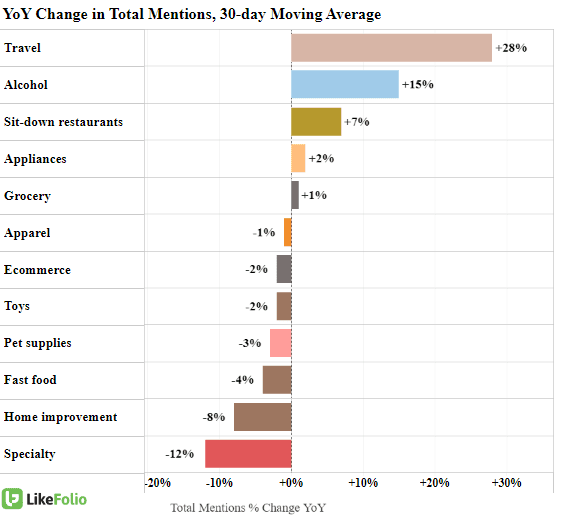

Travel, booze, and sit-down restaurants top out LikeFolio’s list of discretionary spend (noting we included some necessary items like grocery and pet supplies just for a frame of reference).

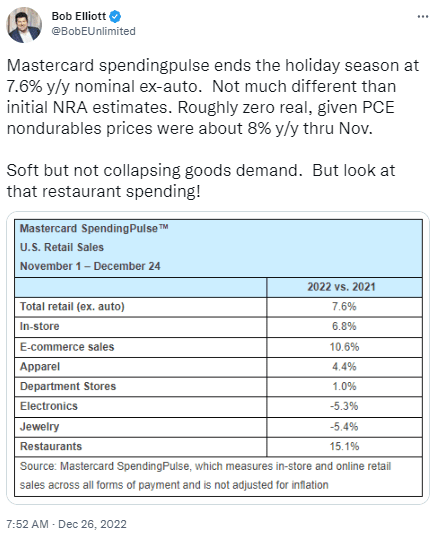

External research by Mastercard mirrors LikeFolio findings…namely a relative weakness in specialty spend (like jewelry and electronics) in favor of entertainment options like going to eat at a restaurant.

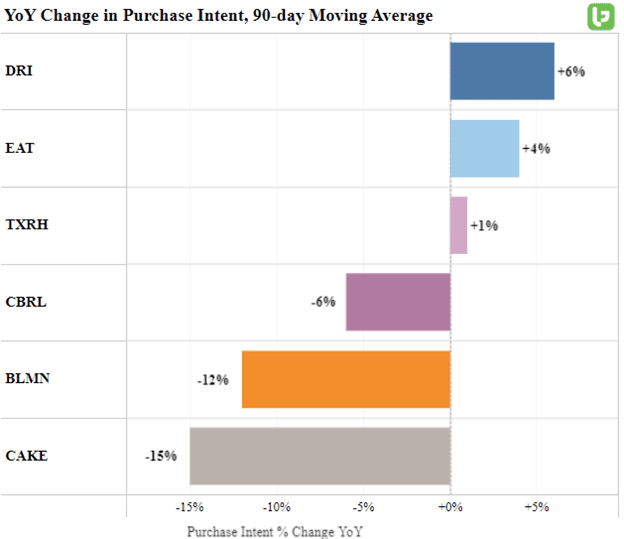

So – who is the cream of the crop this season according to consumers? And which company is missing out on precious dollars?

Here are three names we’re watching:

Darden Restaurants (DRI): Bullish

Darden is the parent of a wide array of restaurant options from family favorites like Olive Garden and Cheddar’s to high-end establishments like Capitol Grille and Eddie V’s.

The company beat earnings and revenue expectations on its second quarter report and raised guidance.

LikeFolio data confirms continued outperformance in the restaurant space, with purchase intent mentions leading peers.

Perhaps the most positive indicator of future sales is Darden’s rising consumer happiness.

DRI sentiment has improved by 5 points post-covid as its top restaurant, Olive Garden, receives a brand re-invention, especially among younger consumers. The Italian classic ranked in the top 5 of Gen Z’s favorite restaurants in 2022, an impressive feat.

We expect continued outperformance into 2023: bullish.

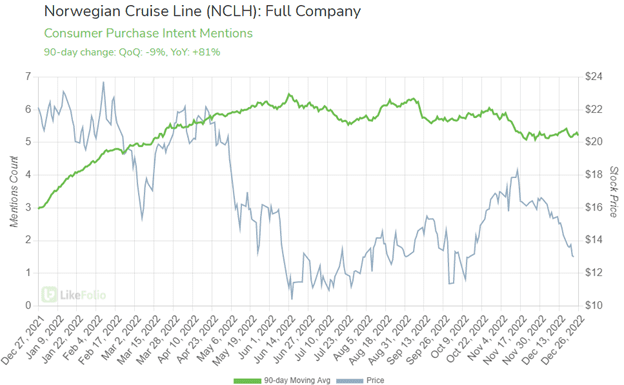

Norwegian Cruise Line (NCLH): Bullish

Leading the travel industry into the New Year is Norwegian Cruise Line.

Demand for NCLH (known for its laid-back cruising style) continues to grow while shares temper, setting up an increasingly tantalizing divergence opportunity.

NCLH shares sank last week after rival Carnival said it expected to continue losing money into the first fiscal quarter of 2023.

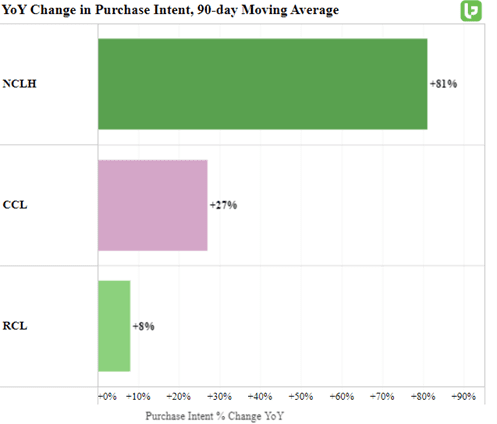

While LikeFolio data can’t speak to near-term drags on expenses, we can offer insight into long-term consumer preferences. A purchase intent comparison shows a significant edge vs. fellow cruise peers.

We’ll be monitoring NCLH ahead of its next earnings report, expected near the end of February. For now, the divergence forming between purchase intent and NCLH shares is increasingly bullish.

Chipotle (CMG): Bearish

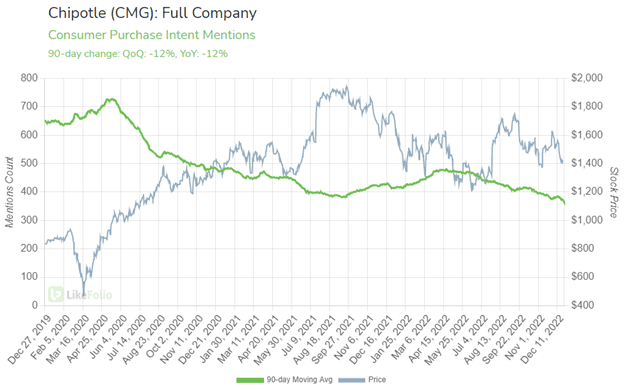

Consumers are eating up sit-down restaurant offerings. But LikeFolio data shows that Chipotle isn’t feeling the love.

Chipotle demand has slipped by double digits on a QoQ and YoY basis.

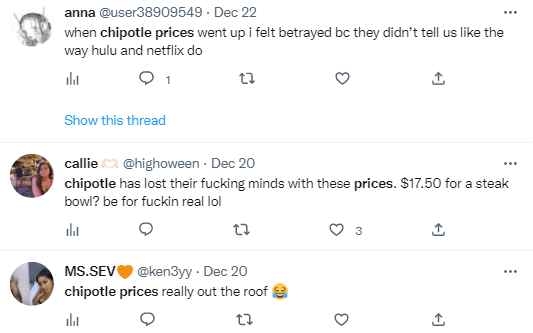

The company has employed a price-raising strategy to offset its supply costs – which has worked through 2022.

But this strategy may not work forever.

LikeFolio qualitative review suggests the hefty price of a burrito may be weighing on consumers.

LikeFolio long-term and short-term signals have shifted into bearish territory for the fast-casual chain.

We’ll continue to monitor ahead of its next report, but early indications are setting up for disappointment.