Disney+ (DIS) The explosive consumer adoption of Disney Plus is […]

Bumble (BMBL) is losing to Match (MTCH) and it’s not because of Tinder.

August 31, 2022

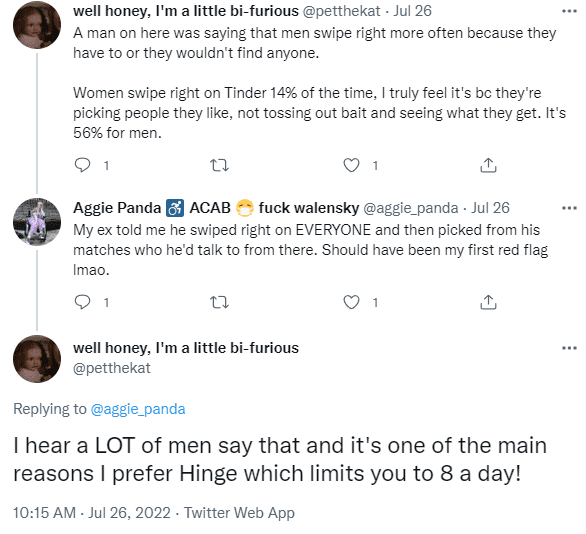

| While Match Group’s (MTCH) flagship Tinder brand is still the top dating app in the United States, it’s losing steam… fast. The good news? It’s losing to another of Match Group’s brands, Hinge. Hinge is preferred by users for a couple of reasons. On Hinge, users are restricted to eight "likes" per day, limiting the number of matches they can initiate. This gives match recipients more confidence that the other user’s interest is legitimate, rather than a fishing-with dynamite type of match-gathering scheme that is prolific among Tinder users. |

| Hinge is also stealing market share from Bumble (BMBL), a dating app that requires the woman to make the first move. While this unique approach was effective at attracting initial users, it looks like the novelty is beginning to wear off for some of its user base. |

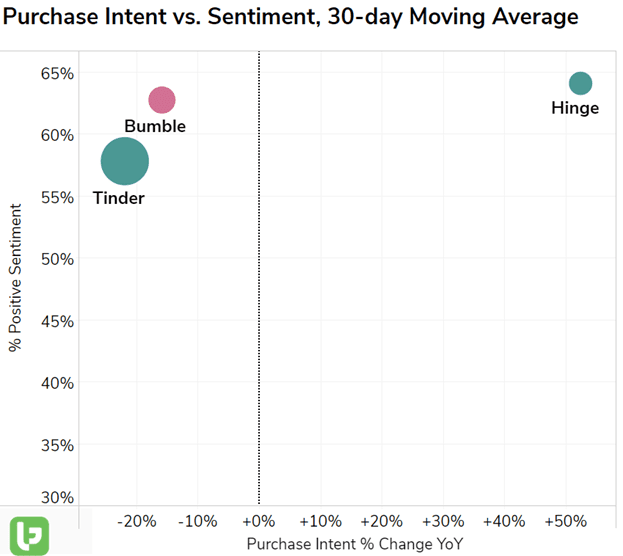

| We can see these trends playing out in LikeFolio’s consumer insights data: |

Hinge is not only beating Tinder and Bumble in terms of user growth, but also consumer happiness… a fantastic combination.

It’s no wonder Match Group is beginning to refer to Hinge as its “breakout star” among its portfolio of dating apps.

Now the question becomes -- will Bumble diversify its apps and strategy, or become a one-hit wonder?