PepsiCo (PEP) The quarantine 15 didn't materialize out of thin […]

Can At-Home Snacking Keep Lifting PepsiCo (PEP)?

April 14, 2021

Can At-Home Snacking Keep Lifting PepsiCo (PEP)?

In 2020, PepsiCo proved itself to be somewhat insulated from COVID-related losses thanks to shifts in consumer behavior. Net revenue in FY20 increased +5%, and PEP shares have gained ~10% since this time last year. A couple of key behavior shifts helped keep PEP afloat...and these are exactly what we'll be watching heading into this earnings report. Notable trends to watch:

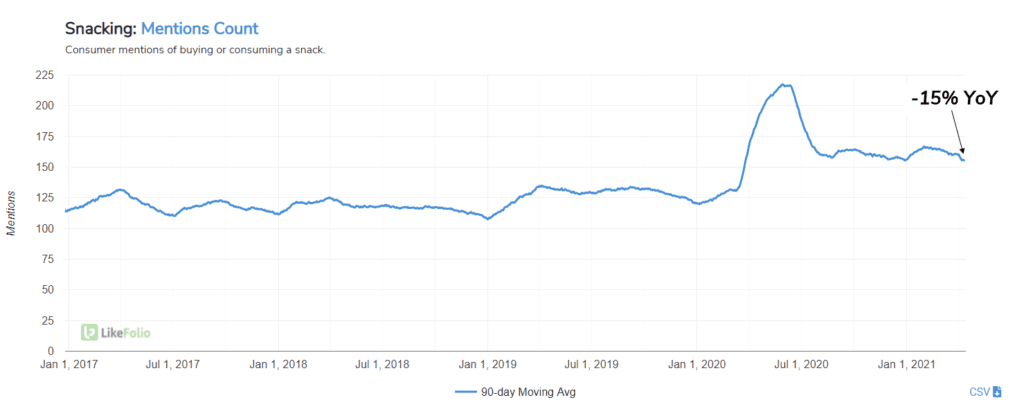

At-home snacking is regulating.

- Snacking mentions have fallen -15% YoY and -4% QoQ, but remain elevated vs. 2019 (+10%).

- Frito-Lay product mentions show signs of normalization, currently pacing -29% YoY.

While snacking (and a lagging Frito-Lay division) weights on overall PepsiCo buzz, the company has other areas of strength:

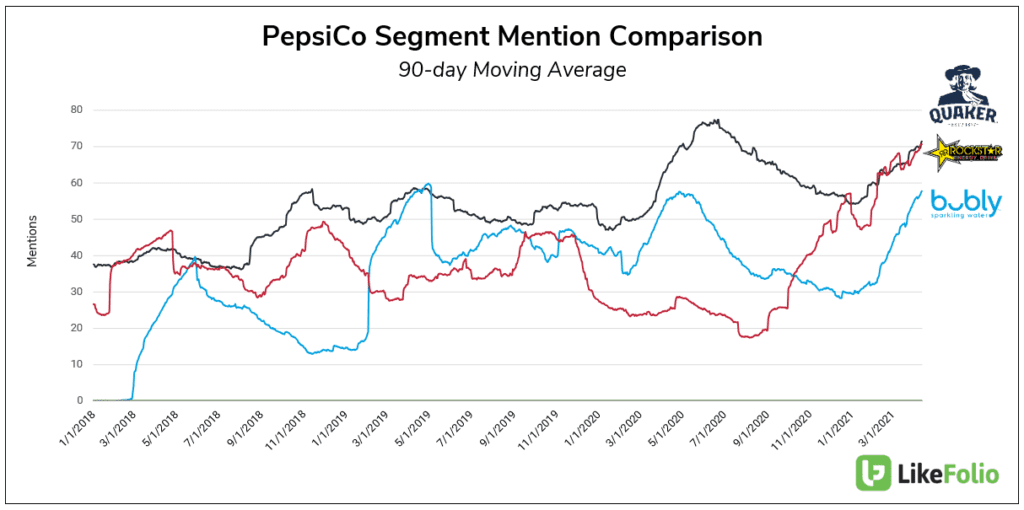

- Renewed breakfast interest is sustaining: LikeFolio data shows sustained buzz for Quaker breakfast products, with mentions pacing +9% YoY.

- Beverage demand is a mixed bag with a "healthy" lean: Bubly continues to show strength, with mentions currently pacing +4% YoY. The comprehensive Gatorade brand is showing YoY comparative weakness (-26% YoY). But "healthier" Gatorade Zero mentions are holding at a higher level.

- Energy drink demand is a tailwind, but watch for newcomers: Energy Drink demand is rising across the board: +48% YoY (30day MA). Last year, PepsiCo acquired Rockstar Energy for $3.86 billion. So far, PEP is executing well post-acquisition. Rockstar Energy mentions have increased by triple digits in 2021, alongside consumer demand for energy drinks.

We'll be listening for continued strength in key areas noted above, as well as for guidance notes when the company reports April 15 before the bell.