PayPal (PYPL) Last week we touched on a huge crypto […]

Can Cash App Maintain its Edge?

Can Cash App Maintain its Edge?

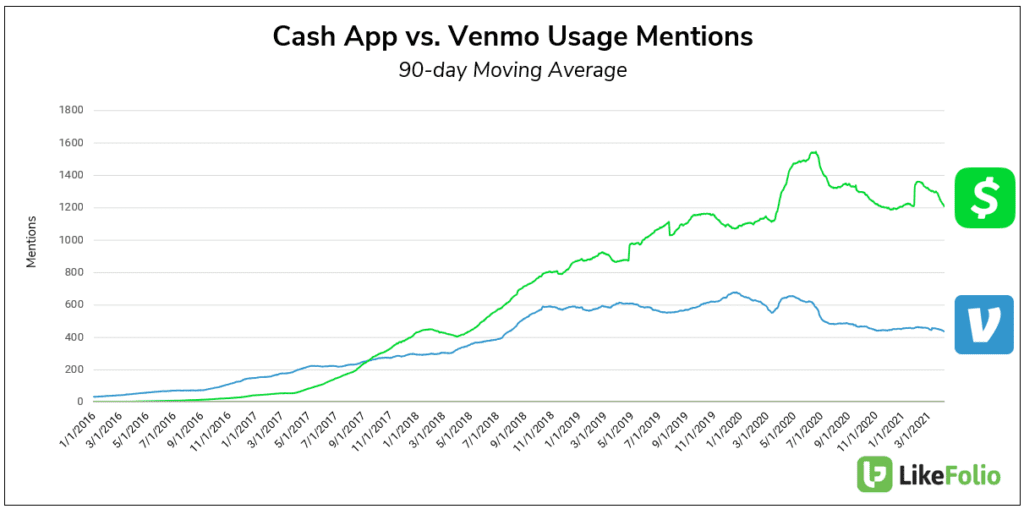

Cash App is a major growth engine for Square (SQ). Last quarter, Cash App accounted for almost half of SQ's total revenue: $377milion/$804 million. The app added 12 million new users in 2020, and the company indicated these new users are more profitable vs. prior customers. How does Cash App stack up vs. fellow peer-to-peer payment provider Venmo? In the last few years, it has pulled ahead of Venmo in regard to user engagement.

Cash App's ecosystem approach is providing more value to consumers, helping to drive growth and allow Cash App to maintain an edge. Square was a first mover in the crypto space, enabling bitcoin buying and selling on Cash App in January 2018. Since then, the company has enabled traditional banking features (like direct deposit) and investing capabilities. The company discovered that this ecosystem approach drives engagement across the board. When consumers use one functionality, they are more likely to use another. For example: "Bitcoin has helped increase gross profit per active customer and engagement in our broader ecosystem as bitcoin actives use other products, such as Cash Card and direct deposit, more frequently compared to the average Cash App customer." PayPal has taken notice. The company announced plans to beef up its peer-to-peer-siloed app Venmo: adding cryptocurrency, budgeting, savings and Honey integrations in 2021. Tracking the chart above will be critical to understanding how each company is executing. Can SQ continue to expand its userbase at a rapid pace? And can PayPal successfully leverage Venmo as an engagement engine? We'll be watching...