Chipotle has been one of LikeFolio's biggest winners over the […]

Can Chipotle New Menu Items Make a Dent in Demand?

Can Chipotle New Menu Items Make a Dent in Demand?

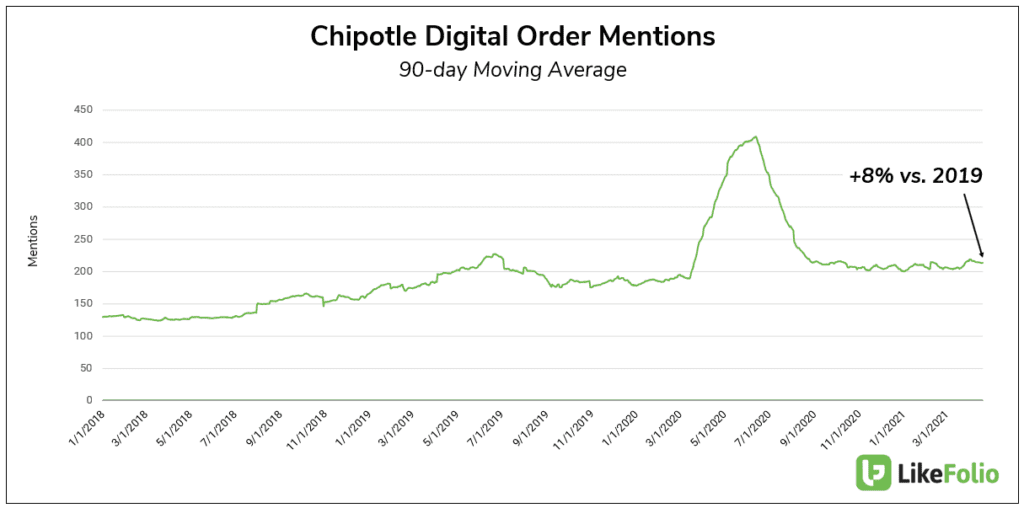

Last quarter Chipotle's digital sales grew 177%, comprising 49% of sales (vs. +202% and +216% in prior quarters). About half of these sales were via delivery and the remainder were order-ahead transactions facilitated by pick up in-store or via Chipotlanes. This digital engagement alongside the return of Carne Asada helped drive same-store sales: +5.7% YoY. Now, Chipotle is utilizing new menu items to continue to attract customers and get new users inside its digital ecosystem.

- Near the end of Q1, Chipotle launched a digital-only menu item: the Quesadilla. This was initially met with mixed consumer reviews: some consumers point out they already had this and now it's more expensive, others point out "a burrito bowl would have been better"...and a third group loves it.

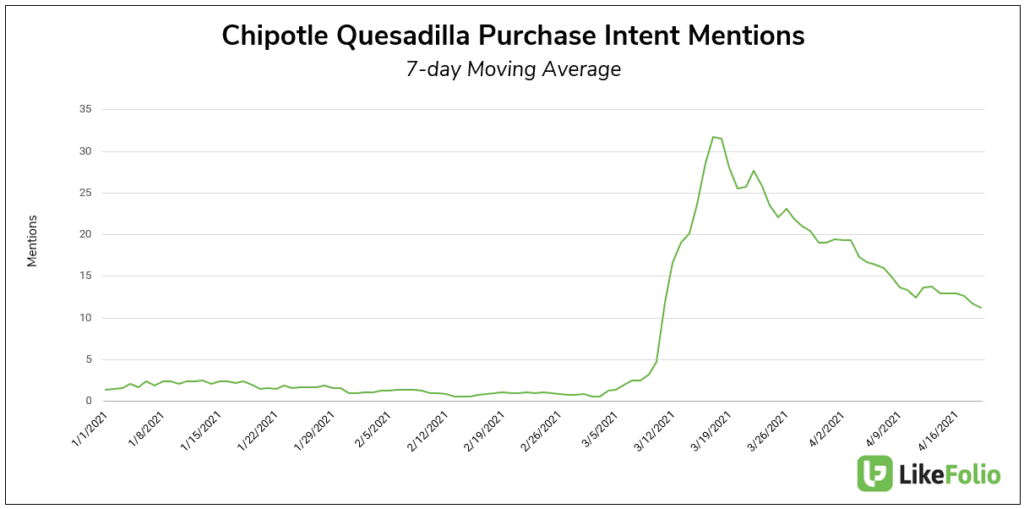

- Sentiment aside, there's no denying consumers are trying the Quesadilla. Purchase Intent Mentions surged on launch and remain high. This is important because quesadilla purchases force users into the Chipotle app and ecosystem.

- Chipotle also strategically released Cauliflower Rice in January as consumers kicked off New Year Resolutions. This item serves as an upcharge, and mentions show strong audience reception. Buzz surged in January alongside the product launch and remained significantly elevated through March.

Is this moving the needle? Somewhat, but it may not be enough.

Chipotle digital fulfillment mentions (including order ahead and delivery) remain elevated vs. 2019, but this explosive rate of growth has slowed significantly.

CMG reports 21Q1 results on April 21 after market close.