We're excited to unveil LikeFolio's Q3 Earnings Cheat Sheet, your […]

Can Curve Finance Break Out in 2022? ($CRV, $CVX)

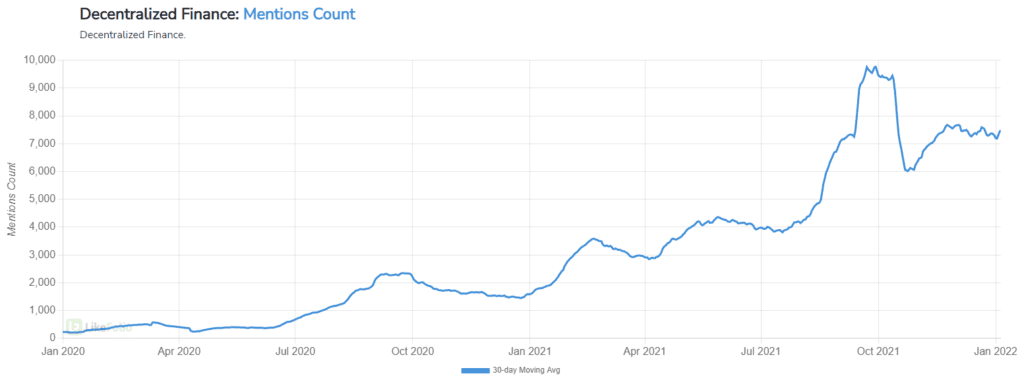

Decentralized Finance (DeFi) remains one of the largest overarching themes in cryptocurrency development.

Blockchain technology naturally lends itself to the finance industry — Trustless protocols assuring fairness and allowing users at all levels to participate in all levels of the system: market making, liquidity provision, and even direct governance.

The longevity of the concept and the relative niche appeal has made the adoption curve for DeFi less extreme than that of newer and flashier phenomenon like NFTs.

Still, interest from individual investors has continued to rise alongside broader cryptocurrency adoption.

The interest peaked in October 2021 and has since maintained a higher level. However, many popular DeFi projects have not returned to their all-time high levels.

To us, this sounds like a good buying opportunity…

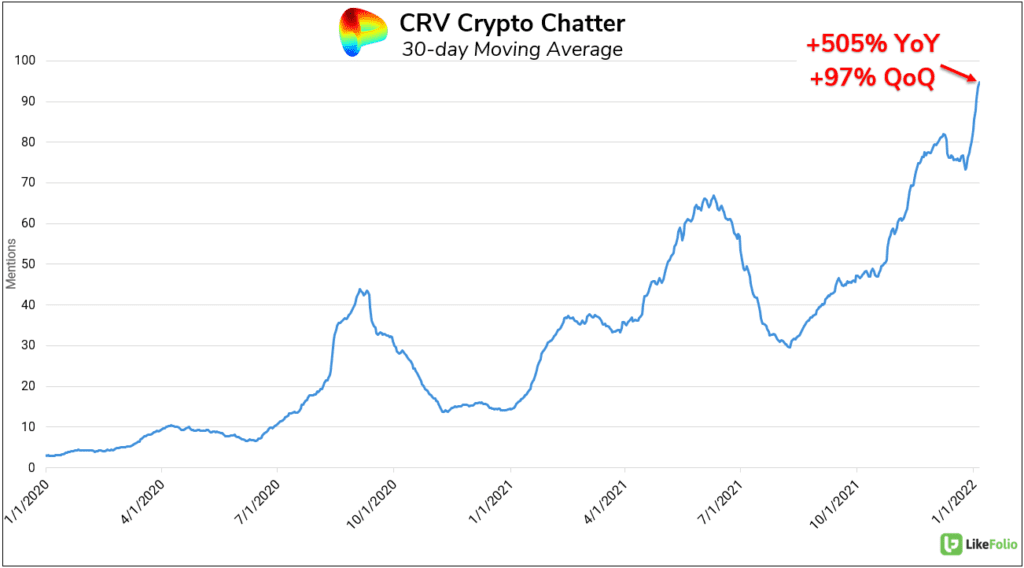

Consider the Curve DAO ($CRV) for a moment.

Curve DAO is the ‘Decentralized Autonomous Organization’ (governing body) behind the Curve Finance protocol.

Curve operates primarily as stablecoin swap platform but also provides liquidity for a number of tradeable crypto assets.

Curve uses a unique Automated Market Maker to promote a higher degree of liquidity, specifically for stable coins (tokens pegged to $1 USD).

The platform generates profits via modest trading fees, which are shared between liquidity providers and CRV token stakeholders.

Curve’s popularity has experienced a massive boom over the past 6 months.

Chatter regarding the Curve Finance protocol and its governance token CRV are at an all-time high level: +505% YoY and +97% QoQ (30d MA).

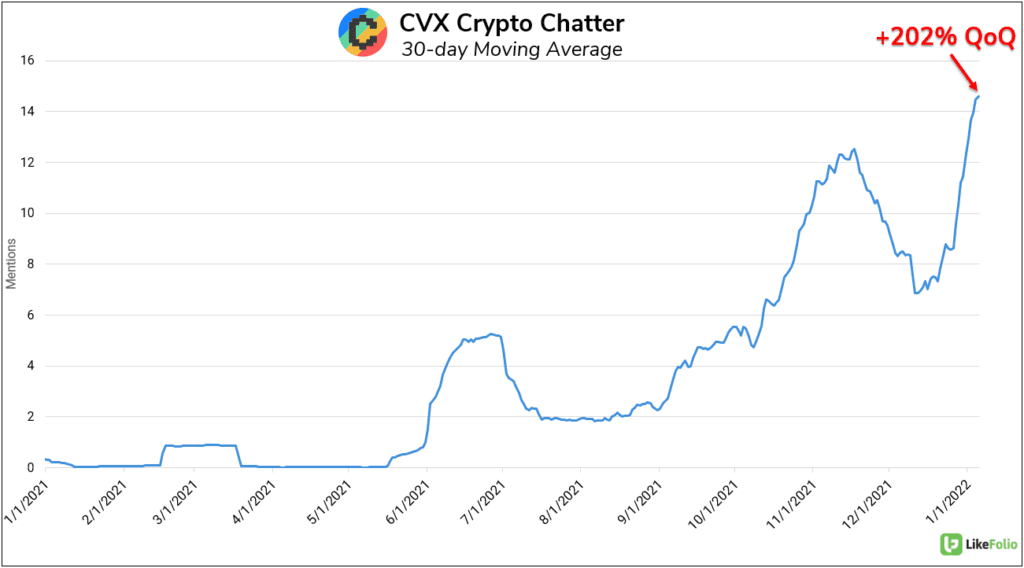

Convex Finance ($CVX) exists as a massive stakeholder in the Curve protocol, allowing users to stake CRV with them and earn additional rewards.

Convex Finance Mentions show even more explosive growth, trending +202% QoQ on a 30-day moving average.