I don’t know about where you live, but in Louisville, […]

Can Darden Restaurants Continue on its Recovery Trajectory? ($DRI)

Can Darden Restaurants Continue on its Recovery Trajectory? ($DRI)

Since emerging from its COVID-induced revenue slump, Darden has shown promising signs of a full return to pre-pandemic operations…But, can the recovery continue?

Darden Restaurants (DRI) owns and operates several chains of casual, sit-down restaurants in the United States, the largest being Olive Garden and Longhorn Steakhouse.

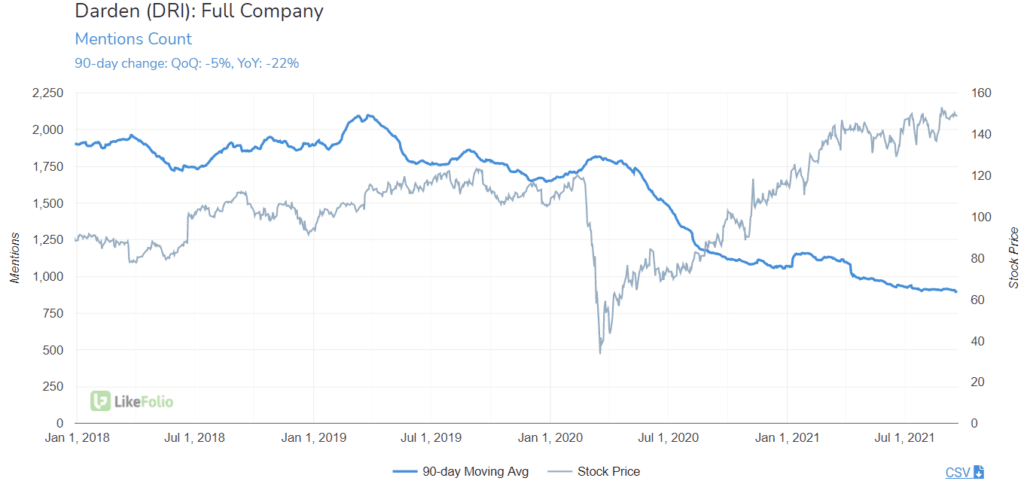

Consumer Mentions of Darden’s owned restaurants remain well below the levels seen in prior years, down -22% YoY on a 90-day moving average.

This general downtrend in Mention volume has impacted most companies in the restaurant industry, as consumers are still hesitant to return to in-person dining.

DRI’s carry-out and delivery-specific mentions have also pulled back from the highs seen last year but are still pacing +11% above 2019 levels -- To-go orders still accounted for a third of Olive Garden's sales last quarter.

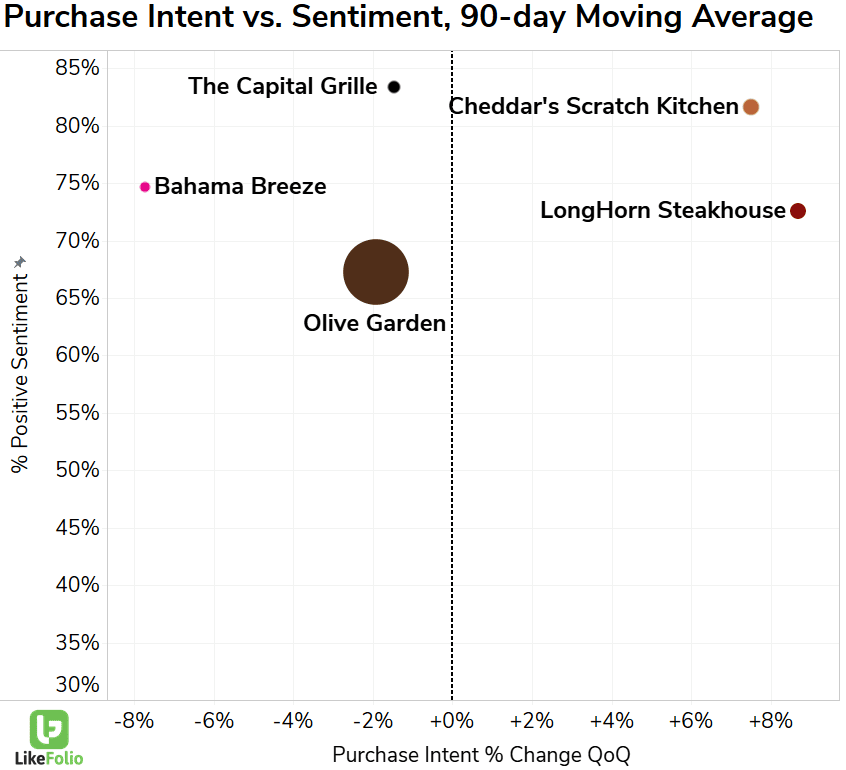

In terms of individual brands, Longhorn Steakhouse has been a major standout for the company.

In addition to boasting the highest volume of Purchase Intent Mentions, DRI also has favorable, top-right positioning on a near-term scatterplot, showing above average PI growth and average Consumer Happiness. While the future remains unclear for the restaurant industry at large, LikeFolio data shows that Darden is still a top performer. Longhorn Steakhouse has shown remarkable growth in recent months, but DRI will need similar strength from the Olive Garden brand to truly recapture it's pre-2020 trajectory.