Snapchat's IPO timing was...well... incredible. They literally took the company […]

Can Meta Platforms Live Up to Its New Name? ($FB)

The company formerly known as Facebook (FB) shocked the world last quarter with a full rebrand: It’s Meta Platforms now.

Taken by itself, an official name change is just a surface-level gesture for a company, unlikely to move the needle in either direction.

However, LikeFolio data shows that this was an inconsequential management decision…It was a genius strategic move.

Why?

In short, Timing.

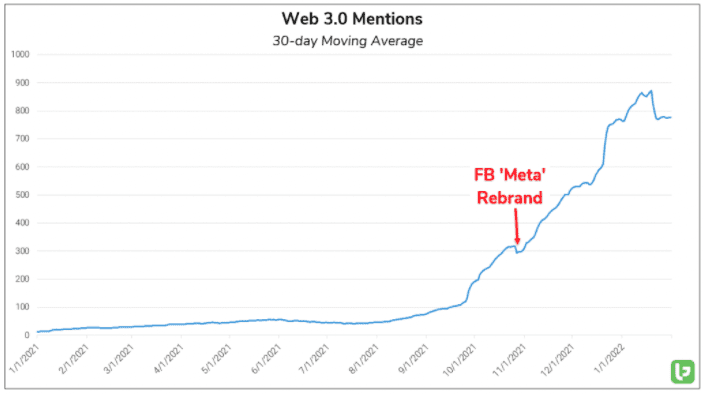

The concept of Web 3.0, a shared vision for the next phase of the internet, had only just begun to enter the popular lexicon when the Meta announcement dropped.

It’s debatable whether or not FB’s rebrand was the catalyst for the resulting surge in Web 3.0 awareness, but the outcome remains:

With a simple name change, a centralized Web 2.0 giant managed to attach itself to the decentralized revolution of Web 3.0.

Meta isn’t just talking the talk either. Its rebranding reflects a radical realignment of the company’s priorities.

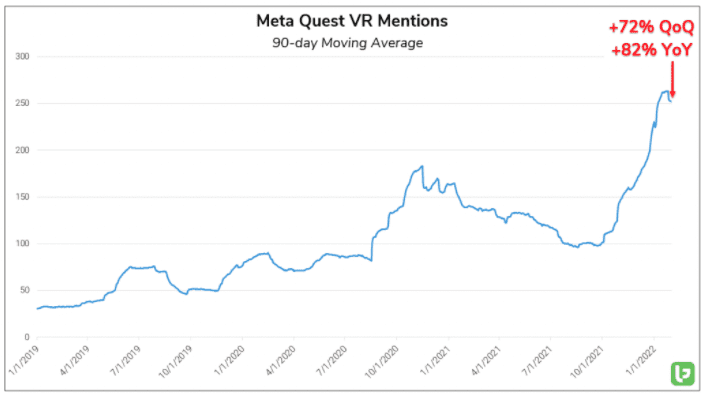

Meta’s VR business, which began with its 2014 acquisition of Oculus, has become a focal point.

On its most recent earnings report, Mark Zuckerberg held up the company’s VR and AR products as “the foundational platform for the metaverse.”

This posturing has already served to bolster consumer Buzz in the near-term:

Meta Quest (Formerly Oculus Quest) mentions are at an all-time high level, up +72% QoQ and +82% YoY on a 90-day moving average.

Meta has been incredibly effective in refocusing public attention towards new aspects of its business.

But, its legacy business, social media, is facing a serious revenue decline at the hands of iOS privacy restrictions.

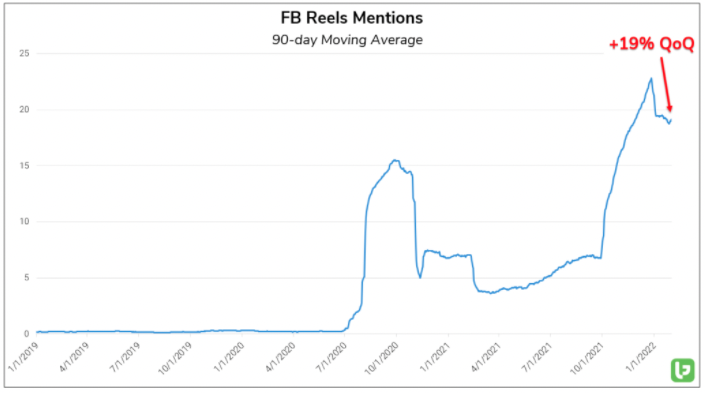

Facebook’s relatively new Reels feature has been stressed as a key area for expansion and a way to attract a younger userbase.

Underlying Reels mentions shows promising adoption: +19% QoQ (90d MA).

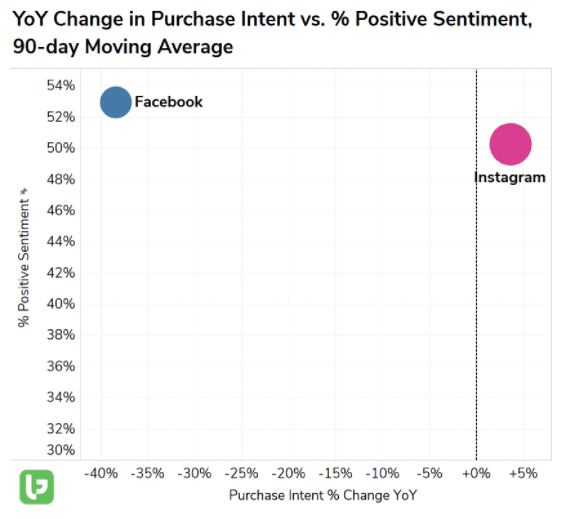

Yet, the former namesake brand is still losing ground with American consumers of all ages, lagging Instagram in terms of YoY demand growth.

It remains to be seen if Meta can effectively pivot away from its traditional business and deliver on the metaverse hype — The market is expecting a rough transition.

FB is set to report its first quarter of earnings as Meta Platforms this week, and VR/AR, gaming, and data centers will need to pick up the slack of declining advertising revenues.