Black Friday Weekend (leading into Cyber Monday) can make or […]

Can Target (TGT) Breathe Life into Ulta (ULTA)?

Can Target (TGT) Breathe Life into Ulta (ULTA)?

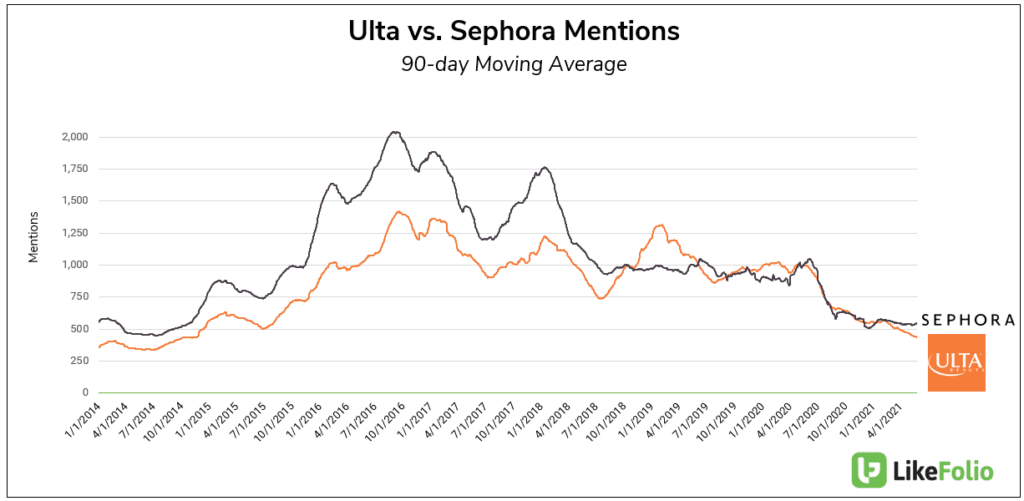

Here's the scenario: Ulta's Purchase Intent Chart looks rough. We haven't recorded volume this low since 2014 -- and this volume is a good indicator of consumer enthusiasm for a brand. But Ulta isn't alone. Fellow beauty peer Sephora's consumer mentions are on a similar downward path.

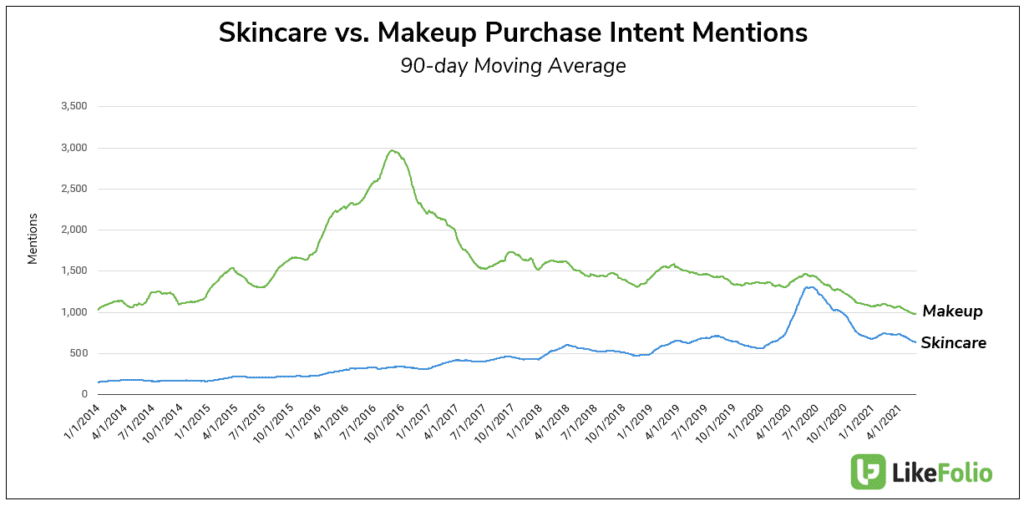

What's going on? The main driver of declining demand in both beauty names is an overall consumer shift away from makeup. In constrast, Skincare demand is rising. The gap between Makeup and Skincare Purchase Intent mentions nearly closed during the quarantine. This has somewhat normalized in 2021, but the gap remains much tighter vs. 2019.

Ulta noted negative makeup comps on its last earnings call due to, "less year-over-year product newness and continued mask-wearing and limitations on makeup-wearing occasions."

But this is a multi-year downward trend, only amplified by the pandemic.

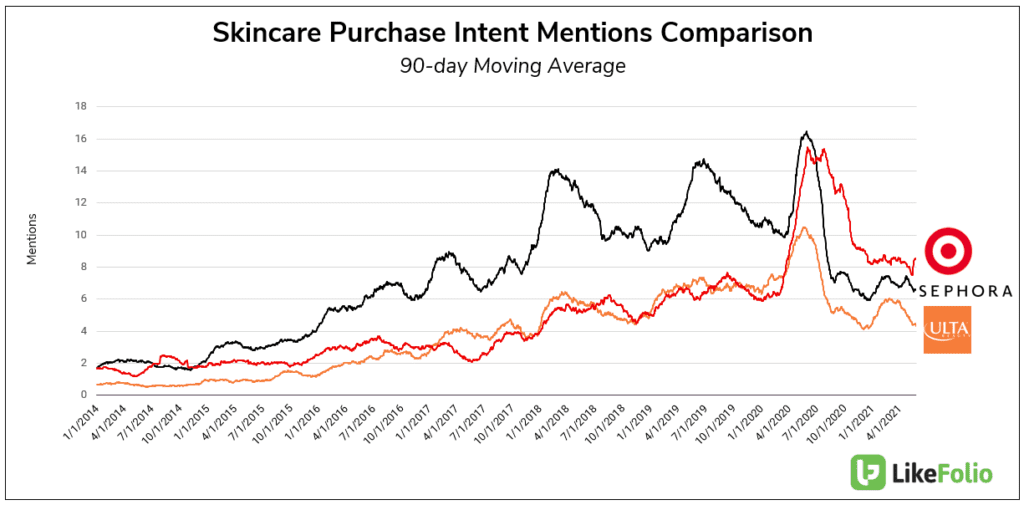

And LikeFolio data suggests competition is brewing in the growing Skincare segment.

Target is taking significant major market share from Ulta and Sephora. Consumer mentions of purchasing skincare products at Target have increased nearly +40% vs. 2019.

This makes the Ulta x Target Partnership make so much sense.

Target provides Ulta with same-day delivery via shipt, an expanded retail footprint, and captive consumers who are already having a positive experience in the store. On the flipside, Ulta provides Target shoppers with access to "higher end" cosmetics and to 30.7 million loyalty members.

We'll be tracking this roll-out to see if Target (and reopening events) can breathe life into Ulta's brand.