What is a DEX? ($UNI, $CAKE, $SUSHI) A decentralized exchange […]

Can we have our $CAKE and eat it too?

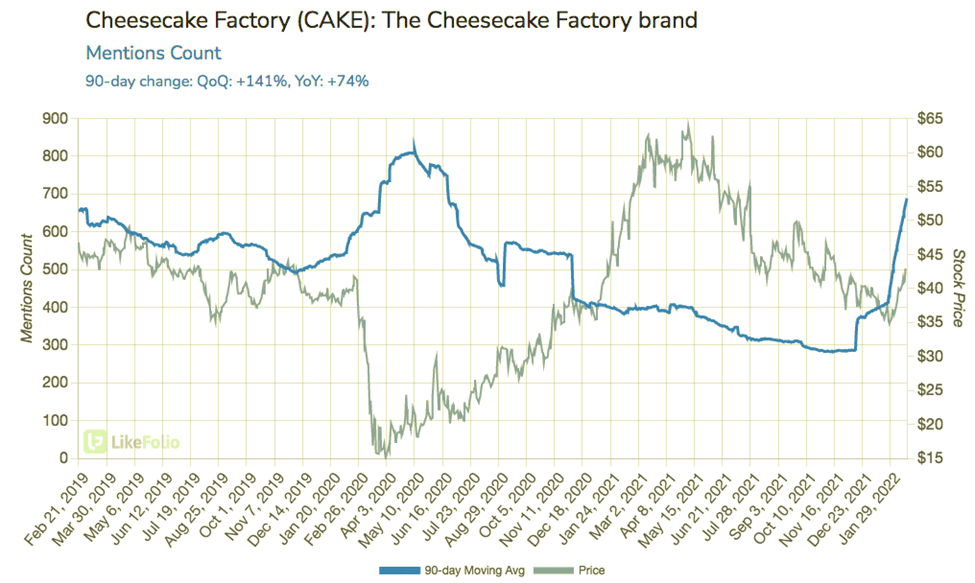

The Cheesecake Factory Incorporated stock price absolutely was just on a tear through the height of Covid, despite many small restaurants struggling.

They own and operate a portfolio of popular restaurants thanks to the acquisition in 2019 of the Sam Fox Restaurant group.

They saw a healthy pullback after almost taking out the all-time high at $67.14. The question we look at now is can it continue this momentum?

If the LikeFolio data has anything to say about it then the answer is a YES. The North Italia brand is one of their sit-down restaurants that was acquired in the Sam Fox deal and the numbers speak for themselves.

- QoQ Purchase Intent Mentions +24%

- YoY Purchase Intent Mentions +262%

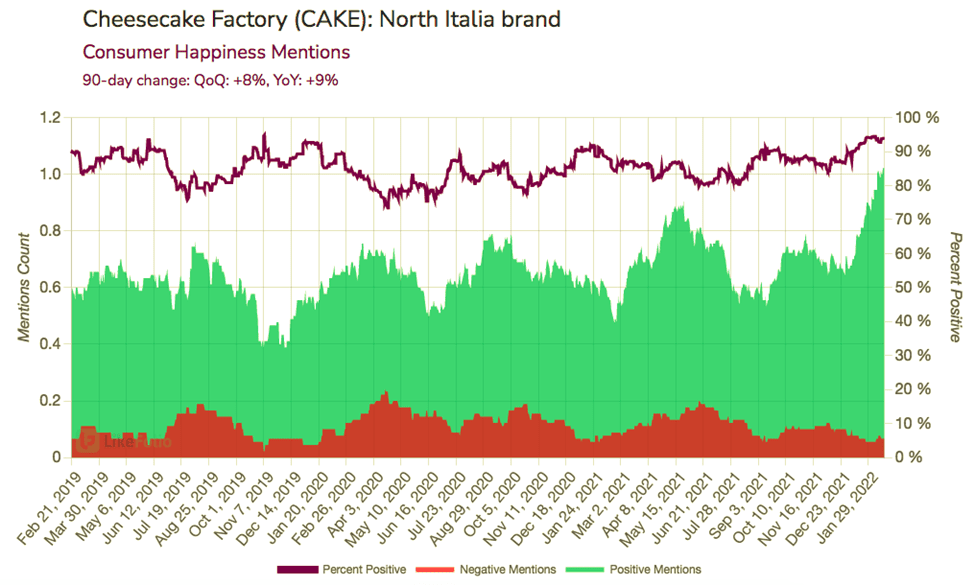

Not only that, but the Consumer Happiness Mentions for North Italia are absolutely off-the-charts as well.

That’s a 93% positive mention rate. Incredible.

Mind you, the namesake brand, The Cheesecake Factory is absolutely showing positive data as well.

And despite the Company missing on EPS last week on earnings ($0.49 v. estimated $0.58) the stock still reacted well.

While some restaurant chains might be struggling still due to Covid and hiring/worker issues the data, as of now, is showing strong signs for a continued move higher in $CAKE.