Chip Shortage "Pin Action": AAP

Chip Shortage "Pin Action": AAP

As an investor, I’m always on the lookout for the secondary effects of major trends.

The “pin action”.

The other day, I drove by the Kentucky Speedway in Sparta, Kentucky, and guess what I saw?

Thousands and thousands of Ford F-150 trucks...brand new ones.. as far as the eye could see.

In fact, just a few weeks ago it was reported that there are over 60,000 of these trucks stranded, waiting for the chips that make their dashboards and other electrical processes function properly.

The media has honed in on this chip shortage, and what it's done to both new and used car prices. (Econ 101 -- supply down, price up!)

But the secret “pin action” story that is unfolding now is how this extreme pricing is impacting CURRENT car owners.

They’re priced out of new and used cars... are they pivoting to DIY repair of what they have?

And if so, which companies are benefitting?

Luckily we have LikeFolio data to tell us EXACTLY what the consumer is doing... and how this could be a huge opportunity for savvy investors with an eye on consumer data.

Advanced Auto Parts (AAP) as a Chip Shortage Winner

There are three macro trends currently benefiting auto parts retailers in a big, big way:

- Rising average vehicle age

- Lack of new vehicle availability

- The return of consumers and workers to the roadway

LikeFolio tracking of “fixing my own car” has risen by over 13% since 2019, and indications that workers are returning to the office are up 38% over the past 90 days.

With less new and used cars available for purchase, these drivers are caught in a tough position when it comes to transportation. And many of them are opting to get out the wrench and fix the car they already own.

So which auto parts company is most likely to win over these customers?

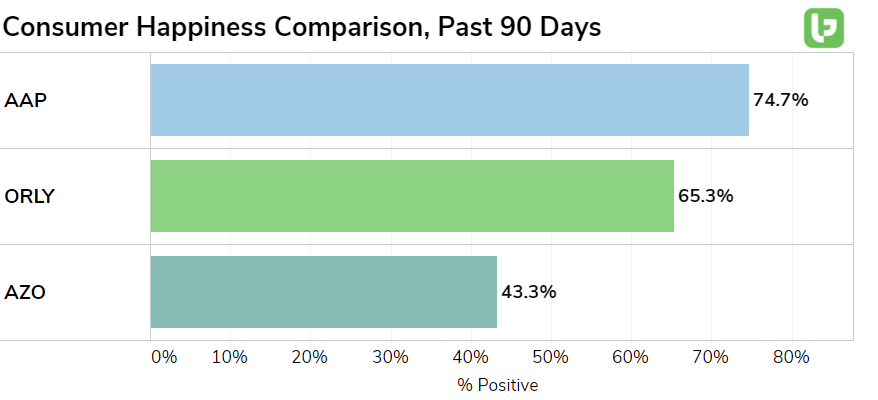

The one with the highest consumer happiness, of course:

As you can see in the chart above, Advanced Auto Parts is blowing away the competition when it comes to producing a good experience for their customers.

AAP is coming in at an extremely strong 74.7% happiness rating, while competitors

O’Reilly Auto Parts (ORLY) and AutoZone (AZO) trail by 9 points and 31 points of consumer happiness respectively.

That’s an enormous edge for Advanced Auto Parts, and one that could create a positive feedback loop of loyal customers and rising revenues over the next few quarters, especially if the chip shortage carries on for as long as analysts are predicting.

We’ll be expecting a good report and outlook out of Advanced Auto Parts on Tuesday when they report earnings.

And, as always, LikeFolio clients will be the first to know when we spot a longer term opportunity in this company or any in the auto parts space.