Dunkin' Donuts is superior to Starbucks. There is really no […]

Coca-Cola (KO) is Dominating

Last week we highlighted a major winner of a holiday season favoring cocktails vs. wine and beer.

But Brown-Foreman isn’t the only beverage company getting in on the holiday fun.

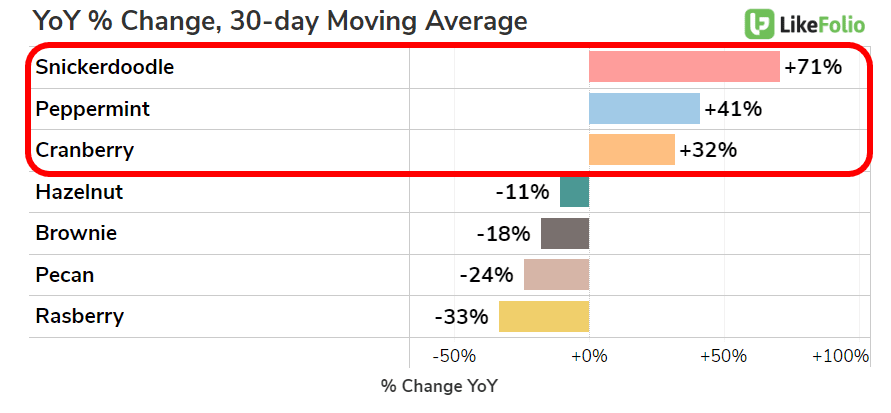

Our research team broke down the top FLAVORS of the season:

And more importantly, identify the companies who are trying to leverage these trendy consumer tastes.

Three names really popped thanks to a viral beverage with a touch of snickerdoodle, peppermint, or cranberry:

- Coca-Cola (KO)

- Wendy’s (WEN)

- Starbucks (SBUX)

But only ONE name has a strong enough portfolio officially claim the status of seasonal WINNER.

Can you guess which one?

Here’s what we’re watching….

Coca-Cola (KO): Lifted by Solid Beverage Offerings

Coke brought back winter spiced cranberry for the 2022 holiday season and it’s flying off shelves.

The seasonal bevvy is so popular many consumers report that they can’t get their hands on a case.

And the special holiday infusion is outperforming traditional “cranberry sprite” by +56% this year.

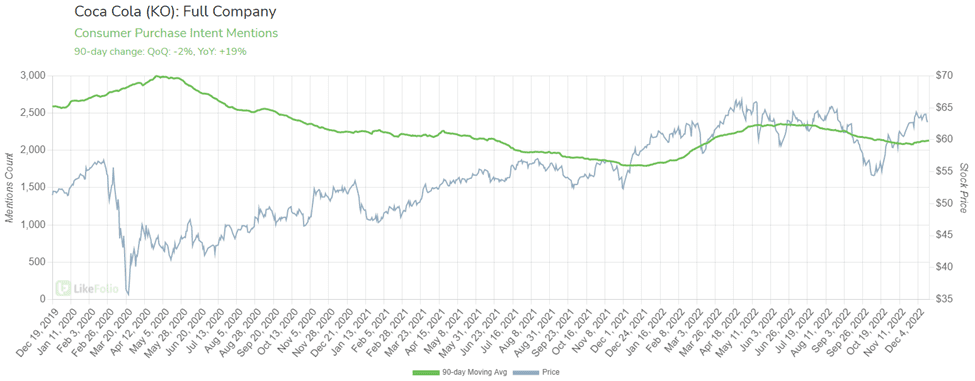

Across the board demand for Coca-Cola’s classic brands (including Sprite) remains strong, currently pacing +19% YoY.

Coca-Cola is also benefitting from increased on-premise consumption in bars, restaurants, and event venues.

We expect continued strength from its balanced portfolio: Leaning Bullish: +10, and the official seasonal beverage winner.

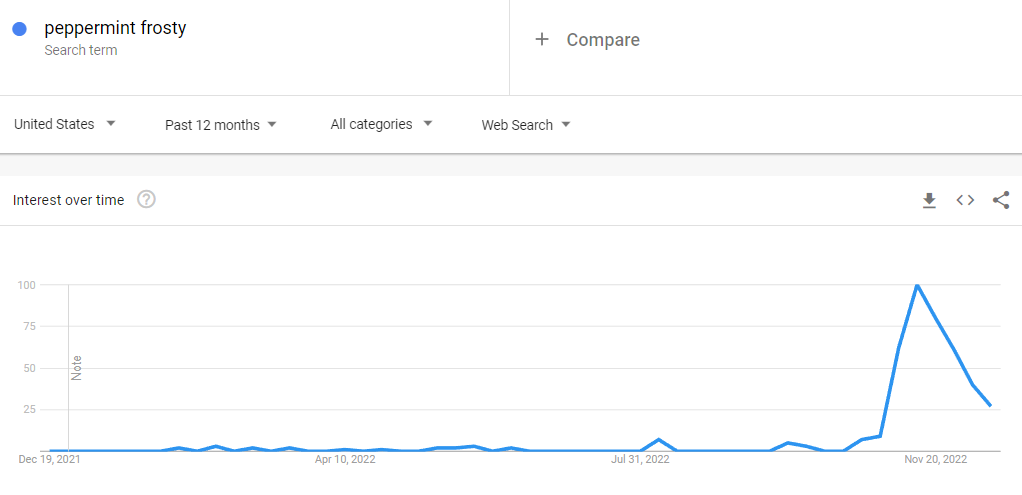

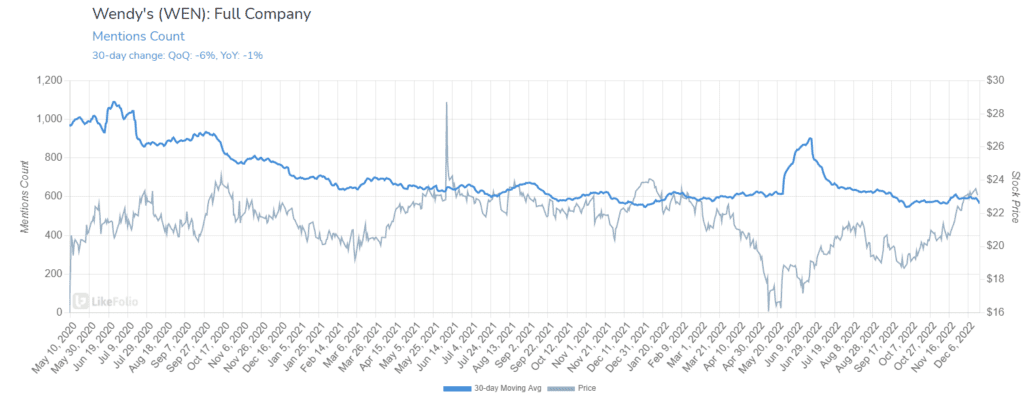

Wendy’s (WEN): Fresh Frosty Flavor Keeps Consumer Interest Alive

In November Wendy’s released a new limited edition frosty: peppermint.

This is only the third Frosty flavor introduced in the last 16 years.

And consumers took notice. Mentions surged in November as consumers tested out the holiday treat.

Despite the initial popularity surge for the peppermint frosty, consumer interest is already dropping off.

Cumulatively, Wendy’s mentions remain flat on a YoY basis.

The peppermint concoction breathed a quick burst of life into the brand, but metrics support a (barely) neutral outlook.

Wendy’s current earnings score is -19.

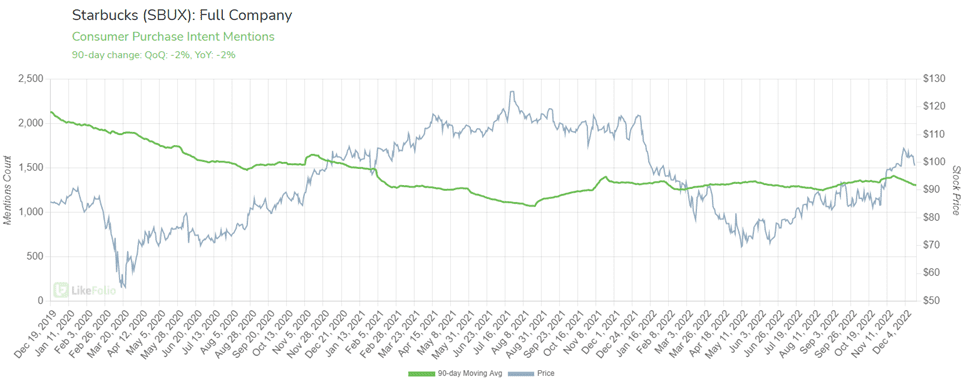

Starbucks (SBUX): Holiday Flavors not enough to Offset Waning Demand

Starbucks is doing something right with its snickerdoodle hot chocolate.

Even consumers who aren’t hot chocolate fans are lapping up this special edition.

Unfortunately, this seasonal offering may not be enough to offset large-scale demand weakness, namely out of covid-driven restrictions in China.

Mentions of purchasing a snack or beverage from Starbucks have slipped by -2% YoY, the first sign of weakness recorded in LikeFolio data in months.

Mentions confirm price hikes may finally be weighing on consumers.

Our team will be monitoring closely through the end of 23Q1 (Jan. 1) to determine earnings outlook. The current earnings score is -16: officially neutral with a slight bearish lean.