In regard to trading volume, Coinbase is the largest cryptocurrency […]

Coinbase is Falling Behind

Last week we spoke about Coinbase’s naturally strong correlation with bitcoin.

But, we wanted to dig a little further into the company’s data.

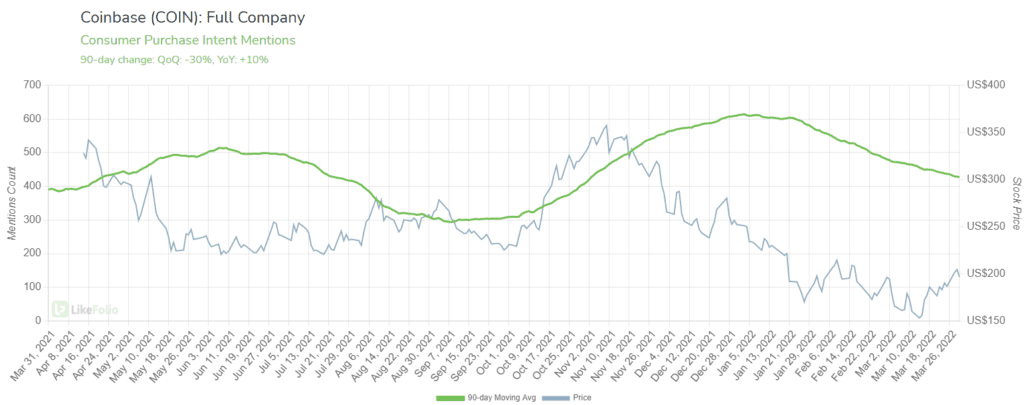

Firstly let’s look at Coinbase Purchase Intent…

Not the most appealing chart if you are a Coinbase bull, trending -30% QoQ and +10% YoY.

Of course, there has been a recent fall in crypto prices lately, but we also have to consider the various factors that have weighed on the crypto industry and the Coinbase share price.

Macro headwinds such as tighter regulations, inflation, rising interest rates, the Russia-Ukraine war, and crypto market volatility are heavily weighing on COIN’s growth.

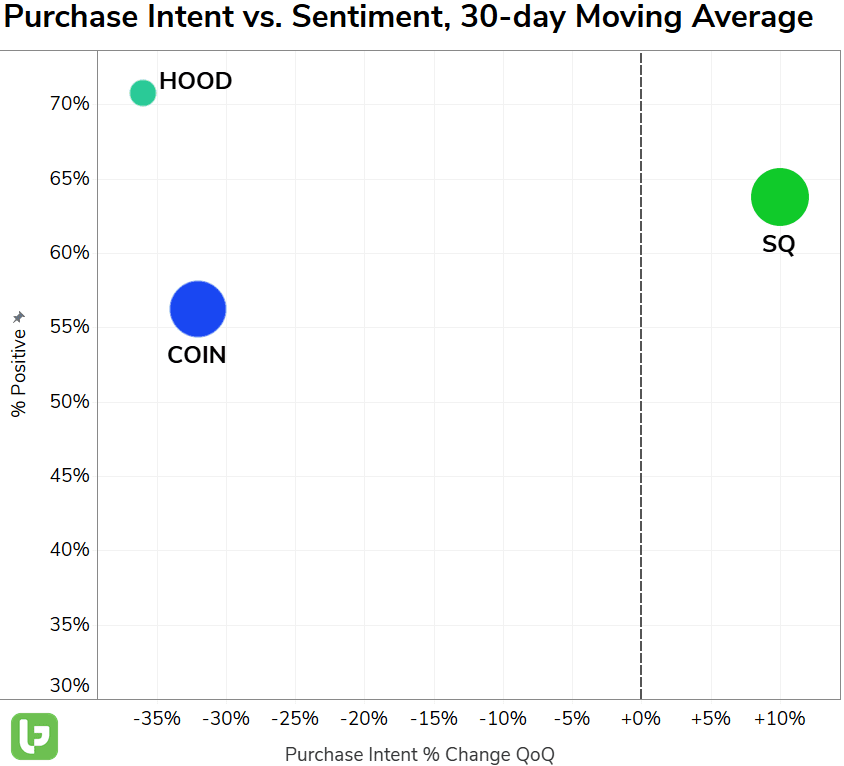

The company is also lagging behind its peers (Robinhood and Square) for Happiness and Demand…

For reference, the ideal placement is in the top right corner... Not an ideal placement for Coinbase investors.

Furthermore, Overall Mentions have also declined lately, trending at -26% QoQ.

That’s not to say that we are extremely bearish on the stock long-term…

Coinbase themselves even said previously that the company “is not a quarter-to-quarter investment, but rather a long-term investment in the growth of the crypto economy.”

Since its IPO, COIN has posted impressive revenue and earnings growth over the past few quarters.

Back in January, CNBC reported that Crypto exchanges such as Coinbase and Binance and online trading platforms including Revolut and eToro had seen a spike in activity.

In addition, it is reinvesting into new businesses besides bitcoin and crypto overall.

The addition of NFTs and derivatives should help diversify revenue and customer mix over time, but it is still is in the very early stages.