In regard to trading volume, Coinbase is the largest cryptocurrency […]

Coinbase Still Has Positives Despite the Decline

Coinbase is a stock born from the bitcoin boom…

The crypto exchange was founded in 2012 and became a public company in April 2021 with its stock hitting a high of over $429 per share on its first day of trading.

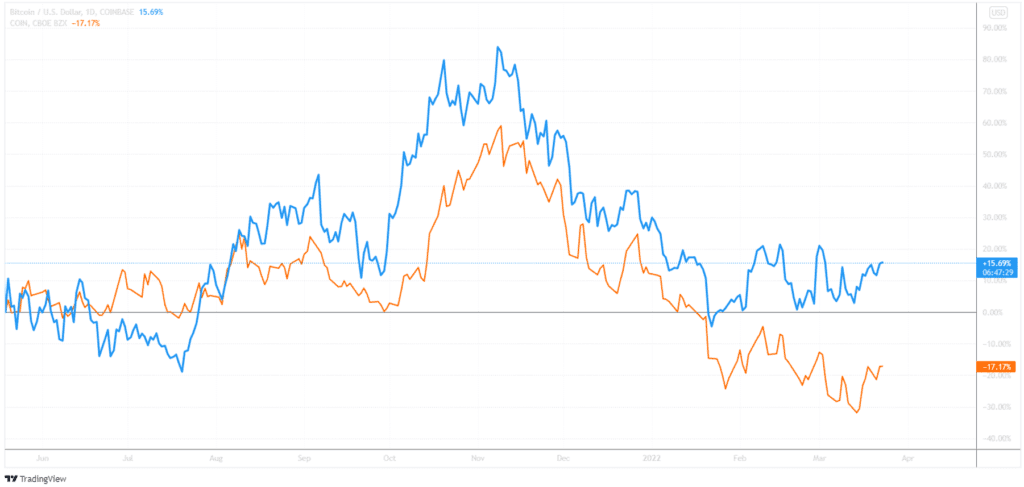

Look how closely tied Coinbase stock is to bitcoin. If BTC falls, so does Coinbase…

The correlation is strong.

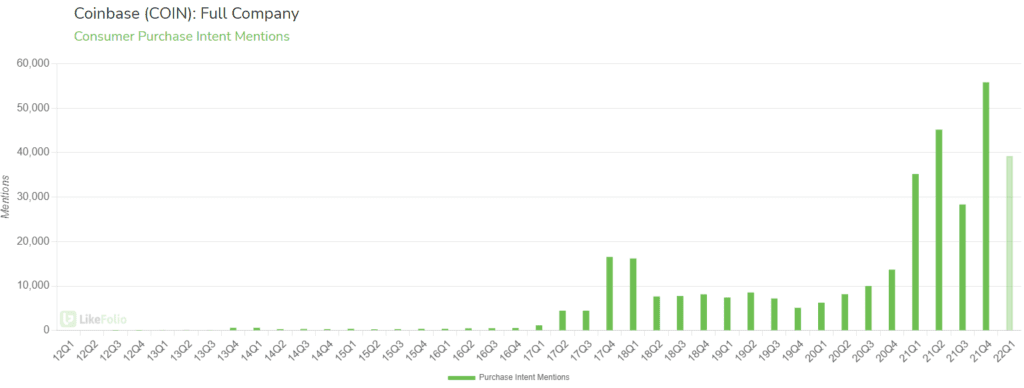

However, when we look at Coinbase Consumer Purchase Intent Mentions, we can see it is still robust.

Yes, there has been a recent dip, and the company already warned that Q1 trading volumes would be lower.

But based on Purchase Intent Mentions pre-pandemic, the demand is still solid, up +12% YoY.

Crypto trends are also continuing to rally with mentions of trading crypto trending at +210% YoY…

So despite the recent dip and plateau, the decline, based on LikeFolio data, hasn’t been substantial.

It was revealed over the weekend that Jim Chanos, a short-seller, is, well, shorting Coinbase. He apparently said it is a “bubble stock.”

He also told CNBC that they believe Coinbase is “over earning.”

Whether that prediction will turn out to be correct or not is another question...