PepsiCo (PEP) The quarantine 15 didn't materialize out of thin […]

Coke (KO) has a Viral Brand on its Hands

Coke (KO) has a Viral Brand on its Hands

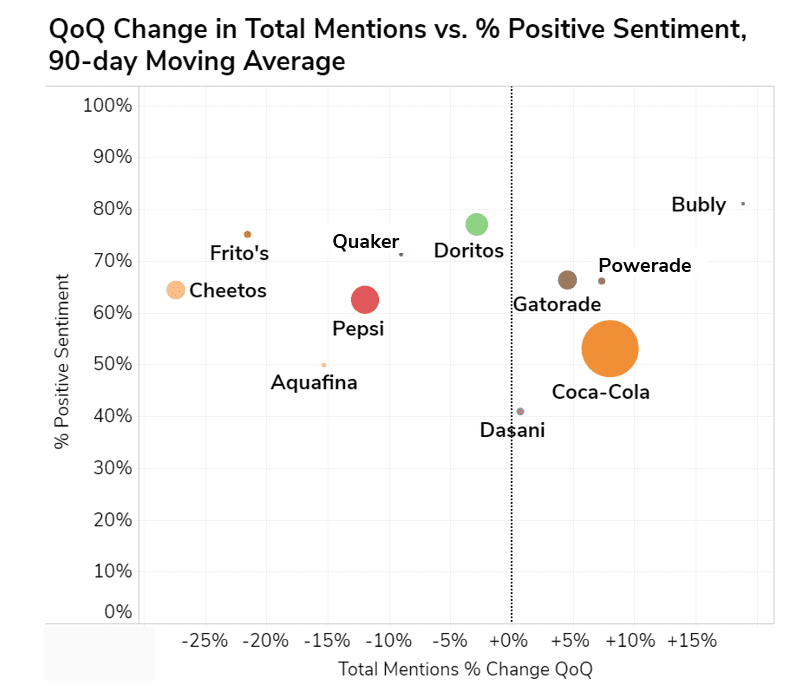

PEP and KO are tough apples-to-apples comparisons due to Pepsi's robust snacking presence a la Frito-Lay and Quaker. We know Pepsi benefitted from stay-at-home trends, including increased snacking, eating breakfast, and a general dismissal of diets. Now, those trends are shifting:

- Snacking: -17% QoQ

- Eating Breakfast: -8% QoQ

- Calorie Awareness is rising on a QoQ and YoY basis

This is working against PEP on the food product front. Consider the near-term performance of high profile Coke and Pepsi brands on the chart below, showing near-term weakness out of Quaker and the "itos" brands.

But perhaps the most interesting element of this chart is what is NOT included: Coke's Topo Chico brand.

We had to cut the sparkling water cult-favorite from the comparison because Topo Chico's consumer demand growth is so explosive it skewed the x-axis.

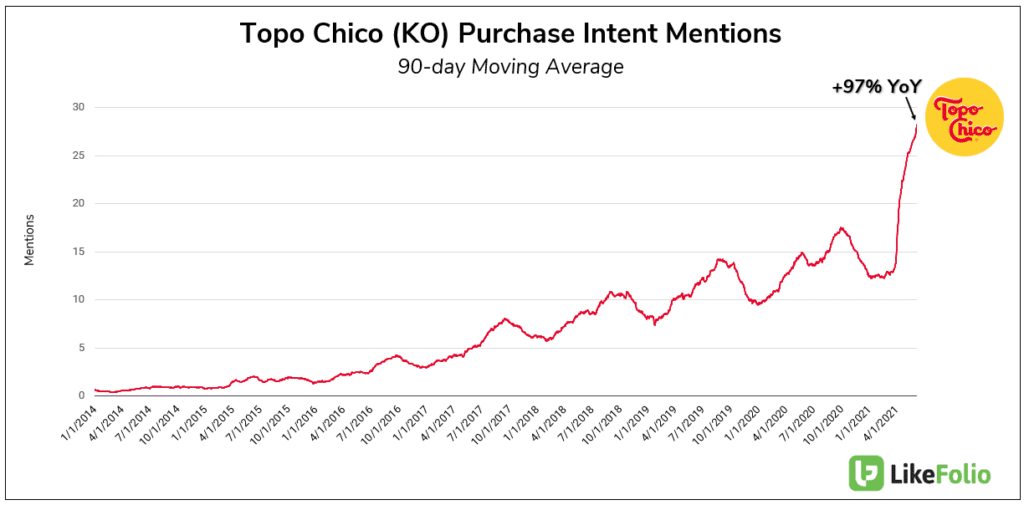

Topo Chico Brand Mentions have increased +97% YoY Topo Chico's sparkling water has been around for years. Coke acquired the brand in 2017, deemed "the sparkling water for cool people," and Coke has turned up the volume. Coke announced it was developing a hard seltzer under the Topo Chico brand last year and officially released the hard seltzer in limited markets at the end of March. Looking ahead, we've got a close eye on reopening trends and emerging brands like Topo Chico. While both companies are consumer staples, Coke appears to have a near-term advantage while Pepsi's Snack division loses steam.