Hilton Worldwide (HLT) In news to no-one, fewer consumers are […]

Consumer Squeeze: These stocks are in trouble

U.S. stocks stumbled yesterday amid concerns over the First Republic Bank's failure and the Federal Reserve contemplating another rate increase.

Market uncertainty and persistently high rates aren't just affecting investors – they're hitting the consumer psyche too.

LikeFolio's MegaTrends report last month accurately predicted the decline in consumer discretionary spending as covid-related government stimulus has run dry, tax refunds are significantly lower this year, and inflation erodes consumer buying power.

As a result, all of the companies featured in that report have seen drops in share price since then, with BBW dropping as much as -15%…. netting savvy members a handsome profit in the process.

Analyzing LikeFolio's earnings scores, a clear pattern emerges:

- Fewer companies are in the Bullish camp

- The neutral band is growing

- More companies, especially discretionary-focused retailers, are entering bearish territory

Leveraging LikeFolio's data, we've identified several companies facing a strong decline in consumer demand.

Here's a quick look at the first two:

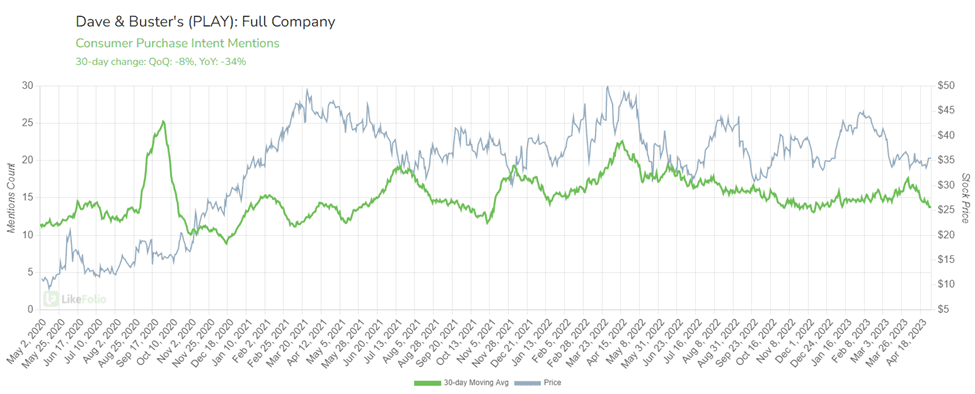

Dave & Buster's (PLAY): -38

Dave & Buster's, the entertainment and dining venue, has a LikeFolio Earnings Score of -38.

With consumers facing financial pressures, they're more cautious about spending on discretionary activities like dining out and entertainment, impacting Dave & Buster's consumer demand.

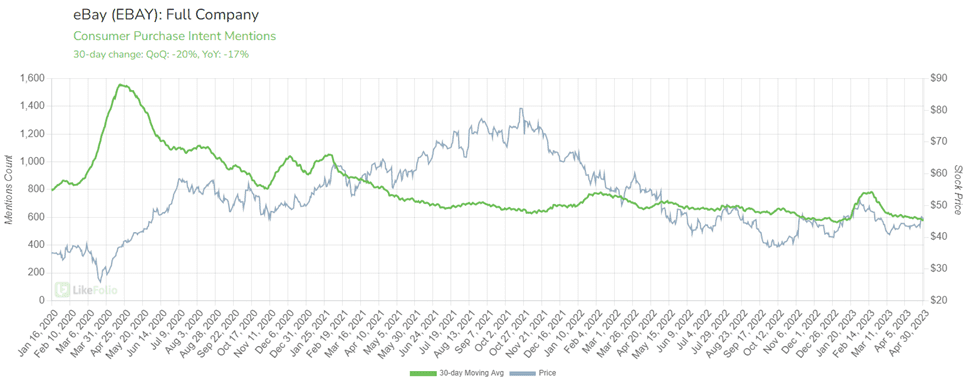

eBay (EBAY): -40

EBay, the e-commerce platform, has a LikeFolio Earnings Score of -40, indicating a bearish trend in consumer sentiment.

Fierce competition from e-commerce giants like Amazon and Walmart, along with unfavorable changes to seller policies, are negatively affecting eBay's market share and user satisfaction.

Demand has slipped by -17% on a YoY basis, notably degrading over the last month (not included in last quarter’s results).

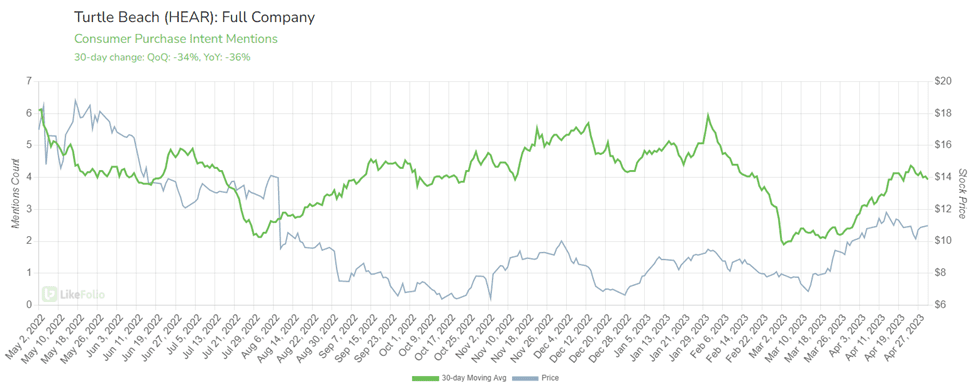

Turtle Beach (HEAR): -44

Turtle Beach, a leading provider of gaming headsets, has a LikeFolio Earnings Score of -78, which is quite bearish.

The company faces stiff competition from other headset manufacturers and is struggling to differentiate its products in an increasingly saturated market.

Additionally, according to LikeFolio trend data, consumers are spending less time on gaming and entertainment, leading to decreased demand for gaming peripherals like headsets.

Purchase intent mentions are -36% lower YoY.

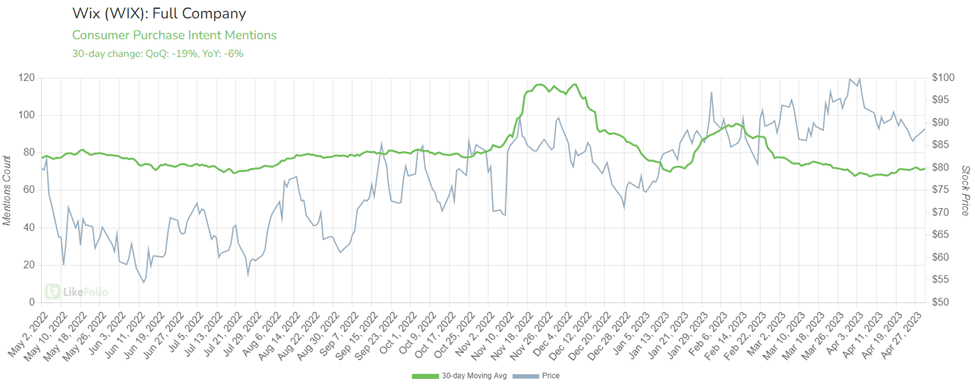

Wix (WIX): -59

Wix, a popular website building platform, has seen its LikeFolio Earnings Score drop to -59, indicating a strong bearish sentiment.

The company faces increasing competition in the website builder market, and the lack of new, innovative features could be causing users to look elsewhere for web design solutions.

Furthermore, with many businesses struggling to stay afloat amid economic turbulence, fewer are likely to invest in upgrading their websites or starting new online ventures.

Demand has dropped by -6% YoY after recording some improvements in 2022.