Kohl's stock was hammered in 2016 and 2017 as the […]

Consumers are Getting Worried…Cui Bono? ($BIG, $DLTR, $DG, $FIVE, $KSS, $ROST, $TJX)

Translation: who is to benefit?

Over the past year, day-to-day life has begun to normalize from pandemic conditions.

Fear of a certain virus has begun to dwindle, but other concerns have since crept into the minds of the American public — Monetary inflation being one of the foremost.

Over the past year, the possibility of rampant inflation has gone from a fringe outcome to a widely recognized reality for consumers and investors alike.

Mentions expressing fear and uncertainty about inflation are at an all-time high on a 90-day moving average: +420% YoY.

These fears aren’t unfounded… The U.S. Bureau of Labor Statistics reported inflation of 7% YoY last month, the highest level seen since 1980.

Consumers have already started to change their shopping habits accordingly.

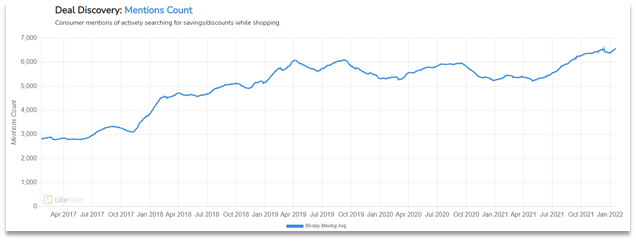

LikeFolio data shows that shoppers are actively searching out savings and discounts, with “Deal Discovery” Mentions rising to new highs in 2022.

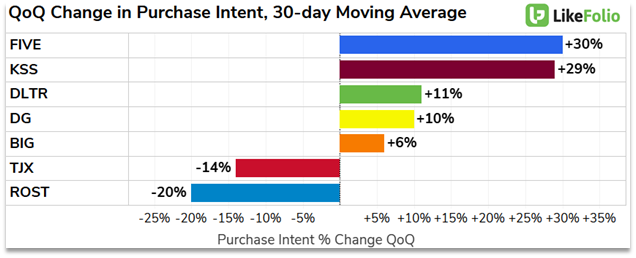

This shift in behavior has been a boon for companies in the discount retail space, confirmed by rising Purchase Intent Mentions:

Prevailing trends are giving many of the companies in the discount space a strong tailwind, particularly stores with a wide variety of goods on offer.

Generic discount stores are showing positive demand growth across the board —

Dollar Tree ($DLTR), Dollar General ($DG), Five Below ($FIVE), and Big Lots ($BIG) all show a positive near-term PI trajectory.

Even the discount sector has been faced with unwelcome price increases: Dollar Tree recently became $1.25 Tree.

However, DLTR customers weren’t phased by this move, as evidenced by solid ‘21Q3 results.

Discount fashion has a mixed outlook — Although Kohls ($KSS) shows robust near-term Demand growth (+29% QoQ), rival fashion retailers TJ Maxx ($TJX) and Ross Stores ($ROST) are lagging the sector at large.

Both ROST and TJX have put up solid numbers in recent quarters, so we’re taking their relative PI underperformance with a grain of salt for now.

We’ll be keeping a close eye on all of these names going forward, with a bullish bias informed by shifting consumer behavior.