The Buy Now Pay Later Industry is Booming Consumer preferences […]

Consumers are Ready to Spend

Consumers are Ready to Spend

Never underestimate American consumers' proclivity to...consume. Retail sales increased 5.3% in January, exceeding the expectation by 4 points -- bolstered by $600 stimulus checks disseminated in that month. LikeFolio trend data shows improvements in key economic macro behaviors:

- Shopping for New Clothes: +30% QoQ

- Buy Now Pay Later: +6% QoQ

- Paid Off Credit Card: +52% QoQ

- Cancelled Credit Card: +3% QoQ

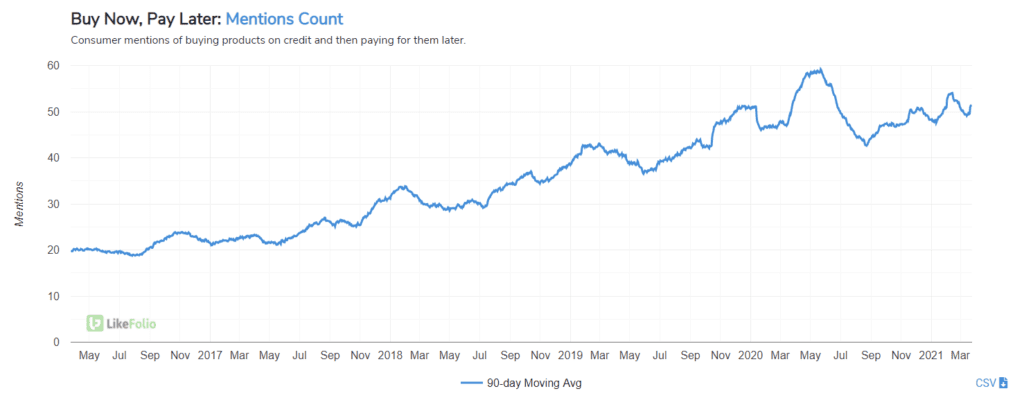

Translation: the consumer is ready to spend, and they want to spend smartly. In fact, the Buy Now, Pay Later (BNPL) model is increasingly preferred by many consumers. Check out the chart of consumer adoption of this financing method...

Affirm (AFRM) functions as a point-of-sale financer, enabling transactions across a wide network of brands that the consumer can pay back in pre-defined monthly increments without accruing any interest. It leverages itself as the "anti-credit card".

Consumer mentions of using AFRM services to finance a purchase have increased +79% YoY (you can see this resurgence in the past month on the chart above). What is driving Affirm adoption? Consider the brands partnered with the financer: Peloton, Wayfair, Walmart, Shopify, Expedia, StubHub, Pottery Barn, Neiman Marcus -- in all, it touts more than 7.9 thousand merchants on its network. And these partners range from home fitness, to fashion, to travel, to live sports and entertainment events. The key is: Affirm is built into these platforms at the point of sale, so once a customer has connected with Affirm once, he or she can use the service to power payments across retail partners without ever leaving the checkout workflow. What do retail partners get out of this? Increased conversions, increased average order value, and and expanded potential customer base. Affirm is placed in a crowded environment with other names like Afterpay, Klarna, and Sezzle. Overall, the brand is exhibiting robust growth and has high user sentiment. In fact, it's NPS (net promotor score) places it between Apple and Amazon...this score is the likelihood of a user to recommend its product or services. AFRM is a new IPO, so short-term volatility is to be expected. However, this is a name high on our watch list, especially if adoption rates continue as they have been.