Rivian is an American automaker specializing in electric vehicle production. Today, […]

Could Rivian (RIVN) Actually Be a Competitor to Tesla (TSLA)?

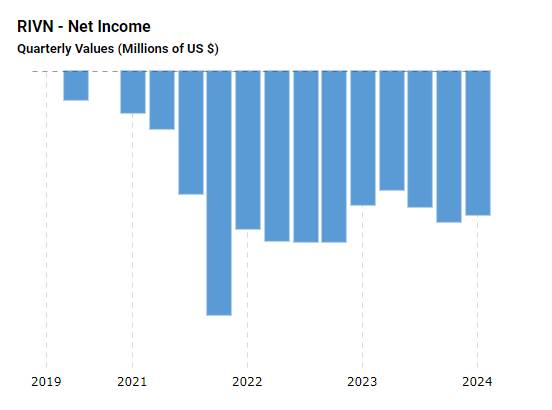

Electric Vehicle (EV) manufacturer Rivian (RIVN) has faced substantial financial difficulties recently, with revenue declines over the past three quarters and a debt of approximately $5 billion. Rivian has yet to return profitable margins since its IPO and has struggled with production issues.

Despite these challenges, a new $5 billion deal with Volkswagen offers a potential lifeline. The deal includes a joint venture to develop new EV software and a $3 billion investment from Volkswagen, aiming to bolster Rivian’s financial stability and growth prospects.

Market Position and Strategic Moves

Since its inception, Rivian has been positioned as a potential competitor to Tesla (TSLA). As of Q1 2024, Rivian and Volkswagen each held a 5.1% share of the US EV market, while Tesla commanded a significant 52.1% share.

Although Tesla’s market presence is dominant, Rivian’s strategic partnership with Volkswagen aims to leverage their combined strengths. Volkswagen benefits from Rivian’s advanced EV software, while Rivian gains critical funding and support to develop new models and reduce operating costs, including the establishment of a new manufacturing plant in Georgia.

Competitive Edge and Consumer Sentiment

Rivian’s competitive position has been enhanced by Tesla's struggles with the Cybertruck launch, which faced delays, recalls, and a price increase, losing its federal EV tax credit. Conversely, Rivian’s R2 model qualifies for such tax credit, improving its market appeal.

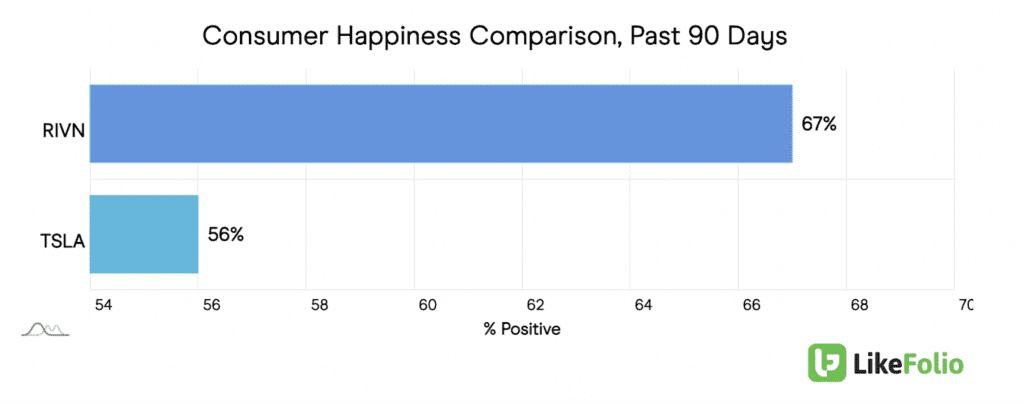

According to LikeFolio’s Consumer Happiness metric, Rivian has seen a 67% increase in consumer happiness over the past 90 days, positioning it favorably against Tesla.

Takeaway:

While Tesla is likely to remain the dominant player in the EV market, Rivian’s partnership with Volkswagen and plans to achieve profitability present a potential for a strong comeback. This new alliance, along with strategic cost reductions and product development, positions Rivian as a promising competitor with significant upside potential.

The combined efforts of Rivian and Volkswagen could reshape the competitive landscape of the EV market, giving Rivian potential for a strong upside.

We can’t help but root for the underdog.