Carnival Cruise Lines is starting to show some weakness in […]

Cruising into Earnings🛳️

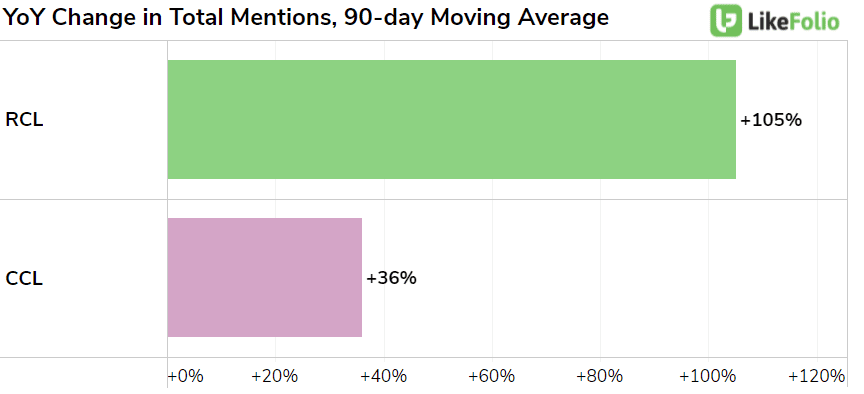

Over the last year, Royal Caribbean (RCL) has outperformed Carnival (CCL) -- from a stock AND consumer health perspective.

RCL shares have shed -18% in value YoY while CCL shares have lost -35% in the same time frame.

Heading into CCL earnings next week, is this lackluster performance likely to continue?

From a comparative perspective, yes.

Royal Caribbean's brand resurgence is much stronger than Carnival's, as evident on the mention bar chart.

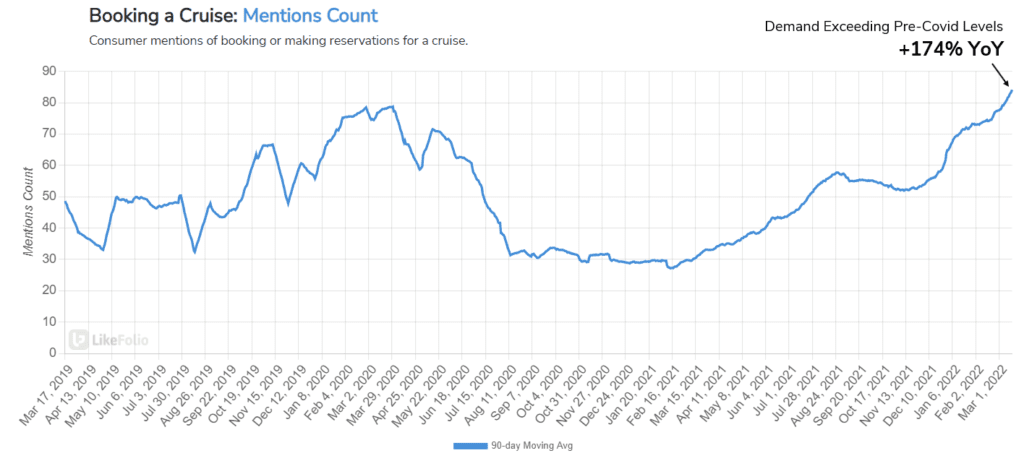

But from an overall booking improvement perspective, a rising tide may lift both boats.

Booking a Cruise mentions show signs of serious pent-up demand.

Generic cruise booking mention volume recently passed pre-covid levels, pacing +174% YoY.

And this is building on top of an already recovering 2021. According to Ship Technology, in 2021, the cruise industry saw a +96% YoY increase in passengers, reaching 13.9 million.

In addition, CCL slightly bests RCL from a consumer happiness perspective.

Perhaps this has to do with Carnival's "fun ships," known for being casual, low-cost, and family-friendly.

In contrast, Royal Caribbean is often viewed as the "Go Big" option for entertainment and luxury travelers.

Regardless, both names are logging serious demand growth as consumers indicate they are ready to get on board.

But we must keep in mind macro factors impacting both companies at the moment. Most notably, oil prices.