“You know it's time to sell when shoeshine boys give […]

Crypto Crash: How to Play It Now (COIN)

Binance crushed competitor FTX, and kicked off a crypto selloff, in grand fashion.

Strongly suggest this thread from Shann Puri recapping how FTX was brought to its knees, and then agreed to be acquired, by Binance.

(UPDATE: BINANCE HAS NOW WALKED AWAY FROM FTX ACQUISITION)

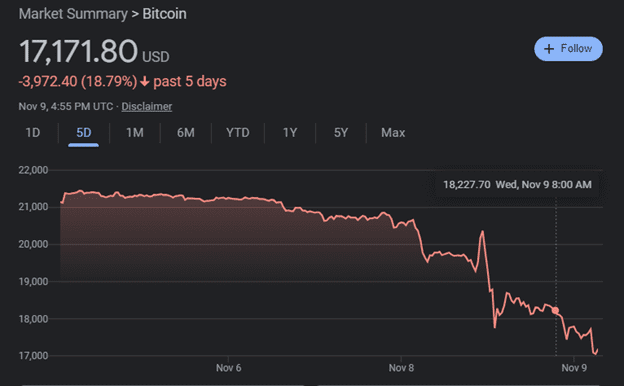

Crypto crashed

Bitcoin moved from $21,000+ to under $19,000 in a matter of hours. It’s now near $17,000.

Panic took hold of markets

Investors and traders in cryptocurrencies began to get scared…

Some sold their crypto stake (sending prices even lower… others simply withdrew what they had from exchanges into cold wallets (more on this later)…

That’s nearly half a billion dollars of withdrawals from Coinbase (COIN) in less than a day.

Coinbase was overwhelmed with sell orders and withdrawals

Coinbase stock drops dramatically

Investors in Coinbase stock see withdrawal flow by Coinbase clients, combined with the overnight implosion of rival FTX, and go into “sell first, ask questions later” mode.

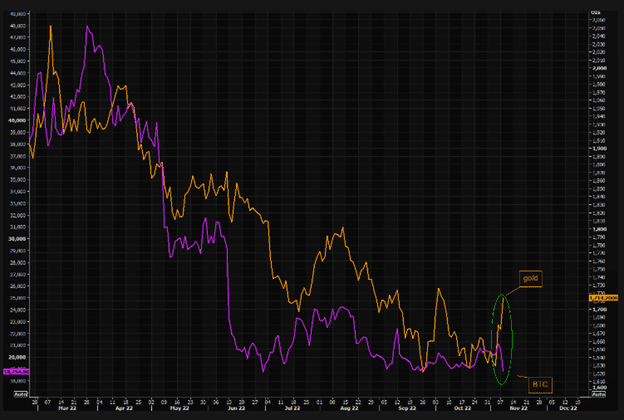

Bitcoin “safe haven” investors flee to gold

What to do NOW?

- If you are a long-term holder of Bitcoin or other cryptocurrencies, we suggest withdrawing the coins from any exchanges into a cold wallet.

There is simply too much downside risk -- in the low-probability event that your exchange implodes, you could literally lose 100% of your cryptocurrency investment.

There are many wallets out there. Possibly the most popular and trusted is the Ledger. Once you get it, write down your seed phrase (on paper, not on your computer) and store it in a safe place. Then send your coins to your ledger wallet address. - Bitcoin bulls may consider adding (or establishing) a position via dollar-cost averaging over the next 2-4 months.

“Forced” liquidations, like what is occurring now due to the FTX implosion, are often buying opportunities for savvy investors looking to take advantage of market panic.

We see no urgency in buying Bitcoin, however. The break of $19,000 combined with the psychological carnage associated with a major exchange going under so quickly will create lasting distrust in cryptocurrencies for some time. - Coinbase (COIN) under $50 could be a long-term steal.

Coinbase, due to its public stock listing and proactive approach to regulatory issues, is probably one of the best-suited exchanges/brokerages to survive a panic market.

For example, the company has begun listing client cryptocurrency funds separately on its balance sheet.

Additionally, as investors flee less-secure exchanges, Coinbase may end up being the biggest beneficiary of the near-term cryptocurrency distrust, as investors seek safer alternatives to transact with and hold their money.

LikeFolio will continue to monitor consumer/investor sentiment in the cryptocurrency market and its associated publicly traded companies.

As always, LikeFolio members will be the first to know when we spot big opportunities for profit in the crypto space.