Peloton (PTON) Last quarter, Peloton crushed estimates: sales grew 172% and […]

Dear Peloton: We're Not Mad, We're Just Disappointed...

Dear Peloton: We're Not Mad, We're Just Disappointed...

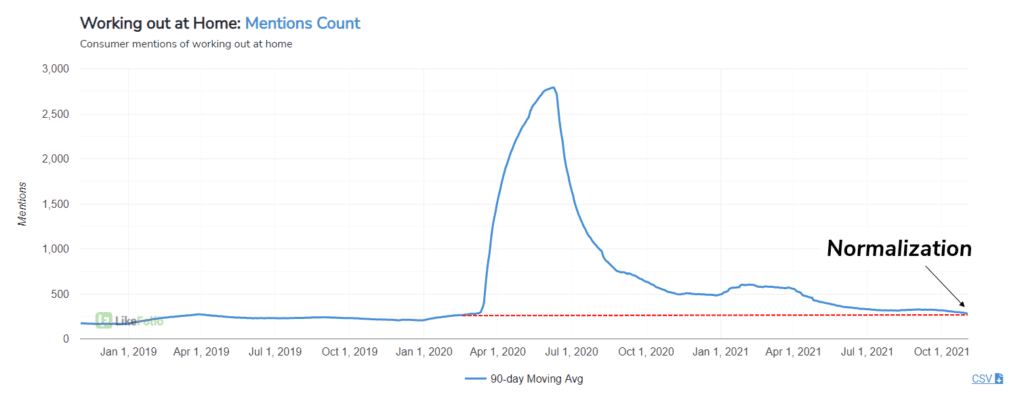

As a team of Peloton bike enthusiasts, this is a tough pill to swallow. After all, this company created the only form of cardio exercise we can all actually agree upon... But LikeFolio data makes us worried for the stock. Why? First: Major Consumer Trends that were working in Peloton's favor are reverting to the norm.

Consumer mentions of working out at home have dropped -45% YoY, essentially completely normalized to pre-Covid levels. Translation: the "stickiness" of virtual workouts is evaporating. Second: Peloton users are less engaged.

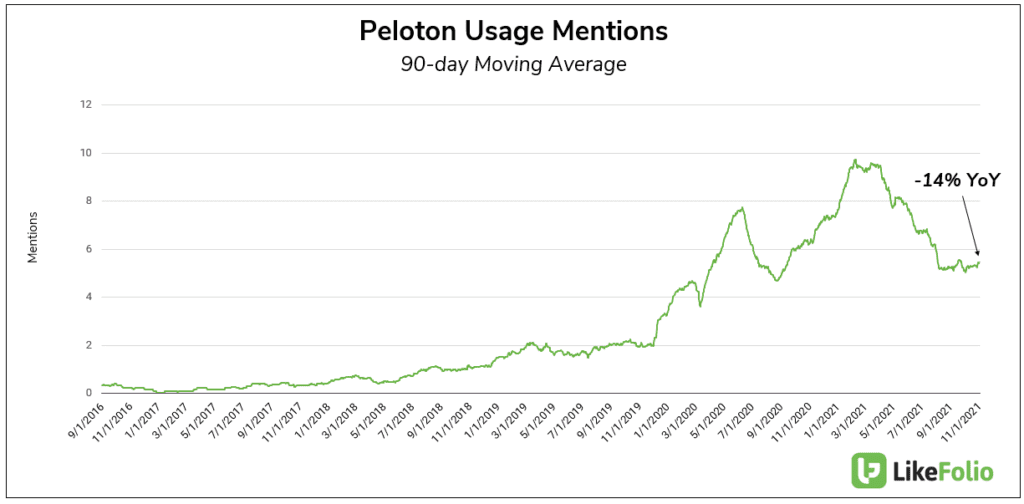

Consumer mentions of taking a Peloton class have dropped by 14% YoY, and show signs of stagnation. Last quarter, Peloton reported the number of average monthly workouts per subscriber fell to 19.9 from 24.7. And data doesn't suggest a re-energized userbase. Third: A bike price drop isn't materially moving the needle. Peloton dropped the price of its bike by $400 last quarter in hopes to undercut the competition and increase unit sales. LikeFolio Purchase Intent data does not reflect a major surge in new machine purchases. In fact, overall demand has decreased by -51% in the quarter being reported.