DeFi and Cryptocurrency: The Future of Finance?

In 2022, rising rates, food price concerns, and inflation dominated the headlines.

But this year, the focus is on technology.

Specifically, technology that can make consumers and companies more efficient (hello AI) and technology that can help protect what matters to consumers, like their finances.

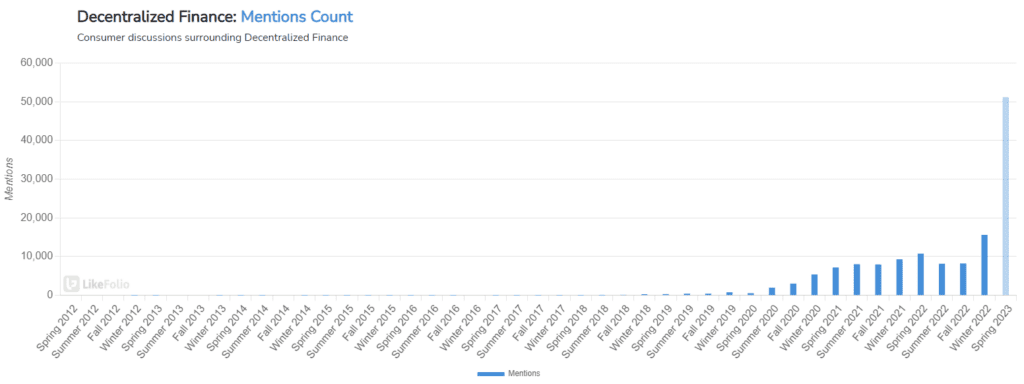

Consumers are worried following the collapse of two US banks and record outflows from smaller lenders. Deposits held by small US banks fell by a record $119 billion to $5.46 trillion after the collapse of Silicon Valley Bank in March. As uncertainty rises, the concept of DeFi is gaining momentum.

DeFi, or Decentralized Finance, is a financial system built on blockchain technology that operates without traditional intermediaries such as banks. It enables greater accessibility and financial inclusion for individuals.

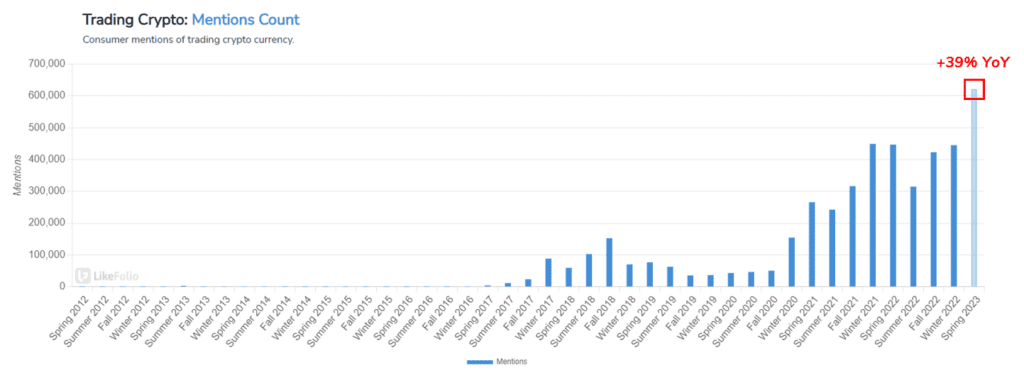

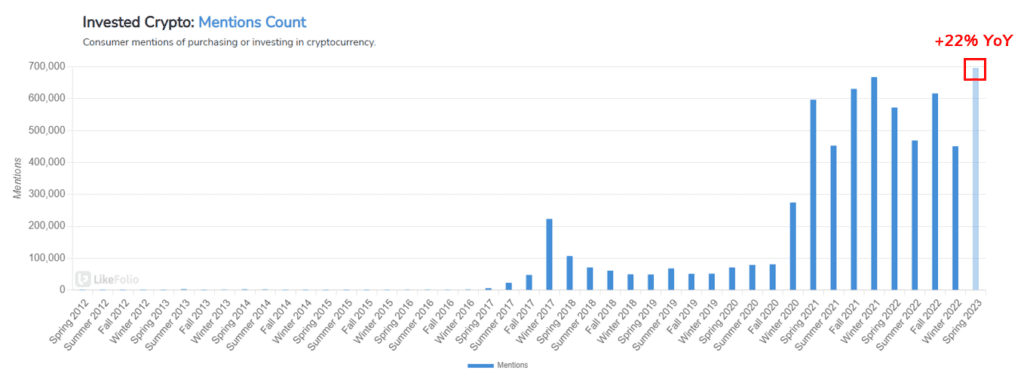

Consumers are not just talking about DeFi -- they are also showing increased interest in cryptocurrencies.

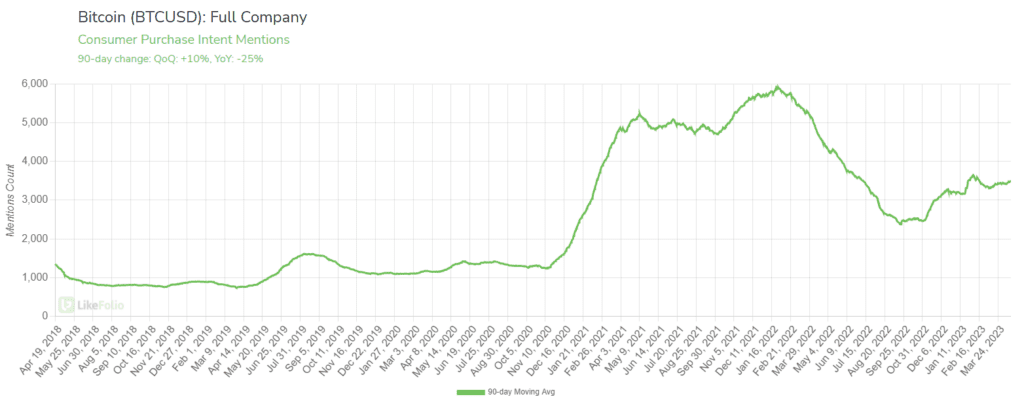

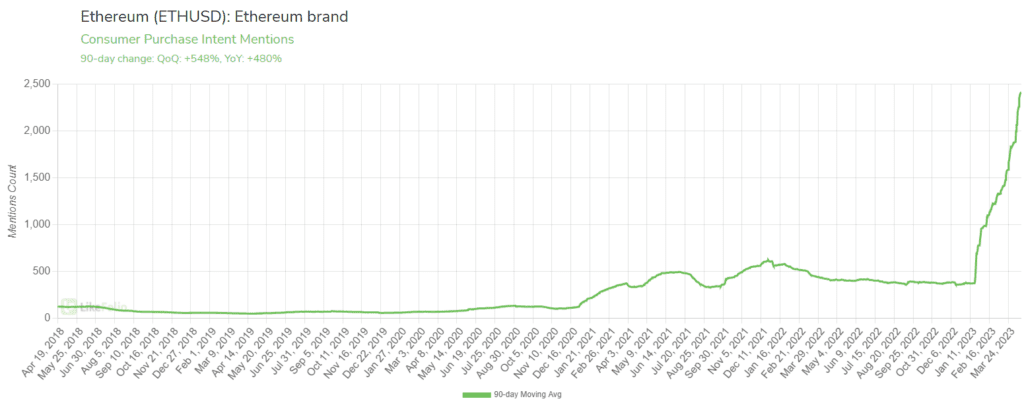

Check out consumer mentions of trading and investing in cryptocurrency in Spring 2023:

Cryptocurrencies are often used as the native currency of many DeFi platforms. They provide a secure and transparent way to store and transfer value without the need for a trusted third party or intermediary.

This makes cryptocurrencies a natural fit for many DeFi use cases, such as peer-to-peer lending, decentralized exchanges, and other forms of financial transactions.

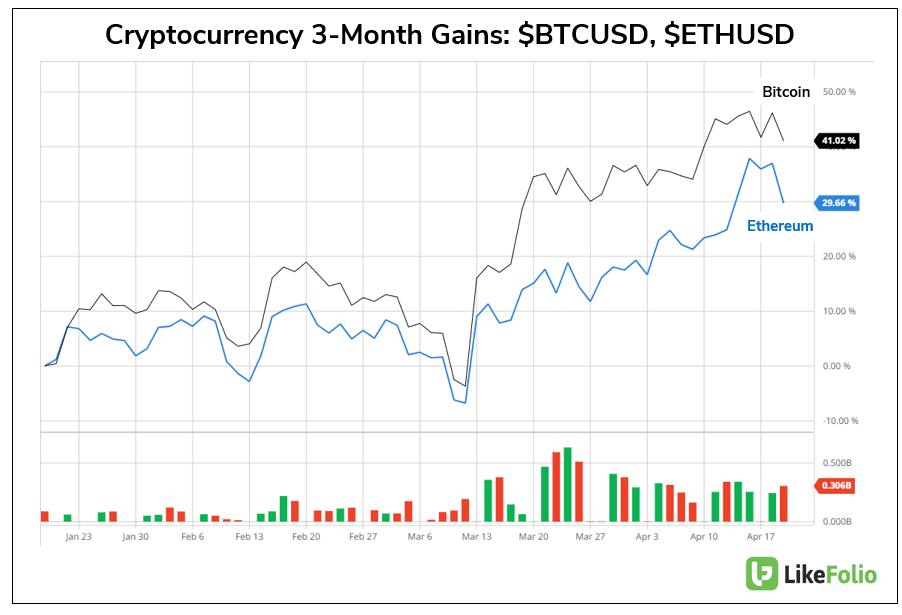

It’s no wonder Bitcoin and Ethereum prices have surged since the onset of banking turmoil.

Interest in cryptocurrency (notably Bitcoin) was already building prior to the Silicon Valley Bank Collapse…this just added fuel to the fire.

Landon, Megan and I highlighted this in LikeFolio’s February podcast.

Current data confirms rising demand for Bitcoin (+10% QoQ)…

…and especially Ethereum (astronomical):

Ethereum demand surged ahead of a key date for the cryptocurrency: a hard-forking upgrade capped off the network’s transition from proof-of-work to proof-of-stake.

More importantly, it allowed previous stakers to make withdrawals for the first time.

Since the Shapella hard fork on April 12, over 1 million ETH has been withdrawn from the Beacon Chain. However, more ETH is currently being staked than withdrawn for the first time since the upgrade. This suggests that the risk of mass selling due to unlocked ETH has been mitigated, with validators choosing to restake their unlocked Ether.

Despite near-term volatility in crypto-markets at large, consumer sentiment is building for both Ethereum and Bitcoin. This bodes well for long-term investors.