Travel Update: Airline Earnings It's time for the airline industry to report […]

Delta (DAL) Boosted by Service, Business Travel

September 13, 2021

Delta (DAL) Boosted by Service, Business Travel

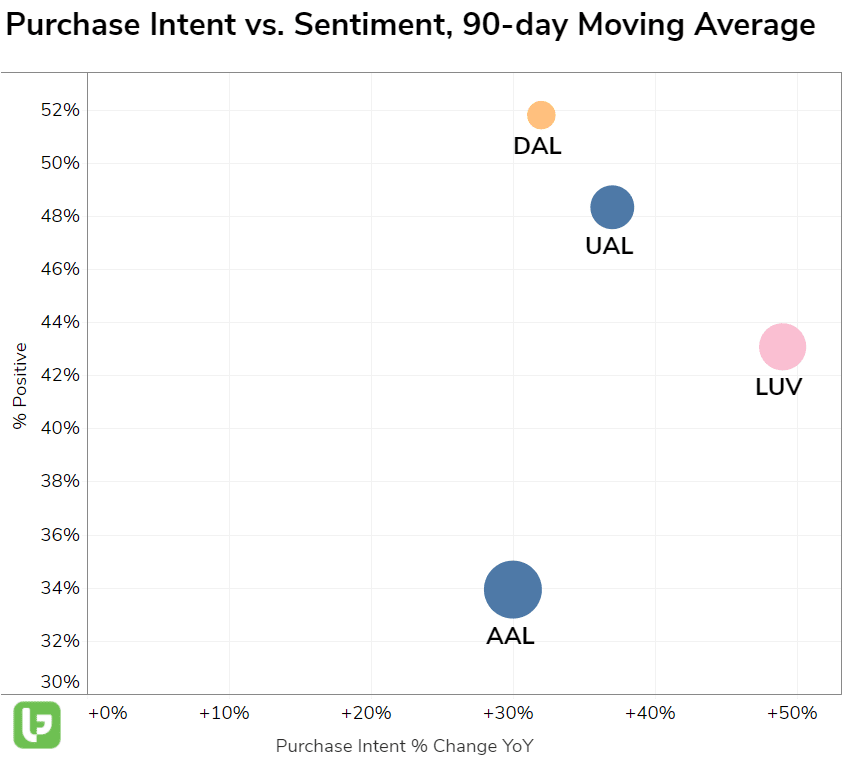

When LikeFolio breaks down Airlines, we focus on the big 4 domestically: LUV, DAL, UAL, AAL, alongside major travel trends.

Here are our key takeaways as we cap off summer...aka seasonal peak travel time:

- AAL is significantly falling behind peers. It used to be LUV/DAL head and shoulders above UAL/AAL. Now, AAL is the lone liner at the bottom of the pack. AAL Happiness is 34% positive, almost 20 points behind leader DAL. The company has not effectively navigated the pandemic, from execution (like cancellations/delays) to staff competency. This thread is not an anomaly for the company.

- DAL is benefitting from a return to business travel and improved customer service. DAL Happiness is flat while peers log significant YoY decline, placing it firmly at the front of the Happiness pack. We see signs of traditionally Southwest-level gestures from flight crews. In addition, Delta noted a 40% recovery in business travel on its last report, surprising many. The company expects this level to be 60% by September. LikeFolio data support continued growth in this segment. The fastest-growing travel trend we track is traveling for work: +42% higher YoY.

- LUV is losing its Happiness edge. Happiness has dropped by 19 points YoY, placing it third. Typically this is the happiness leader. Mentions show the company has been hampered by flight delays and cancellations.

- UAL has joined its upper echelon Airline travel peers. Happiness is higher vs. Southwest, and demand recovery outpaces Delta. However, the company has voiced concern over the impact of the delta variant on Q3 revenue.