Designer Brands (DBI) Earnings Preview

Designer Brands (DBI) Earnings Preview

Designer Brands houses retailers DSW, The Shoe Company, Shoe Warehouse, and licensing rights for Vince Camuto, Jessica Simpson, and Lucky Brand footwear, among others in the Camuto Group.

Shares of DBI have gained more than 90% in value year-to-date, propelled higher by a short squeeze rally at the end of January and stimulus/reopening hopes fueling investor optimism.

Does LikeFolio data support this level of optimism?

Not this quarter.

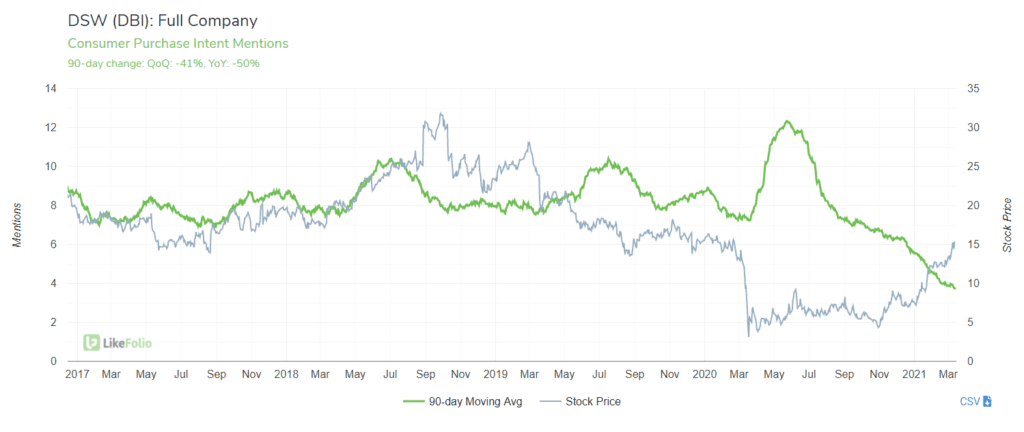

Purchase Intent mentions are currently trending -50% lower YoY.

In the last year, the company has pivoted to athleisure (vs. traditional seasonal/dress shoes): "By the end of the third quarter, we had grown the athleisure department to 49% at DSW, well above our seasonal penetration of 28%, which has historically been a much larger part of our business." LikeFolio data shows Mentions of its top brands (dominated by athletic names like Nike) alongside "DSW" registered exactly flat YoY for the quarter ending Jan. 30, and exhibit signs of weakness since then. Consumer Happiness was tested during the pandemic as the retailer shifted to digital fulfillment. Sentiment has started to improve in the past month, but was notably lower in the quarter being reported. DBI reports earnings Tuesday, March 16 before the bell.