This week's Sunday Earnings Sheet is off to a good […]

DG & FIVE: The Past and the Future of Discount Retail?

March 17, 2021

DG & FIVE: The Past and the Future of Discount Retail?

Five Below reports Wednesday (today) after market and Dollar General follows suit Thursday before the bell. Let's break it down.

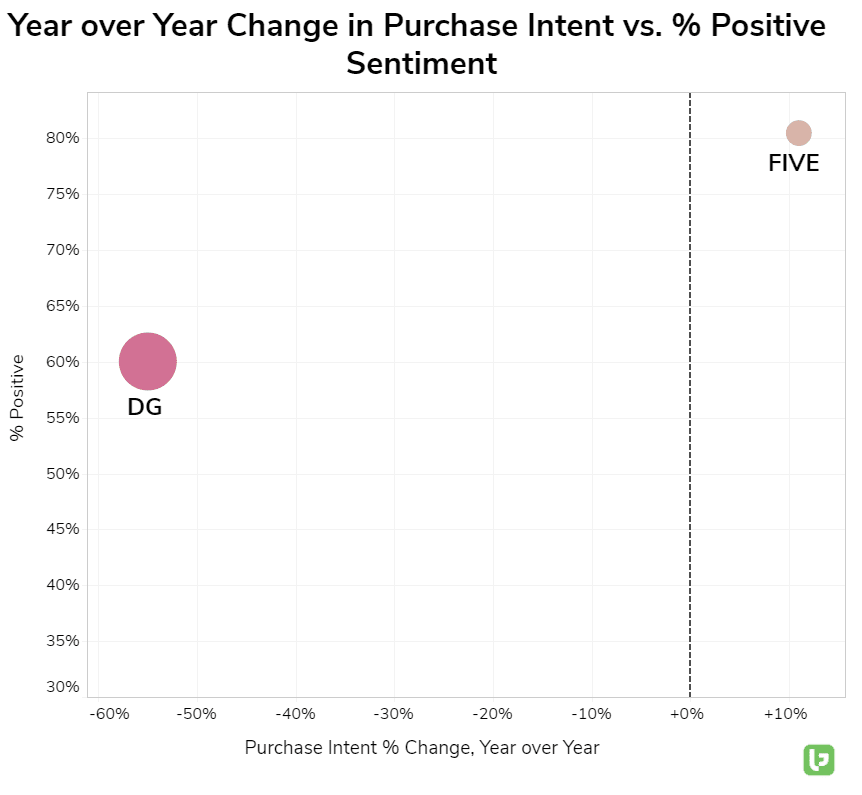

Viewed with a long-term lens, the chart above is very telling. Here are key takeaways:

- Five Below is making strides in the discount retail space. You can see this reflected by YoY growth in Purchase Intent and overall levels of consumer happiness. The upper right part of the chart is where you want to be.

- Dollar General isn't maintaining the momentum displayed in prior quarters. While it is certainly entering a period of tough comps, demand mentions for the quarter that ended Jan. 29 fell -7% YoY.

- Dollar General has a significant edge in volume, driven by sheer physical presence. The total volume of demand mentions are represented by the size of each circle on the chart above. Dollar General's store footprint exceeds 17,000 vs. Five Below's hovering just above 1,000 locations.

Looking ahead, it's clear the two are offering drastically different experiences for consumers. We'll be watching to see if both retailers can meet a high bar when they report Q4 earnings. But if you're considering a long-term growth story, our bet is with Five Below.