Fiverr (FVRR) Since a downgrade from UBS analysts over valuation concerns, […]

Did Stitch Fix miss a golden opportunity?

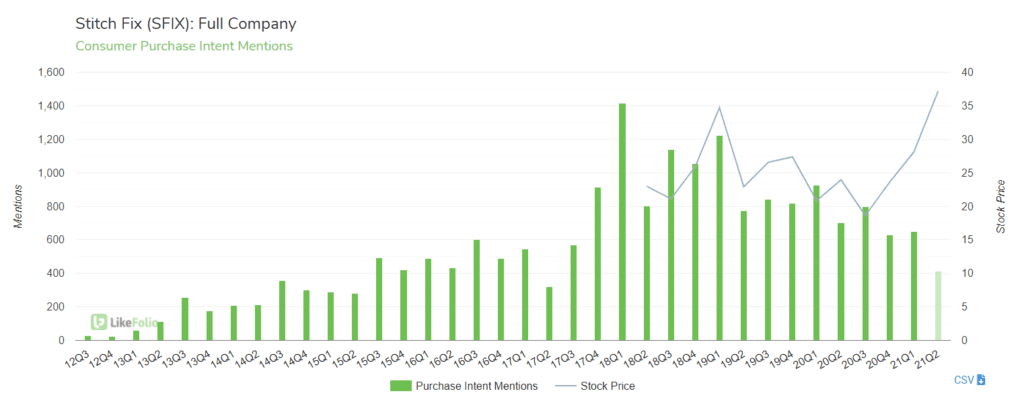

Stitch Fix (SFIX)

Last quarter, SFIX shares fell 14% after releasing earnings. While sales rebounded slightly in 20Q4, it wasn't enough to satisfy the market and make up for steep losses.

Has the company righted its ship? According to LikeFolio data, not yet.

Consumer demand showed modest improvement in 21Q (+3% YoY), but guidance doesn't look strong.

SFIX Purchase Intent mentions in 21Q2 (underway) are pacing -36% QoQ, -41% YoY.

Stitch Fix was digital before digital was cool. If the company isn't thriving as brick-and-mortal stores are shuttered, when will it?

The company reports Monday, Dec. 7 after the bell.

Fiverr (FVRR)

Last Friday, CNBC analyst Jim Cramer gave his opinion on several stocks, including Fiverr International (FVRR) which he deemed “too speculative.”

LikeFolio data begs to differ, revealing booming consumer demand for the freelance platform. Purchase Intent Mentions for the FVRR are on pace for a 16th consecutive...