Roku makes streaming devices that allow its customers to stream […]

Digital ads are back, baby

Two rising digital stars are leading the market higher today on the back of solid earnings reports.

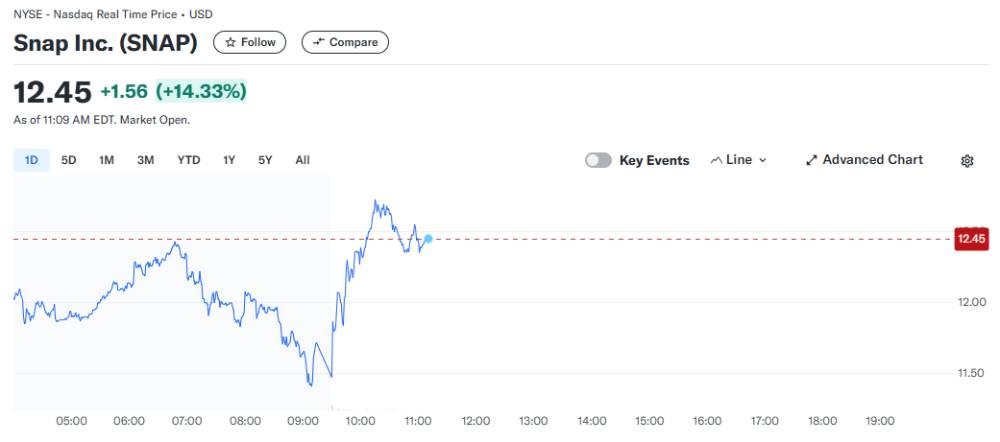

Snapchat (SNAP): +14%

Snap’s better-than-expected earnings report sparked a surge in its stock, driven by a strong quarterly performance and gains in advertising. The company posted adjusted earnings of 8 cents per share on $1.37 billion in revenue, beating expectations and marking a 15% revenue jump year-over-year. With improved AI-driven ad targeting, Snap attracted more marketers to its platform, boosting its global average revenue per user to $3.10 and increasing daily active users to 443 million.

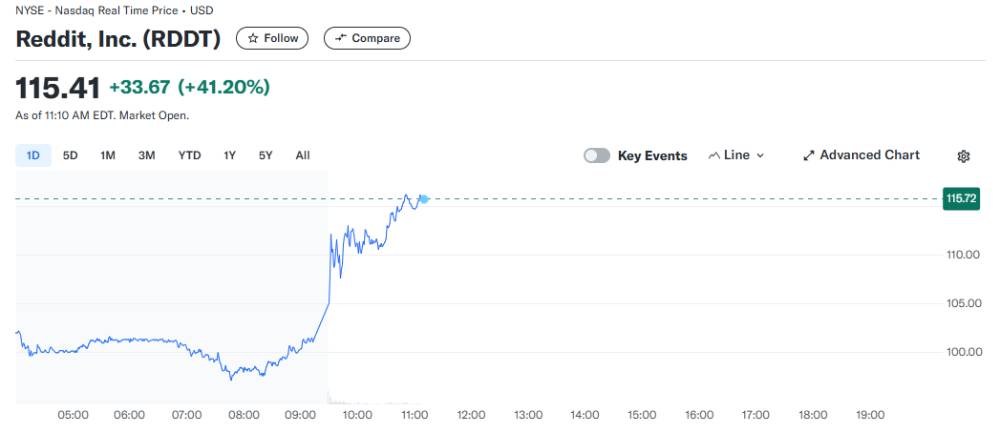

Reddit (RDDT): +41%!

Reddit’s third-quarter earnings far exceeded expectations, catapulting its stock in premarket trading. The company reported $348.4 million in revenue, surpassing estimates of $313.6 million, while turning profitable for the first time since its IPO, posting 16 cents per share against a projected loss of 7 cents. Advertising fueled this growth, generating $315.1 million, while data licensing deals with AI firms contributed an additional $33 million. Though daily active users reached 97.2 million—slightly below estimates—Reddit saw substantial 47% year-over-year user growth.

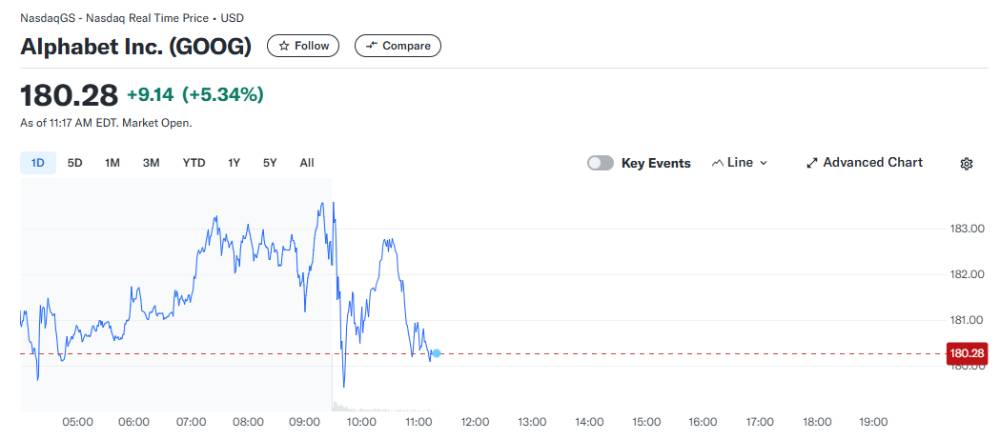

Alphabet (GOOGL): +5%

Google’s advertising revenue for Q3 came in at $65.85 billion, closely aligning with market expectations. The 10.4% year-over-year increase reflects solid performance but a slower growth rate compared to some prior quarters. Search ads contributed the bulk of this revenue, bringing in $49.4 billion, up 12.3% from last year, supported by AI enhancements that helped improve ad relevance and user targeting. Meanwhile, YouTube ads reached $8.92 billion, slightly above forecasts, indicating resilience despite competition from platforms like TikTok and Netflix

Do you notice a theme?

The up-and-comers have much more room for gains -- and they are finally catching up to the big dogs. But luckily for all involved, the rising ad tide is lifting all boats, albeit at different levels.

We already saw some moves to the upside for other ad adjacent names in our portfolios today, aside from SNAP:

- [ ]: +1.5% (new all-time highs)

- [ ]: +1.8% (reports next week)

- [ ]: +3.5% (brand new add!)

As election-related spending and holiday ad demand rise, companies with improving ad experiences, like the one featured in our buy alert yesterday, and companies like [ ] (with improving, shoppable platforms) are positioned strongly for outsized growth.